Archer Aviation (NYSE:ACHR) Partners With United Airlines For New York City Air Taxi Network

Archer Aviation (NYSE:ACHR) recently announced plans to roll out a new air taxi network in partnership with United Airlines in New York City, aiming to transform urban mobility. This initiative came on the heels of another significant partnership with Ethiopian Airlines to expand air taxi services internationally. These developments underscored Archer's commitment to enhancing urban transportation, likely contributing to its stock's 14% rally over the last week. This surge was notable amidst broader market gains, which saw the Nasdaq and S&P 500 indices rise by 2% to 3%, bolstered by positive earnings reports and optimistic economic sentiment.

Archer Aviation has 5 risks (and 2 which make us uncomfortable) we think you should know about.

Over the past three years, Archer Aviation's total shareholder return has been 117.57%. This outpaces the US Aerospace & Defense industry, which returned 15.9% over the past year, and the broader US market, which returned 5.9%. This strong performance highlights investor optimism surrounding Archer's growth potential and industry positioning.

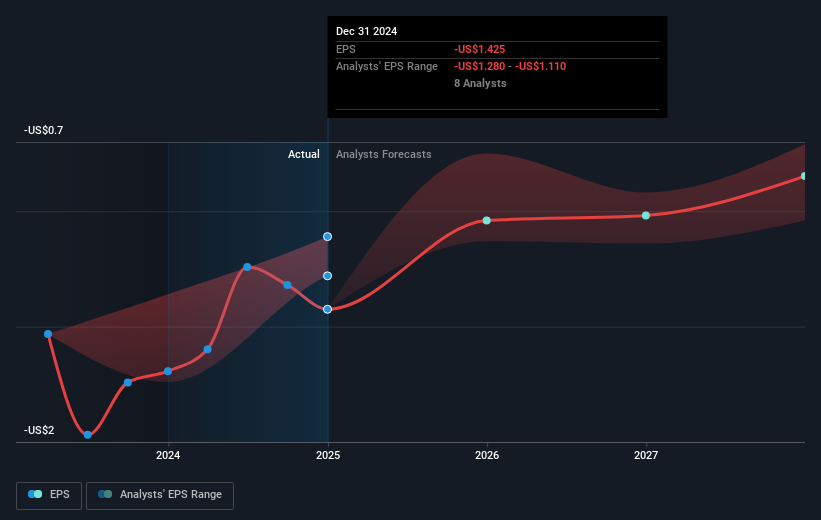

The company's recent partnerships with United Airlines and Ethiopian Airlines could significantly impact its revenue and earnings forecasts. However, Archer remains unprofitable and faces challenges in realizing these forecasts. Current share price movements suggest a discount compared to the consensus analyst price target of US$11.39, indicating potential upside if future developments align with expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English