MSCI (NYSE:MSCI) Expands Private Market Insights With New Venture-Backed Company Indexes

MSCI (NYSE:MSCI) recently launched two MSCI All Country Venture-Backed Private Company Indexes, aiming to enhance transparency in the private market. Despite this significant development, MSCI's stock saw a 1.69% dip over the past week. This decline occurred amid a broadly positive market environment that showcased investor optimism driven by strong earnings reports and easing tariff concerns, leading to gains in major indices like the S&P 500, which rose by 1.8%. The company's dividend affirmation and share buyback efforts during the same period might have provided some support, though not enough to counteract the overall downward move.

We've identified 1 possible red flag for MSCI that you should be aware of.

The recent development involving MSCI's launch of the MSCI All Country Venture-Backed Private Company Indexes could potentially bolster its position in the investment community by enhancing transparency within the private market. This move aligns with MSCI's ongoing initiatives to expand its global custom indices and partnerships, which are projected to positively influence revenue and subscription growth. If these indexes achieve traction, it could help to alleviate some constraints faced in revenue growth due to market challenges.

MSCI shares have provided a total return of 67.21% over the past five years, indicating strong long-term performance. Over the last year, MSCI outperformed the US Capital Markets industry, which saw a 13.7% increase, showcasing its resilience within a competitive space. Despite a recent share price decline of 1.69%, the company's longer-term growth has been robust, outpacing the broader market growth rate over the same period.

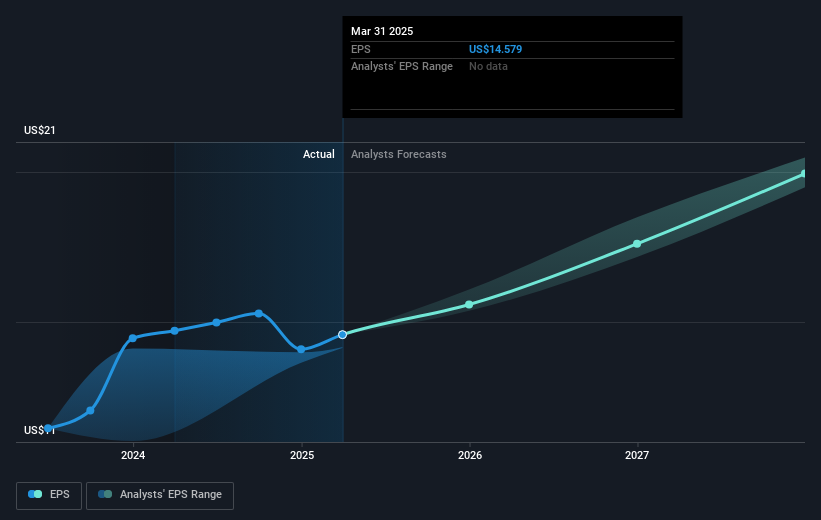

Anticipated improvements in customization capabilities and new partnerships are expected to drive revenue and earnings growth further. Analysts forecast MSCI's earnings could rise to US$1.6 billion by 2028, assuming continued expansion in ESG and climate-related solutions. The consensus price target of US$621.87 suggests a potential for share price appreciation, with the current price of US$538.48 reflecting a discount of 13.4% to this target. This positions MSCI to potentially capitalize on its core strengths and evolving market demands.

Examine MSCI's earnings growth report to understand how analysts expect it to perform.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English