Expert Outlook: Sun Communities Through The Eyes Of 4 Analysts

Sun Communities (NYSE:SUI) has been analyzed by 4 analysts in the last three months, revealing a diverse range of perspectives from bullish to bearish.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 1 | 0 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 2 | 0 | 0 | 0 | 0 |

| 2M Ago | 1 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

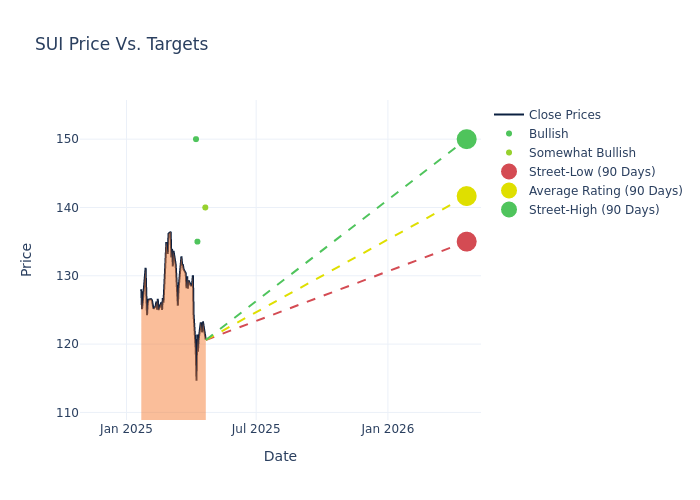

In the assessment of 12-month price targets, analysts unveil insights for Sun Communities, presenting an average target of $141.75, a high estimate of $150.00, and a low estimate of $135.00. A 0.64% drop is evident in the current average compared to the previous average price target of $142.67.

Analyzing Analyst Ratings: A Detailed Breakdown

An in-depth analysis of recent analyst actions unveils how financial experts perceive Sun Communities. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating |Current Price Target| Prior Price Target | |--------------------|--------------------|---------------|-----------------|--------------------|--------------------| |Aaron Hecht |JMP Securities |Lowers |Market Outperform| $140.00|$150.00 | |Anthony Hau |Truist Securities |Lowers |Buy | $135.00|$142.00 | |Peter Abramowitz |Jefferies |Announces |Buy | $150.00|- | |Anthony Hau |Truist Securities |Raises |Buy | $142.00|$136.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Sun Communities. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of Sun Communities compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Sun Communities's stock. This examination reveals shifts in analysts' expectations over time.

Capture valuable insights into Sun Communities's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Sun Communities analyst ratings.

Get to Know Sun Communities Better

Sun Communities is a residential REIT that focuses on owning manufactured housing, residential vehicle communities, and marinas. The company currently owns a portfolio of 645 properties, which includes 341 manufactured housing communities, 166 residential vehicle communities, and 138 marina properties. Sun targets owning properties that are desirable as second homes or vacation properties with nearly 50% of the portfolio located in either Florida or Michigan near major bodies of water.

Unraveling the Financial Story of Sun Communities

Market Capitalization Analysis: With a profound presence, the company's market capitalization is above industry averages. This reflects substantial size and strong market recognition.

Positive Revenue Trend: Examining Sun Communities's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 2.59% as of 31 December, 2024, showcasing a substantial increase in top-line earnings. When compared to others in the Real Estate sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Sun Communities's net margin is below industry averages, indicating potential challenges in maintaining strong profitability. With a net margin of -30.08%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Sun Communities's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of -3.07%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): Sun Communities's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of -1.32%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: Sun Communities's debt-to-equity ratio is below the industry average. With a ratio of 1.04, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

How Are Analyst Ratings Determined?

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English