Apollo Global Management (NYSE:APO) Announces Key Board Changes with Cohn and Rowan Leadership

Apollo Global Management (NYSE:APO) is currently undergoing significant leadership changes with the appointment of Gary Cohn as Lead Independent Director and Marc Rowan assuming a dual role as CEO and Chair of the Board. These corporate developments align with broader company restructuring efforts and were complemented by product enhancements and a notable partnership with Summit Ridge Energy. Despite these moves, the company's 2% price increase over the past week is in line with a generally flat market, adding weight to any broader trends, given that the market itself has shown little significant variation over the same period.

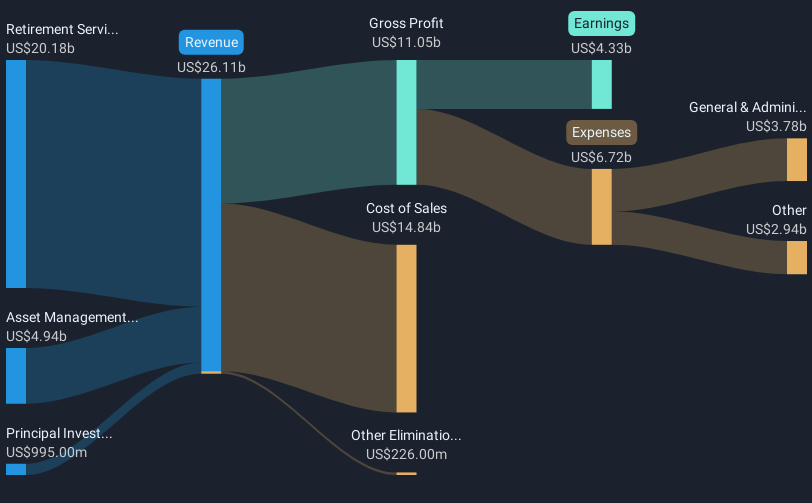

The recent leadership changes at Apollo Global Management, including the appointments of Gary Cohn and Marc Rowan, are aligned with the company's restructuring efforts. These corporate adjustments could enhance operational execution, potentially impacting its strategic focus on areas such as industrial renaissance and retirement solutions. Over the longer term, Apollo's shares have shown significant appreciation, achieving a total return of 280.94% over five years. This performance reflects a robust expansion, though it must be considered alongside market dynamics and the recent modest share price increase of 2% over the past week.

Relative to the industry, Apollo matched the US Diversified Financial industry's 19.1% return over the past year, indicating competitive performance in a stable market environment. The recent news, supplemented by Apollo's S&P 500 inclusion, may bolster public market exposure and drive origination volumes, with possibilities for increased revenue and earnings in the future. Despite a share price currently at US$125.21, analysts have set a price target of US$154.65, implying a potential upside. However, actualizing this target hinges on executing forecasts, such as achieving US$5.6 billion in earnings by 2028 alongside a profit margin elevation, with the price movement being minuscule compared to expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English