D.R. Horton (NYSE:DHI) Expands Into Farms Of New Kent With 45 New Townhomes

D.R. Horton (NYSE:DHI) recently entered into an agreement to develop 45 townhomes in the Farms of New Kent community, signaling business expansion efforts as construction is set to commence soon. Despite this positive development, the company's share price remained flat over the last week amidst broader market volatility, which saw a 4% decline due to fluctuating earnings reports and tariff concerns. D.R. Horton's second-quarter earnings, featuring a downturn in sales and net income, along with a new share buyback program, would have aligned with the market's broader moves, reflecting a cautious investor sentiment.

Buy, Hold or Sell D.R. Horton? View our complete analysis and fair value estimate and you decide.

The agreement to develop 45 townhomes in the Farms of New Kent community highlights D.R. Horton's focus on expanding its footprint within the affordable housing market. This initiative positions the company advantageously to meet ongoing demand, potentially translating into increased sales volumes and positively influencing revenue forecasts. The company's emphasis on faster construction cycles could enhance operational efficiency, potentially boosting earnings as margins improve. Despite the promising expansion, D.R. Horton's recent share price stabilization amid broader market volatility may reflect lingering investor caution regarding short-term profits and overall market conditions.

Over the past five years, D.R. Horton's total return, including share price and dividends, amounted to 201.47%. This long-term gain provides a robust context against the company's recent underperformance relative to the broader US Consumer Durables industry, which saw a 12% decline over the previous year. The deviation may stem from current market challenges affecting short-term earnings, as highlighted by an earlier downturn in sales and net income.

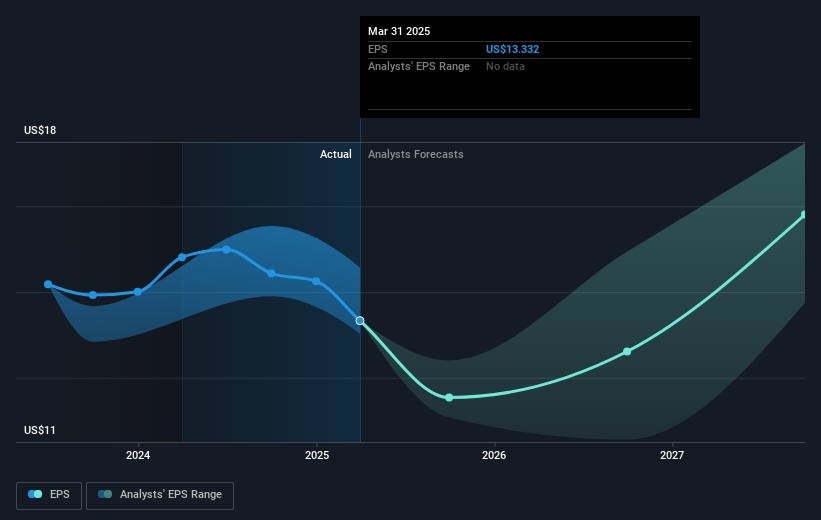

Furthermore, with analysts projecting revenue growth of 4.9% annually and potential margin contraction from 12.7% to 11.9% over the next three years, the recently announced development may offer a positive catalyst to counterbalance such pressures. Nonetheless, the current share price stands at approximately 21.33% below the consensus price target of US$146.52, suggesting an upside potential based on projected 2028 earnings and a potential increase in the price-to-earnings ratio. Investors should consider these estimates alongside their expectations of the company's future performance and market dynamics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English