電影《大空頭》原型Q2瘋狂撤離美股 僅持GEO(GEO.US)這一隻股票

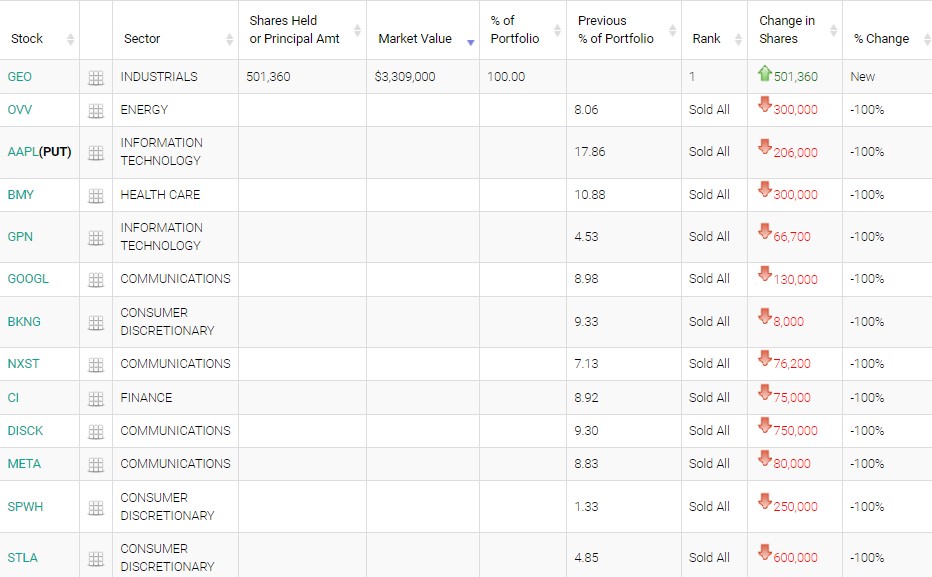

智通財經APP獲悉,好萊塢電影《大空頭》原型Micheal Burry旗下的資產管理機構Scion Asset Management在今年第二季度瘋狂拋售12只美股,截至第二季度末,該公司僅僅持有一隻美股GEO(GEO.US)。

根據美國證券交易委員會(SEC)披露,Micheal Burry旗下這家資產管理公司遞交了截至2022年6月30日的第二季度(Q2)持倉報告(13F)。該資產管理機構第二季度持倉總市值僅爲330.9萬美元,相比之下上一季度持倉總市值爲2.01379億美元。該機構在第二季度的持倉組合中新增了1只個股,清倉12只個股。其中前十大持倉標的佔總市值比例爲100%。

週一提交給監管機構的13F文件顯示,該機構第二季度拋售了包括Booking(BKNG.US),谷歌母公司Alphabet(GOOGL.US)和Facebook母公司Meta Platforms(META.US)在內所有美股持倉,僅僅增持且持有一隻美股——私人監獄運營商Geo Group Inc.。

截至6月30日,Geo Group是Scion唯一持有的多頭股票。文件顯示Scion持有總部位於佛羅里達州博卡拉頓的Geo Group總計501,360股,該公司股價當地時間週一聞訊飆升近11%,至7.60美元,自第二季度末以來的漲幅已超過15%。

現年51歲的Micheal Burry在2008年金融危機爆發前夕的一場反向押注抵押貸款中獲得最終勝利,在這場全球金融危機中可以說賺得盆滿鉢滿,從而聲名鵲起。近幾個月來,他在社交媒體上成爲了一個受衆多投資愛好者追捧的“網紅”基金經理,他在近期預期美國經濟即將陷入低迷。在今年5月的一條推文中,他表達了未來可能出現類似於14年前那次金融危機的擔憂。

Micheal Burry本人拒絕就最新13F文件發表公開評論。

根據監管規定,所有管理超過1億美元美國股票的基金經理都需要披露季度持倉信息,僅顯示在美國證券交易所交易的股票的具體持倉情況,不披露非美國的交易證券標的或空頭頭寸。這類申報文件提供了投資機構截至上一季度末的持倉情況,可能無法反映當前最新的投資情況。

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English