Teradyne (NasdaqGS:TER) Sees 10% Stock Dip Over Last Week Amid Broader Market Challenges

Teradyne (NasdaqGS:TER) has partnered with ficonTEC to launch an innovative high-volume, double-sided wafer probe test cell for silicon photonics, marking a significant development in electro-optical testing for co-packaged optics. Despite this advancement, the company's stock fell 10% over the past week. This decline comes amid broader market challenges, as the Dow Jones fell sharply due to UnitedHealth's profit forecast cut and the tech sector faced pressure from U.S. export restrictions to China. While Teradyne's collaboration could bolster its long-term position in silicon photonics, market conditions have weighed on its short-term performance.

Buy, Hold or Sell Teradyne? View our complete analysis and fair value estimate and you decide.

The partnership between Teradyne and ficonTEC in the silicon photonics space could positively impact the company's market positioning, especially within the growing sector of electro-optical testing. Despite this development, Teradyne's share price experienced a one-week decline of 10%, partly due to external market pressures. This movement contrasts with the company's five-year total returns of 15.71%, showing a longer-term strength despite short-term volatility. Over the past year, Teradyne has underperformed relative to the US Semiconductor industry and broader market, each showing modest gains.

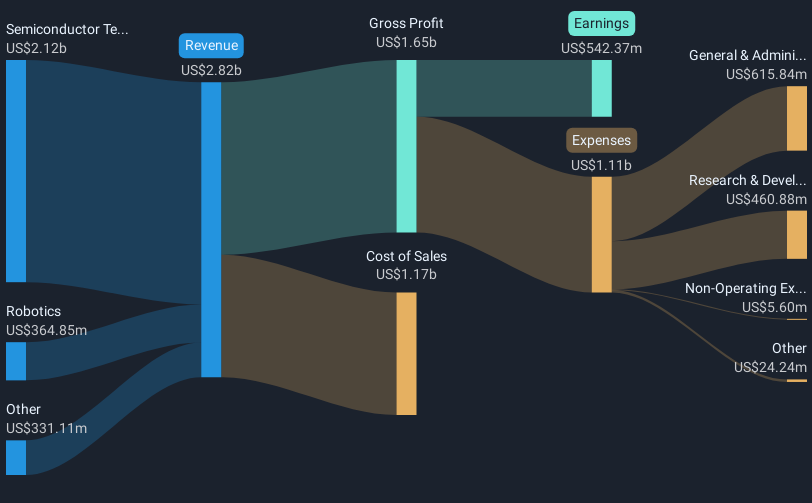

In terms of revenue and earnings forecasts, this collaboration with ficonTEC may help drive anticipated growth, particularly through increased penetration in areas like automotive and semiconductor testing driven by AI compute demand. Analysts expect Teradyne’s future revenue to reach 4.1 billion US$, with earnings potentially climbing to 1.0 billion US$ by 2028. However, challenges in the robotics and semiconductor markets, as well as execution risks, could impact these forecasts. The current share price of 67.96 US$ reflects a 41.9% discount to the analyst consensus price target of 116.90 US$, suggesting potential for future appreciation should the company meet these optimistic growth expectations.

Explore Teradyne's analyst forecasts in our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English