Tech Sector Enthusiasm Lifts MicroStrategy (NasdaqGS:MSTR) Shares 11% Over the Past Week

MicroStrategy (NasdaqGS:MSTR) experienced a price increase of 11% over the past week, coinciding with a broad market upswing where the Nasdaq Composite climbed 2.3%. This modest jump aligns with the tech sector's overall momentum, partly driven by investor enthusiasm following positive earnings reports from major tech firms. While no specific events were reported about MicroStrategy during this period, the market's general optimism likely supported the stock's movement. With chipmakers leading the tech rally, broader investor confidence provided an environment for similar companies, like MicroStrategy, to flourish alongside positive market trends.

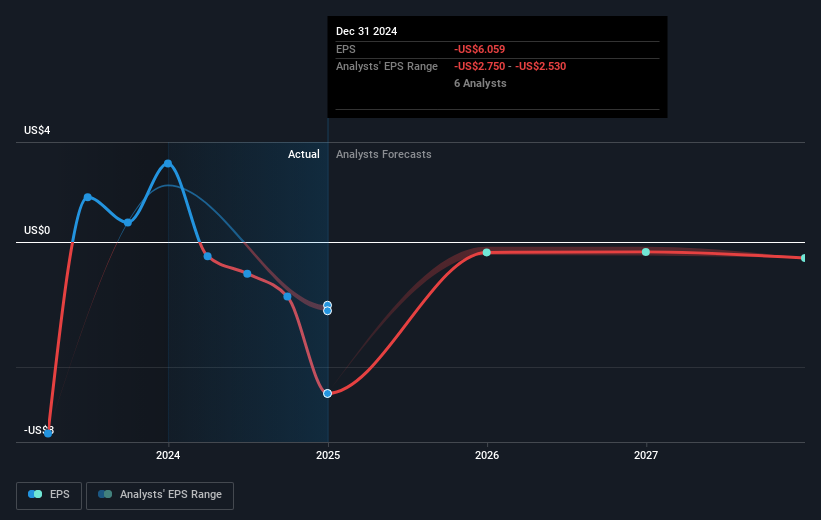

Over the past five years, MicroStrategy's total shareholder return surged by a very large 2612.03%. This long-term performance significantly outpaced the broader market and the US Software industry, which returned 5.9% and 2.2% over the past year, respectively. The recent 11% weekly uptick in share price contributes to the company's ongoing momentum, even in light of challenging earnings figures that include a US$670.81 million net loss for Q4 2024.

The underperformance in revenue and earnings could weigh on future forecasts, with revenue expected to grow at 2.7% per year, slower than the US market's anticipated 8.1%. Despite recent gains, MicroStrategy's current share price trades at a discount to the consensus analyst price target of approximately US$488.01, reflecting lingering market concerns about valuation and profitability. The upcoming dividend and amendments to increase authorized shares could entice investors looking for both income and potential long-term growth opportunities.

Click to explore a detailed breakdown of our findings in MicroStrategy's financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English