These Analysts Revise Their Forecasts On Nasdaq After Better-Than-Expected Earnings

Nasdaq Inc (NASDAQ:NDAQ) reported better-than-expected earnings for its first quarter on Thursday.

The company posted quarterly revenue of $1.24 billion, versus estimates of $1.23 billion. The company's quarterly earnings came in at 79 cents per share, versus estimates of 77 cents per share.

Total revenue was up 11% year-over-year and annual recurring revenue climbed 8% year-over-year to $2.8 billion.

"Nasdaq's first quarter results underscore the resilience of our business model and our ability to deliver growth across our divisions in a rapidly shifting environment," said chair and CEO Adena Friedman.

Nasdaq declared a quarterly dividend of 27 cents per share, payable on June 27 to shareholders of record as of June 13.

In a separate press release, Nasdaq announced that the company and Amazon.com Inc's (NASDAQ:AMZN) Amazon Web Services (AWS) will introduce a new suite of solutions including infrastructure, software, data management and services that will enable market operators to overcome modernization barriers.

Nasdaq shares fell 0.1% to trade at $74.64 on Friday.

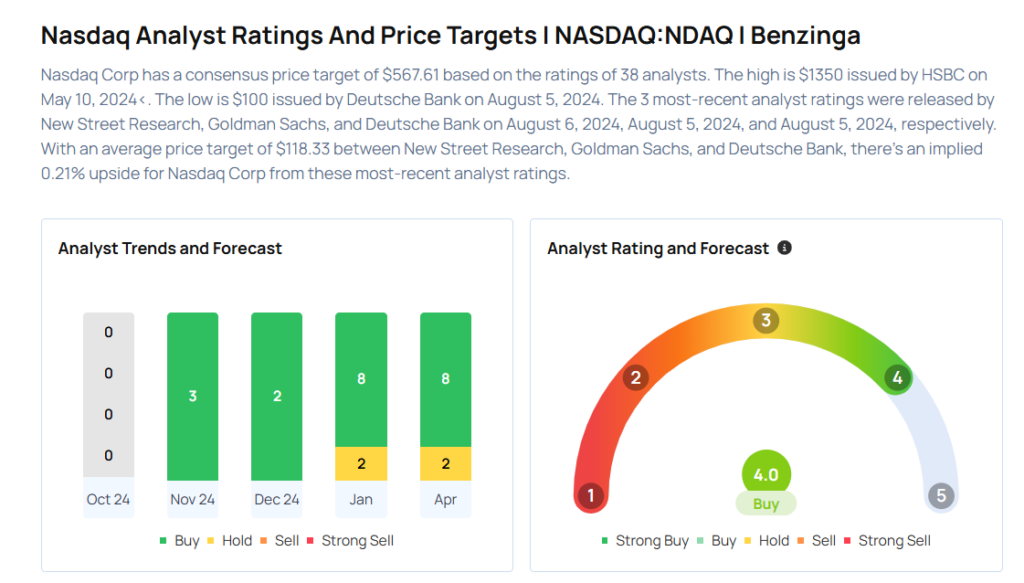

These analysts made changes to their price targets on Nasdaq following earnings announcement.

- Barclays analyst Benjamin Budish maintained Nasdaq with an Overweight rating and lowered the price target from $86 to $84.

- UBS analyst Alex Kramm maintained Nasdaq with a Neutral and raised the price target from $76 to $82.

- Keefe, Bruyette & Woods analyst Kyle Voigt maintained the stock with an Outperform rating and raised the price target from $87 to $88..

Considering buying NDAQ stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English