Microchip Technology (NasdaqGS:MCHP) Introduces BR235 Series for Aerospace and Defense Applications

Microchip Technology (NasdaqGS:MCHP) experienced a 10% increase in its share price over the past week, coinciding with the company's announcement of the BR235 and BR235D power relays. These products cater to mission-critical applications, enhancing reliability in aerospace and defense sectors—an appealing aspect given recent market uncertainties. Meanwhile, the broader tech market faced downward pressure due to U.S. export restrictions affecting major semiconductor firms like Nvidia and AMD. Despite the tech sector's broader challenges, Microchip Technology's focus on innovation in specialized components helped it stand out during a period marked by divergent market trends.

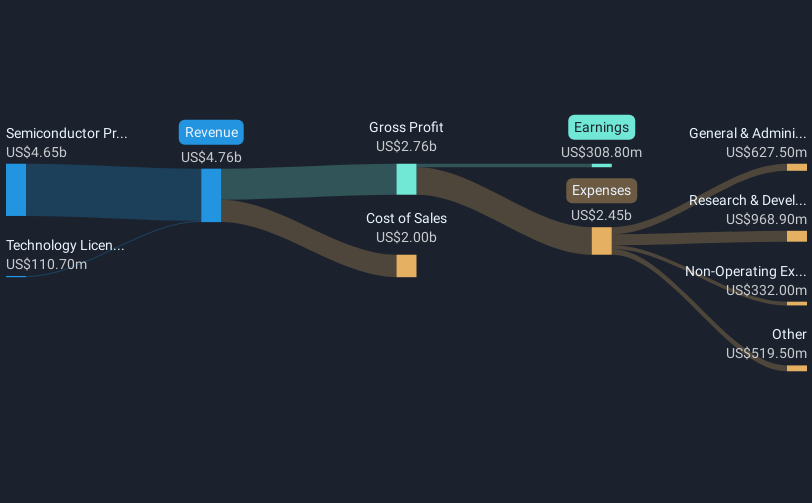

The recent 10% surge in Microchip Technology's share price following the introduction of their BR235 and BR235D power relays highlights investor enthusiasm for new product innovations, particularly within aerospace and defense sectors. This enthusiasm is underlined by the company's focus on mission-critical solutions. Such developments could positively impact Microchip's revenue and earnings forecasts by enhancing their product portfolio and potentially driving design wins.

Over the past five years, Microchip Technology has achieved a total return of 12.95%, inclusive of share price and dividends, which provides a broader context to its recent price movements. However, the company's performance during the past year has been less favorable, underperforming both the US Semiconductor industry's 5.3% return and the US market return of 5.9%. This could suggest room for potential recovery if the company's strategic initiatives bear fruit.

In the face of market fluctuations affecting semiconductor players such as Nvidia and AMD, Microchip Technology's focus on specialized components appears to play a crucial role in its market positioning. While the current share price of US$35.34 represents a significant gap to the analysts' consensus price target of US$65.61, any realization of projected earnings growth and efficiency improvements could aid in bridging this difference. Nonetheless, the elevated price-to-earnings ratio remains a key consideration, as it currently exceeds both industry and peer averages, posing a challenge for valuation alignment.

Understand Microchip Technology's track record by examining our performance history report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English