SIGN UP

LOG IN

Top 2 Health Care Stocks That May Crash This Month

Benzinga·04/25/2025 13:00:34

Listen to the news

As of April 25, 2025, two stocks in the health care sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered overbought when the RSI is above 70, according to Benzinga Pro.

Here's the latest list of major overbought players in this sector.

Lexicon Pharmaceuticals Inc (NASDAQ:LXRX)

- On March 28, Lexicon Pharmaceuticals entered into an exclusive license agreement with Novo Nordisk A/S (NYSE:NVO) for LX9851, a first-in-class, oral non-incretin development candidate in obesity and associated metabolic disorders. Under the terms of the agreement, Novo Nordisk obtains an exclusive, worldwide license to develop, manufacture, and commercialize LX9851 in all indications. The company's stock jumped around 95% over the past month and has a 52-week high of $2.45.

- RSI Value: 73.9

- LXRX Price Action: Shares of Lexicon Pharmaceuticals gained 4.7% to close at $0.70 on Thursday.

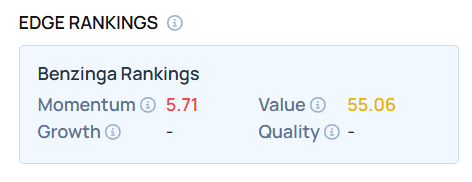

- Edge Stock Ratings: 5.71 Momentum score with Value at 55.06.

Amarin Corporation PLC (NASDAQ:AMRN)

- On March 12, Amarin announced its intent to effect a 1-for-20 ADS ratio change. The company also reported fourth-quarter financial results. “Since taking on the role of CEO of Amarin last year, I have worked with our leadership team and the Board of Directors to identify opportunities to leverage our unique assets, skills and resources to drive value,” said Aaron Berg, President & CEO, Amarin. “In 2024, while still progressing with the early launch in markets outside the U.S. and despite a dynamic generic market in the U.S., we generated more than $200 million in revenue and ended the year with nearly $300 million in cash and no debt — all measures exemplifying the strength and resilience of our franchise and the impact of our disciplined approach to capital deployment.” The company's stock gained around 24% over the past five days and has a 52-week high of $20.60.

- RSI Value: 73.5

- AMRN Price Action: Shares of Amarin rose 7.9% to close at $11.18 on Thursday.

BZ Edge Rankings: Find out where other stocks stand—explore the full comparison now.

Read This Next:

Photo via Shutterstock

Risk Disclosure: The content of this page is not an investment advice and does not constitute any offer or solicitation to offer or recommendation of any investment product. It is for general purposes only and does not take into account your individual needs, investment objectives and specific financial circumstances. All investments involve risk and the past performance of securities, or financial products does not guarantee future results or returns. Keep in mind that while diversification may help spread risk it does not assure a profit, or protect against loss, in a down market. There is always the potential of losing money when you invest in securities, or other financial products. Investors should consider their investment objectives and risks carefully before investing. For more details, please refer to risk disclosure.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

Language

English

©2025 Webull Securities Limited. All rights reserved.