Shandong Boan Biotechnology Co., Ltd.'s (HKG:6955) 48% Price Boost Is Out Of Tune With Revenues

Despite an already strong run, Shandong Boan Biotechnology Co., Ltd. (HKG:6955) shares have been powering on, with a gain of 48% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 35% in the last year.

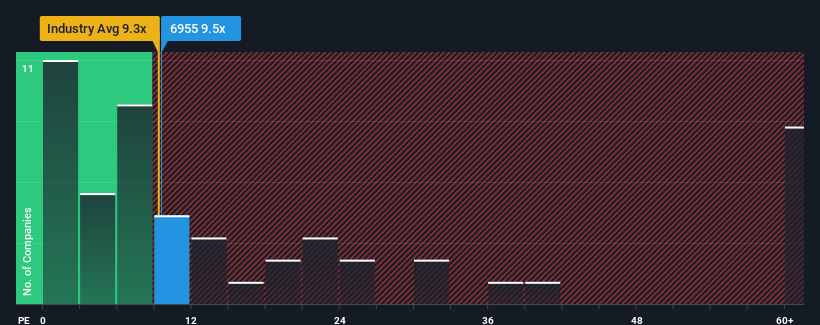

Although its price has surged higher, you could still be forgiven for feeling indifferent about Shandong Boan Biotechnology's P/S ratio of 9.5x, since the median price-to-sales (or "P/S") ratio for the Biotechs industry in Hong Kong is also close to 9.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Shandong Boan Biotechnology

What Does Shandong Boan Biotechnology's Recent Performance Look Like?

Recent times haven't been great for Shandong Boan Biotechnology as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Shandong Boan Biotechnology's future stacks up against the industry? In that case, our free report is a great place to start.How Is Shandong Boan Biotechnology's Revenue Growth Trending?

In order to justify its P/S ratio, Shandong Boan Biotechnology would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an exceptional 18% gain to the company's top line. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 28% as estimated by the sole analyst watching the company. With the industry predicted to deliver 35% growth, the company is positioned for a weaker revenue result.

With this information, we find it interesting that Shandong Boan Biotechnology is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On Shandong Boan Biotechnology's P/S

Shandong Boan Biotechnology appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look at the analysts forecasts of Shandong Boan Biotechnology's revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Shandong Boan Biotechnology that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English