April 2025's Top Growth Stocks With Strong Insider Ownership

Over the last 7 days, the United States market has experienced a 4.4% decline, maintaining a flat performance over the past year with earnings forecasted to grow by 13% annually. In such conditions, stocks that exhibit strong growth potential coupled with high insider ownership can be particularly appealing as they often indicate confidence from those closest to the company in its future prospects.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (NasdaqGS:SMCI) | 14.2% | 29.8% |

| Hims & Hers Health (NYSE:HIMS) | 13.2% | 21.8% |

| Duolingo (NasdaqGS:DUOL) | 14.4% | 37.2% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 12.2% | 65.1% |

| Astera Labs (NasdaqGS:ALAB) | 15.8% | 61.4% |

| Niu Technologies (NasdaqGM:NIU) | 36% | 82.8% |

| Red Cat Holdings (NasdaqCM:RCAT) | 18.3% | 123% |

| Clene (NasdaqCM:CLNN) | 19.4% | 63.1% |

| Upstart Holdings (NasdaqGS:UPST) | 12.6% | 100.2% |

| Credit Acceptance (NasdaqGS:CACC) | 14.4% | 33.8% |

Let's review some notable picks from our screened stocks.

AlTi Global (NasdaqCM:ALTI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AlTi Global, Inc. offers wealth and asset management services across the United States, the United Kingdom, and internationally with a market cap of approximately $463.70 million.

Operations: The company's revenue segments include Corporate at $0.14 million, International Real Estate at $8.54 million, and Wealth & Capital Solutions at $198.26 million.

