Investors in Fiverr International (NYSE:FVRR) from three years ago are still down 61%, even after 13% gain this past week

It's nice to see the Fiverr International Ltd. (NYSE:FVRR) share price up 13% in a week. But that is small recompense for the exasperating returns over three years. Indeed, the share price is down a tragic 61% in the last three years. So it's good to see it climbing back up. The rise has some hopeful, but turnarounds are often precarious.

On a more encouraging note the company has added US$101m to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Fiverr International became profitable within the last five years. We would usually expect to see the share price rise as a result. So it's worth looking at other metrics to try to understand the share price move.

Revenue is actually up 7.8% over the three years, so the share price drop doesn't seem to hinge on revenue, either. This analysis is just perfunctory, but it might be worth researching Fiverr International more closely, as sometimes stocks fall unfairly. This could present an opportunity.

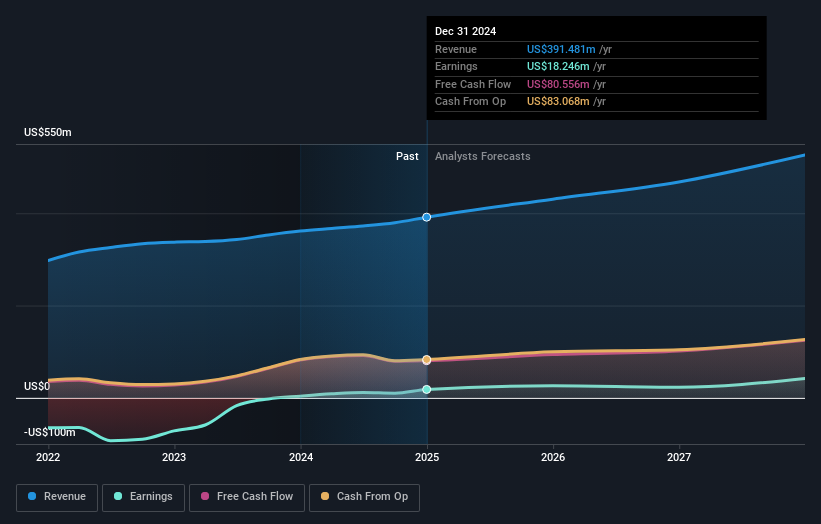

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Fiverr International is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling Fiverr International stock, you should check out this free report showing analyst consensus estimates for future profits .

A Different Perspective

We're pleased to report that Fiverr International shareholders have received a total shareholder return of 25% over one year. There's no doubt those recent returns are much better than the TSR loss of 4% per year over five years. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. It's always interesting to track share price performance over the longer term. But to understand Fiverr International better, we need to consider many other factors. Take risks, for example - Fiverr International has 1 warning sign we think you should be aware of.

But note: Fiverr International may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English