Micron Technology (NasdaqGS:MU) Sees 11% Price Drop Over The Last Week

Micron Technology (NasdaqGS:MU) recently announced no share repurchases in a recent tranche of its buyback program, although it declared a cash dividend earlier. Despite launching innovative memory products for AI servers and collaborating with NVIDIA, Micron's stock price fell by 11% last week. This followed a challenging period for technology stocks, with chip sector concerns heightened by U.S. export restrictions to China impacting the broader market. With the Nasdaq gaining slightly against a declining Dow, Micron's performance aligned with sector trends, where chipmakers like Nvidia faced scrutiny over AI product exports.

You should learn about the 1 warning sign we've spotted with Micron Technology.

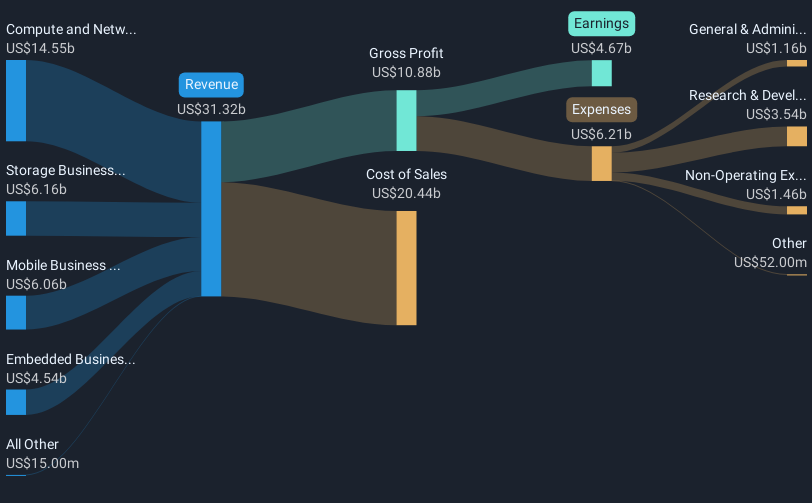

Micron Technology's recent decision not to repurchase shares, despite declaring a cash dividend, might reflect its focus on preserving capital for investments in advanced technologies like HBM and LPDDR5X. This decision, along with broader market concerns about U.S. export restrictions, contributed to an 11% decline in its share price last week. Over a longer five-year timeframe, however, Micron's total shareholder return, combining share price appreciation and dividends, was 61.51%, indicating robust growth compared to its recent dip. In contrast to the broader market, Micron's stock underperformed both the U.S. market, which saw a 4.6% return, and the semiconductor industry with a similar 4.1% return over the past year.

The implications of these market conditions on Micron's revenue and earnings forecasts are significant. Increased HBM sales and the adoption of LPDDR5X could bolster revenue and align market share with AI-driven demand. However, increased manufacturing costs and competitive pressures may compress margins and impact earnings potential. With the recent price standing at US$65.54, this move positions Micron's shares at a discount of nearly 49.2% to the analyst consensus price target of US$129.07, suggesting potential upside should the company achieve its projected revenue and earnings growth over the coming years.

Assess Micron Technology's previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English