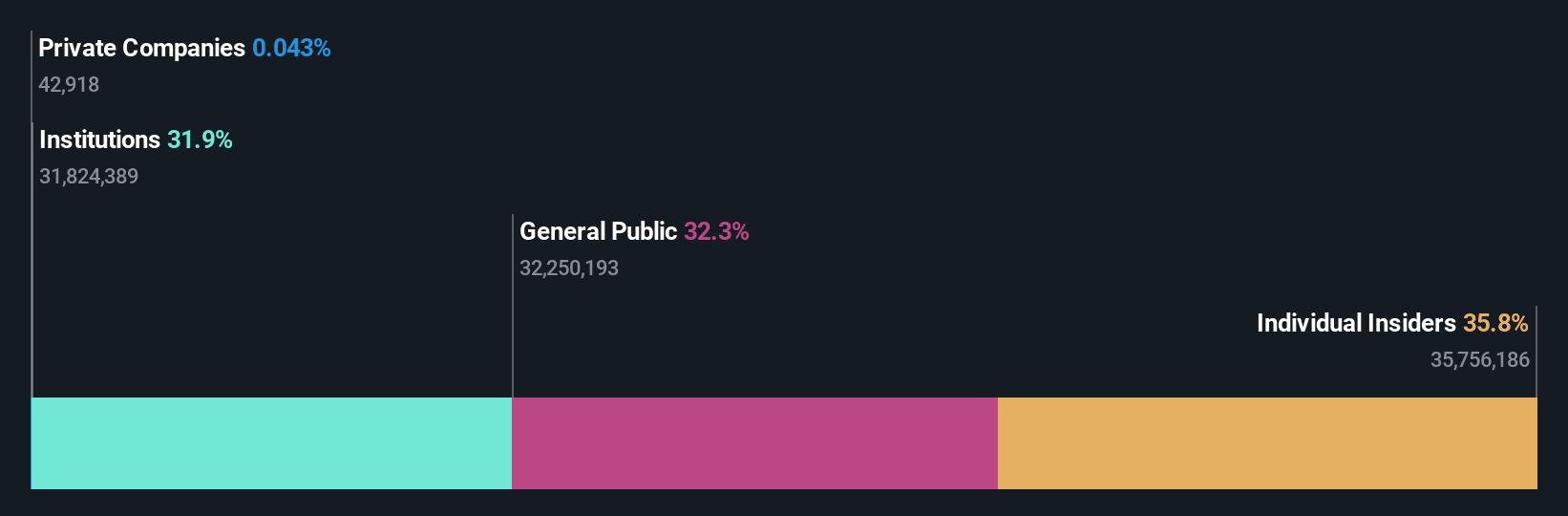

Insider Ownership: 37.7%

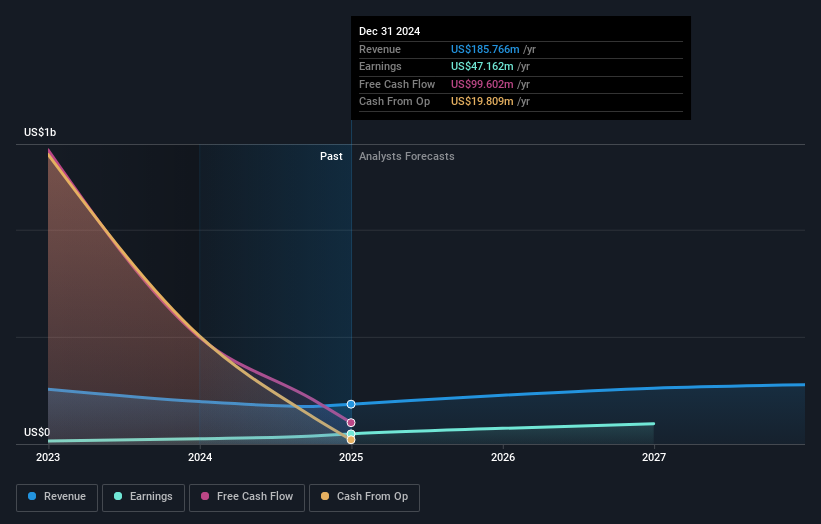

AlTi Global is experiencing financial challenges, with a net loss of US$98.14 million for 2024, though losses have narrowed from the previous year. Revenue forecasts suggest growth at 14.8% annually, surpassing the US market average but below high-growth thresholds. The company anticipates profitability in three years, indicating above-average market growth potential. Recent leadership changes include appointing Mike Harrington as CFO to strengthen financial strategy amid limited cash runway and past shareholder dilution concerns.

- Navigate through the intricacies of AlTi Global with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of AlTi Global shares in the market.

Bausch Health Companies (NYSE:BHC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bausch Health Companies Inc. is a diversified specialty pharmaceutical and medical device company that develops, manufactures, and markets products in areas such as gastroenterology, neurology, dermatology, and eye health globally, with a market cap of approximately $1.88 billion.

Operations: The company's revenue segments are comprised of Salix at $2.33 billion, Diversified Products at $950 million, Bausch + Lomb at $4.79 billion, International Pharmaceuticals at $1.11 billion, and Solta Medical at $440 million.

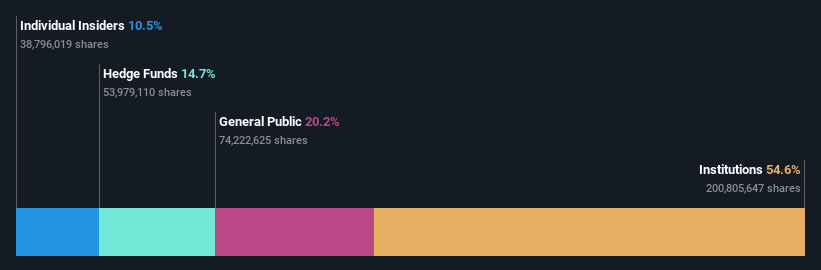

Insider Ownership: 10.5%

Bausch Health Companies is navigating financial restructuring with a US$4.4 billion debt offering to refinance existing obligations, aiming for improved fiscal stability. Despite negative shareholders' equity, the company forecasts significant earnings growth of 83.12% annually over the next three years and anticipates becoming profitable within this period, indicating above-average market growth potential. Revenue projections remain modest compared to market averages, though insider ownership remains high without recent substantial insider trading activity.

- Dive into the specifics of Bausch Health Companies here with our thorough growth forecast report.

- The analysis detailed in our Bausch Health Companies valuation report hints at an deflated share price compared to its estimated value.

Northpointe Bancshares (NYSE:NPB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Northpointe Bancshares, Inc., with a market cap of $403.08 million, operates as the bank holding company for Northpointe Bank, offering a range of banking products and services in the United States.

Operations: The company's revenue is primarily derived from its Retail Banking segment, which generated $144.01 million, and its Mortgage Warehouse (MPP) segment, which contributed $43.46 million.

Insider Ownership: 22.7%

Northpointe Bancshares demonstrates strong growth potential with earnings forecasted to increase significantly at 33.3% annually, outpacing the US market. Despite trading at 47% below its estimated fair value, insider selling has been significant recently. The company reported a substantial rise in net income and earnings per share for 2024. Recent leadership changes aim to bolster its mortgage warehouse lending division, potentially enhancing strategic growth initiatives within this sector.

- Click here and access our complete growth analysis report to understand the dynamics of Northpointe Bancshares.

- The valuation report we've compiled suggests that Northpointe Bancshares' current price could be quite moderate.

Next Steps

- Explore the 201 names from our Fast Growing US Companies With High Insider Ownership screener here.

- Curious About Other Options? Uncover 10 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English