Coupang (NYSE:CPNG) Unveils Rocket Pitch Connecting U.S. Sellers To South Korean E-commerce Market

Coupang (NYSE:CPNG) recently launched its "Rocket Pitch" initiative, aiming to facilitate U.S. sellers' entry into the South Korean e-commerce market by partnering with the International Trade Administration. This development is timely as Coupang's stock saw a 6% rise last week. Given the broader market rally, driven largely by tech stock gains amidst positive earnings reports and tariff developments, Coupang's strategic initiative added weight to these broader market movements. However, it also stands alone as a significant effort to enhance international operations, likely contributing positively to investor sentiment about the company's growth potential.

You should learn about the 3 weaknesses we've spotted with Coupang.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

The recent launch of Coupang's "Rocket Pitch" initiative may significantly influence the company's growth strategy by tapping into the U.S. seller market, thus enhancing its international presence. This move aligns with the company's narrative of expanding logistics and service diversification, potentially bolstering revenue and margins through greater international reach. This initiative, along with Coupang's other strategic investments in AI and logistics automation, may elevate revenue forecasts by driving operational efficiencies and expanding market offerings.

Over the past three years, Coupang's total shareholder return, inclusive of share price growth and dividends, was 72.03%. This longer-term performance provides context for assessing the recent week's 6% share price rise, showing the stock's potential resilience and growth capability. Despite this, the company's performance over the past year trails behind the US Multiline Retail industry, which saw a return of 7.6%, reflecting potential market challenges or unique strategic positioning.

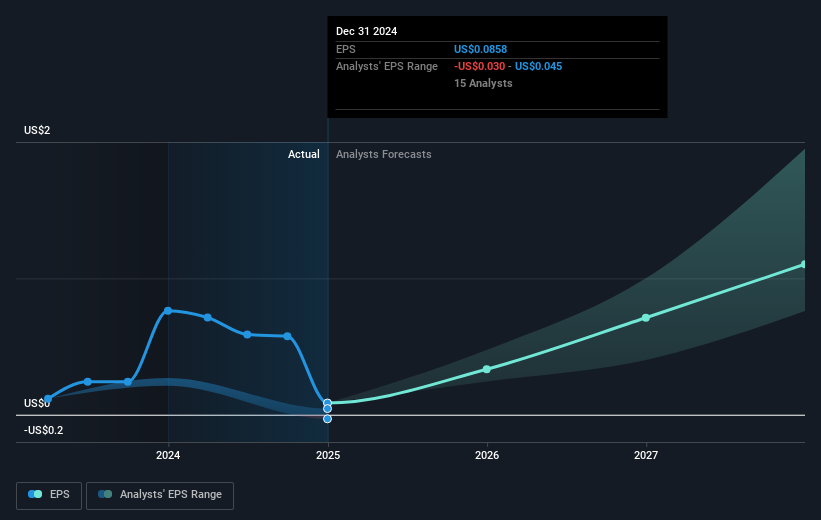

With the current share price at US$21.68, the analyst consensus price target at US$29.79 indicates a potential upside of 27.2%. This highlights a substantial growth expectation, contingent upon the company's ability to achieve projected earnings of US$2 billion by 2028 and ride on expansions like the "Rocket Pitch." However, Coupang will need to navigate currency fluctuations and cost pressures from its investments to meet these optimistic forecasts. The alignment and discrepancy between analyst targets and share price movement underscore the critical need for ongoing evaluation of Coupang's strategic initiatives in relation to changing market dynamics.

Review our historical performance report to gain insights into Coupang's track record.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English