Novavax (NasdaqGS:NVAX) Announces Positive SHIELD-Utah Study Results

Novavax (NasdaqGS:NVAX) recently announced preliminary results from its SHIELD-Utah study, showcasing the Novavax COVID-19 vaccine's effectiveness and reduced side effects compared to a competitor's vaccine. This positive announcement aligns with a 17.8% increase in the company's share price last week. The broader market was also on an upward trend, with indices gaining noticeably over the same period. While the details from Novavax's study can potentially bolster investor confidence and support the share price rise, the company's movement remains consistent with broader gains in the market, which remain strong amid mixed economic signals and tariff uncertainty.

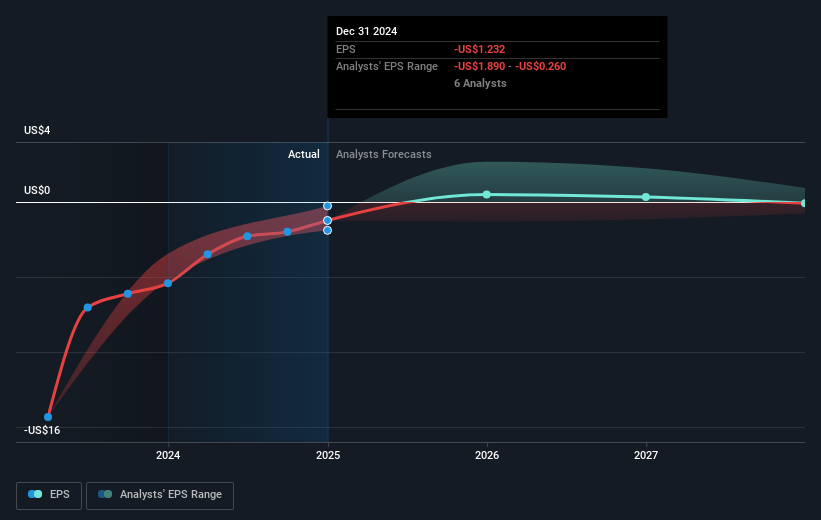

Novavax's recent announcement regarding the SHIELD-Utah study could influence perceptions of the company's future prospects. The vaccine’s favorable results may further solidify investor confidence and potentially impact revenue and earnings forecasts. However, given the company's dependency on partnerships for growth, particularly with Sanofi, the actual realization of these projections remains contingent upon successful collaboration outcomes. Analysts already forecast a decline in revenue over the next three years, which could be mitigated if the SHIELD-Utah findings translate to higher demand or new partnerships.

Over the past year, Novavax's total shareholder return, inclusive of dividends, amounted to 78.99%. This positive performance starkly contrasts with its longer-term share price volatility and highlights an impressive recovery against challenging quarterly fluctuations. Compared to the broader U.S. Biotechs industry, which returned 7.9% over the past year, Novavax outperformed significantly. Given the current share price of $6.01, it sits notably below the consensus analyst target of $15.17, emphasizing considerable room for potential growth if projected earnings of US$54.6 million by 2028 materialize. Investors must weigh these assumptions, acknowledging both the possibilities and inherent risks outlined in the company's partnerships and pipeline strategies.

Evaluate Novavax's prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English