SmarTone Telecommunications Holdings (HKG:315) Is Increasing Its Dividend To HK$0.175

SmarTone Telecommunications Holdings Limited's (HKG:315) periodic dividend will be increasing on the 17th of November to HK$0.175, with investors receiving 13% more than last year's HK$0.155. This takes the dividend yield to 6.9%, which shareholders will be pleased with.

See our latest analysis for SmarTone Telecommunications Holdings

SmarTone Telecommunications Holdings' Earnings Easily Cover The Distributions

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. Prior to this announcement, the company was paying out 132% of what it was earning, however the dividend was quite comfortably covered by free cash flows at a cash payout ratio of only 25%. Given that the dividend is a cash outflow, we think that cash is more important than accounting measures of profit when assessing the dividend, so this is a mitigating factor.

Earnings per share is forecast to rise by 49.9% over the next year. If recent patterns in the dividend continues, the payout ratio in 12 months could be 80% which is a bit high but can definitely be sustainable.

Dividend Volatility

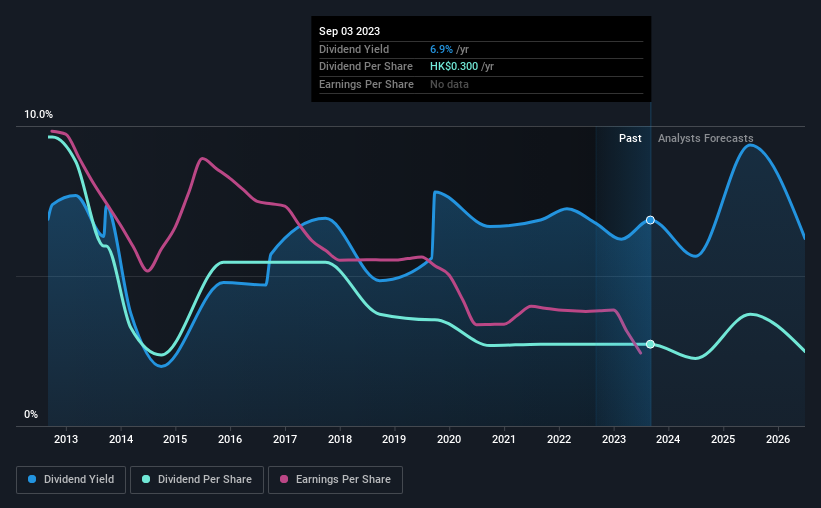

Although the company has a long dividend history, it has been cut at least once in the last 10 years. The dividend has gone from an annual total of HK$1.06 in 2013 to the most recent total annual payment of HK$0.30. Dividend payments have fallen sharply, down 72% over that time. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

The Dividend Has Limited Growth Potential

Given that the track record hasn't been stellar, we really want to see earnings per share growing over time. SmarTone Telecommunications Holdings' EPS has fallen by approximately 15% per year during the past five years. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in. However, the next year is actually looking up, with earnings set to rise. We would just wait until it becomes a pattern before getting too excited.

SmarTone Telecommunications Holdings' Dividend Doesn't Look Sustainable

Overall, we always like to see the dividend being raised, but we don't think SmarTone Telecommunications Holdings will make a great income stock. The company is generating plenty of cash, which could maintain the dividend for a while, but the track record hasn't been great. We would probably look elsewhere for an income investment.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. Taking the debate a bit further, we've identified 2 warning signs for SmarTone Telecommunications Holdings that investors need to be conscious of moving forward. Is SmarTone Telecommunications Holdings not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English