A Glimpse Into The Expert Outlook On ON Semiconductor Through 27 Analysts

Ratings for ON Semiconductor (NASDAQ:ON) were provided by 27 analysts in the past three months, showcasing a mix of bullish and bearish perspectives.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 8 | 6 | 11 | 2 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 2 | 1 | 0 | 0 |

| 2M Ago | 1 | 0 | 1 | 0 | 0 |

| 3M Ago | 7 | 4 | 8 | 2 | 0 |

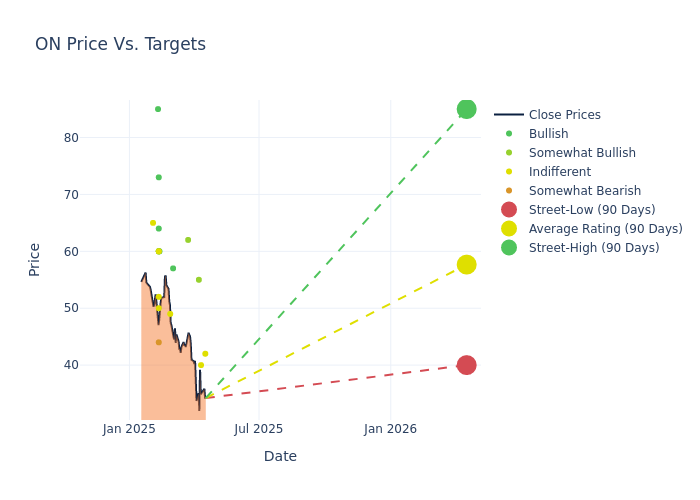

Insights from analysts' 12-month price targets are revealed, presenting an average target of $58.26, a high estimate of $85.00, and a low estimate of $40.00. This current average represents a 19.16% decrease from the previous average price target of $72.07.

Understanding Analyst Ratings: A Comprehensive Breakdown

The perception of ON Semiconductor by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating |Current Price Target| Prior Price Target | |--------------------|--------------------|---------------|---------------|--------------------|--------------------| |Tore Svanberg |Stifel |Lowers |Hold | $42.00|$52.00 | |Christopher Danely |Citigroup |Lowers |Neutral | $40.00|$52.00 | |John Vinh |Keybanc |Lowers |Overweight | $55.00|$60.00 | |Vijay Rakesh |Mizuho |Lowers |Outperform | $62.00|$71.00 | |Quinn Bolton |Needham |Maintains |Buy | $57.00|$57.00 | |Kevin Cassidy |Rosenblatt |Maintains |Neutral | $49.00|$49.00 | |David Williams |Benchmark |Lowers |Buy | $60.00|$90.00 | |William Stein |Truist Securities |Lowers |Hold | $52.00|$60.00 | |Suji Desilva |Roth MKM |Lowers |Buy | $60.00|$100.00 | |Joe Quatrochi |Wells Fargo |Lowers |Overweight | $60.00|$80.00 | |Toshiya Hari |Goldman Sachs |Lowers |Buy | $64.00|$77.00 | |Tore Svanberg |Stifel |Lowers |Hold | $52.00|$60.00 | |Christopher Rolland |Susquehanna |Lowers |Positive | $60.00|$70.00 | |Anthony Stoss |Craig-Hallum |Lowers |Hold | $50.00|$78.00 | |Craig Ellis |B. Riley Securities |Lowers |Buy | $73.00|$90.00 | |Kevin Cassidy |Rosenblatt |Lowers |Neutral | $49.00|$75.00 | |Quinn Bolton |Needham |Lowers |Buy | $57.00|$66.00 | |Vijay Rakesh |Mizuho |Lowers |Outperform | $71.00|$85.00 | |Harlan Sur |JP Morgan |Lowers |Neutral | $60.00|$88.00 | |Joseph Moore |Morgan Stanley |Lowers |Underweight | $44.00|$52.00 | |Christopher Danely |Citigroup |Lowers |Neutral | $52.00|$77.00 | |Quinn Bolton |Needham |Lowers |Buy | $57.00|$66.00 | |Blayne Curtis |Jefferies |Lowers |Buy | $85.00|$100.00 | |Kevin Cassidy |Rosenblatt |Maintains |Neutral | $75.00|$75.00 | |Joseph Moore |Morgan Stanley |Lowers |Underweight | $52.00|$64.00 | |Pradeep Ramani |UBS |Lowers |Neutral | $65.00|$72.00 | |Christopher Rolland |Susquehanna |Lowers |Positive | $70.00|$80.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to ON Semiconductor. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of ON Semiconductor compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of ON Semiconductor's stock. This analysis reveals shifts in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of ON Semiconductor's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on ON Semiconductor analyst ratings.

Get to Know ON Semiconductor Better

Onsemi is a supplier of power semiconductors and sensors focused on the automotive and industrial markets. Onsemi is the second-largest power chipmaker in the world and the largest supplier of image sensors to the automotive market. While the firm used to be highly vertically integrated, it now pursues a hybrid manufacturing strategy for flexible capacity. Onsemi is pivoting to focus on emerging applications like electric vehicles, autonomous vehicles, industrial automation, and renewable energy.

Understanding the Numbers: ON Semiconductor's Finances

Market Capitalization Analysis: Falling below industry benchmarks, the company's market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Negative Revenue Trend: Examining ON Semiconductor's financials over 3M reveals challenges. As of 31 December, 2024, the company experienced a decline of approximately -14.65% in revenue growth, reflecting a decrease in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Information Technology sector.

Net Margin: ON Semiconductor's net margin is impressive, surpassing industry averages. With a net margin of 22.06%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): ON Semiconductor's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of 4.37%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): ON Semiconductor's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of 2.71%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: With a high debt-to-equity ratio of 0.38, ON Semiconductor faces challenges in effectively managing its debt levels, indicating potential financial strain.

Analyst Ratings: What Are They?

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English