Atmus Filtration Technologies Inc. (NYSE:ATMU) Not Lagging Market On Growth Or Pricing

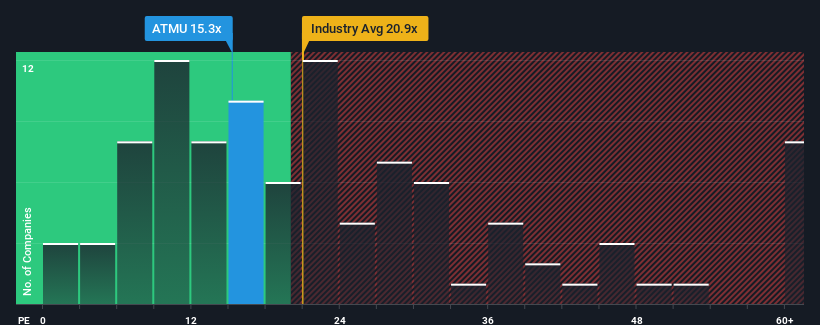

It's not a stretch to say that Atmus Filtration Technologies Inc.'s (NYSE:ATMU) price-to-earnings (or "P/E") ratio of 15.3x right now seems quite "middle-of-the-road" compared to the market in the United States, where the median P/E ratio is around 17x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Our free stock report includes 2 warning signs investors should be aware of before investing in Atmus Filtration Technologies. Read for free now.Recent times have been advantageous for Atmus Filtration Technologies as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for Atmus Filtration Technologies

What Are Growth Metrics Telling Us About The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Atmus Filtration Technologies' to be considered reasonable.

If we review the last year of earnings growth, the company posted a worthy increase of 8.5%. The latest three year period has also seen a 10.0% overall rise in EPS, aided somewhat by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Shifting to the future, estimates from the seven analysts covering the company suggest earnings should grow by 9.9% per annum over the next three years. Meanwhile, the rest of the market is forecast to expand by 10% each year, which is not materially different.

In light of this, it's understandable that Atmus Filtration Technologies' P/E sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Bottom Line On Atmus Filtration Technologies' P/E

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Atmus Filtration Technologies' analyst forecasts revealed that its market-matching earnings outlook is contributing to its current P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

Before you take the next step, you should know about the 2 warning signs for Atmus Filtration Technologies that we have uncovered.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English