2 Unstoppable Stocks Destined to Achieve a $1 Trillion Valuation

The $1 trillion stock club has been getting a bit thinner amid the stock market sell-off, as a handful of companies have fallen out of this prestigious club. At this writing, there are only eight companies with a $1 trillion valuation worldwide, but two more could easily join their ranks over the next few months if the market recovers.

Taiwan Semiconductor (NYSE: TSM) and Broadcom (NASDAQ: AVGO) are two companies that are destined to join the $1 trillion valuation club. Each has already reached that threshold but is currently on the outside looking in thanks to the sell-offs.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

These two companies will be OK over the long term and will likely rejoin the $1 trillion club either this year or next. Here's a closer look.

1. Taiwan Semiconductor

Broadcom and TSMC aren't that far away from joining the $1 trillion club, as Broadcom and TSMC are currently valued at around $800 billion and $770 billion, respectively. That's still a 25% increase from today's level to get to $1 trillion, so if these stocks can do that in short order, they could be fantastic stocks to buy right now.

TSMC is the world's largest chip foundry. It makes chips for its clients who cannot do so themselves. These include companies like Nvidia (NASDAQ: NVDA), Apple (NASDAQ: AAPL), and Broadcom. By staying neutral in the chip production world, Taiwan Semiconductor isn't competing against its clients, which is why it has grown to become the top option in the foundry space.

Another reason it is near the top is its drive to offer the most advanced technology. Currently, TSMC's most powerful chip is the 3 nanometer (nm) variety, which means chip traces are spaced at a minimum of 3 nm apart. However, it's slated to launch 2 nm and 1.6 nm chips this year and next, which represent improvements over current technology.

As for tariffs, Taiwan Semi's CEO recently made this comment:

We understand there are uncertainties and risks from the potential impact of tariff policies. However, we have not seen any change in our customers' behavior so far. Therefore, we continue to expect our full year 2025 revenue to increase by close to mid-20s percent in U.S. dollar terms.

This is an extremely bullish comment by the CEO, and it makes me even more confident that TSMC will eventually return to the $1 trillion club.

2. Broadcom

Broadcom does many different things, but one emerging product line makes me bullish on the stock. Its custom AI accelerators, which it calls XPUs, are an alternative to Nvidia's GPUs, which have dominated the AI computing marketplace. Some customers are fed up with the prices they have to pay for Nvidia's GPUs and prefer Broadcom's XPUs because they are tailored to one workload, such as those used to train an AI model, eliminating ancillary functions that one customer may use and another doesn't.

While the adoption of these units doesn't spell the end for Nvidia, it does open the door for Broadcom to steal a sliver of the market, which it projects it will do shortly.

By 2027, Broadcom expects the addressable market for XPUs to be $60 billion to $90 billion from just three clients. With two clients launching their XPUs later this year and two more clients selecting Broadcom to produce their XPUs, that market opportunity is expected to expand. Considering Broadcom's trailing 12-month revenue totals $54.5 billion, any growth from this segment will dramatically boost its overall total.

This makes Broadcom a great stock to pick up for cheap, as the latest market sell-off has opened up an attractive buying opportunity.

Both stocks are on sale

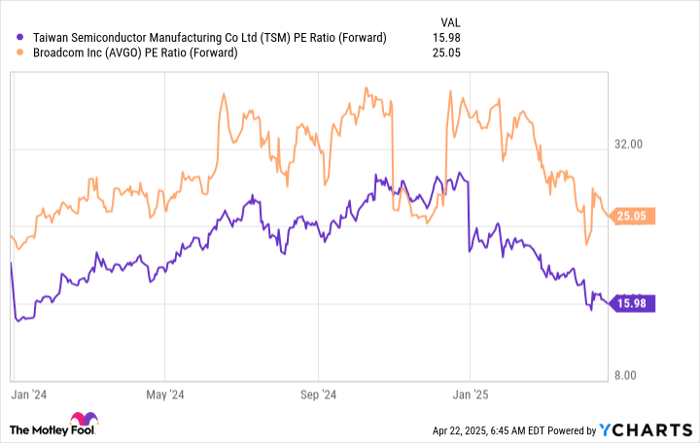

From a forward price-to-earnings (P/E) standpoint, both Broadcom and TSMC look like bargain deals.

TSM PE Ratio (Forward) data by YCharts

Broadcom has a slightly higher premium than TSMC, as investors aren't as worried about Broadcom losing as much business as TSMC. However, the price you pay for both businesses is still much cheaper than in recent months.

I think both stocks look like great deals now and will provide investors with market-beating returns over the long term. However, you'll have to be patient, as there are plenty of fears regarding tariffs surrounding the broader economy.

Keithen Drury has positions in Broadcom, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Apple, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English