While shareholders of American Eagle Outfitters (NYSE:AEO) are in the red over the last year, underlying earnings have actually grown

Investors can approximate the average market return by buying an index fund. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. Investors in American Eagle Outfitters, Inc. (NYSE:AEO) have tasted that bitter downside in the last year, as the share price dropped 52%. That contrasts poorly with the market return of 7.4%. Longer term shareholders haven't suffered as badly, since the stock is down a comparatively less painful 26% in three years. The falls have accelerated recently, with the share price down 37% in the last three months.

Although the past week has been more reassuring for shareholders, they're still in the red over the last year, so let's see if the underlying business has been responsible for the decline.

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Even though the American Eagle Outfitters share price is down over the year, its EPS actually improved. It could be that the share price was previously over-hyped.

It's surprising to see the share price fall so much, despite the improved EPS. So it's well worth checking out some other metrics, too.

American Eagle Outfitters' dividend seems healthy to us, so we doubt that the yield is a concern for the market. The revenue trend doesn't seem to explain why the share price is down. Unless, of course, the market was expecting a revenue uptick.

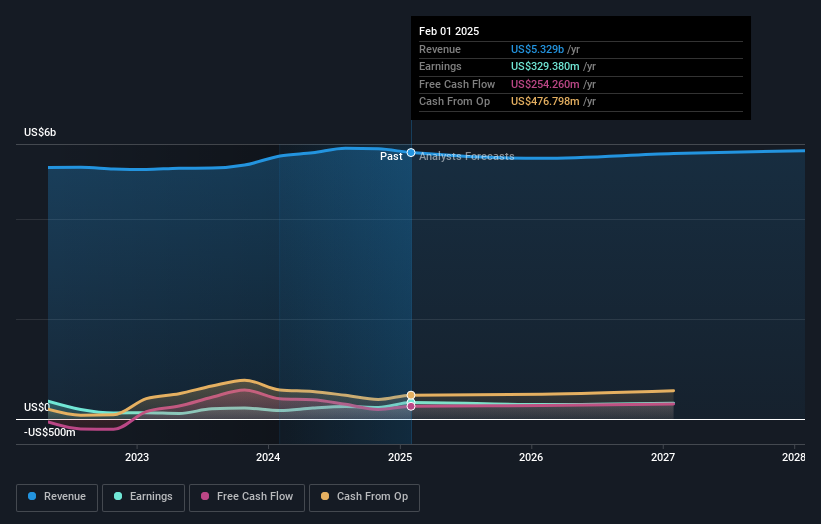

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

American Eagle Outfitters is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. If you are thinking of buying or selling American Eagle Outfitters stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

While the broader market gained around 7.4% in the last year, American Eagle Outfitters shareholders lost 50% (even including dividends). Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 8% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand American Eagle Outfitters better, we need to consider many other factors. Take risks, for example - American Eagle Outfitters has 2 warning signs (and 1 which is potentially serious) we think you should know about.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English