3 Growth Companies Insiders Own With Earnings Growth Up To 139%

In the current U.S. market, investors are navigating a landscape marked by mixed performance across major indices, with the S&P 500 and Nasdaq showing modest gains while the Dow Jones Industrial Average has faced downward pressure due to sector-specific challenges. Amid these fluctuations, growth companies with high insider ownership can offer unique insights into potential future performance, as insiders often have a deep understanding of their company's prospects and are willing to invest significantly in its success.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (NasdaqGS:SMCI) | 14.2% | 29.8% |

| Duolingo (NasdaqGS:DUOL) | 14.4% | 37.2% |

| Hims & Hers Health (NYSE:HIMS) | 13.3% | 21.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 12.3% | 64.8% |

| Astera Labs (NasdaqGS:ALAB) | 15.8% | 61.4% |

| Red Cat Holdings (NasdaqCM:RCAT) | 19.4% | 122.6% |

| Niu Technologies (NasdaqGM:NIU) | 36.2% | 82.8% |

| Clene (NasdaqCM:CLNN) | 19.5% | 63.1% |

| Upstart Holdings (NasdaqGS:UPST) | 12.7% | 100.2% |

| Credit Acceptance (NasdaqGS:CACC) | 14.4% | 33.8% |

We're going to check out a few of the best picks from our screener tool.

Himax Technologies (NasdaqGS:HIMX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Himax Technologies, Inc. is a fabless semiconductor company that offers display imaging processing technologies across various regions including China, Taiwan, Korea, Japan, the United States, and internationally with a market cap of approximately $1.17 billion.

Operations: The company's revenue is primarily derived from Driver IC products, contributing $751.33 million, and Non-Driver Products, which account for $155.48 million.

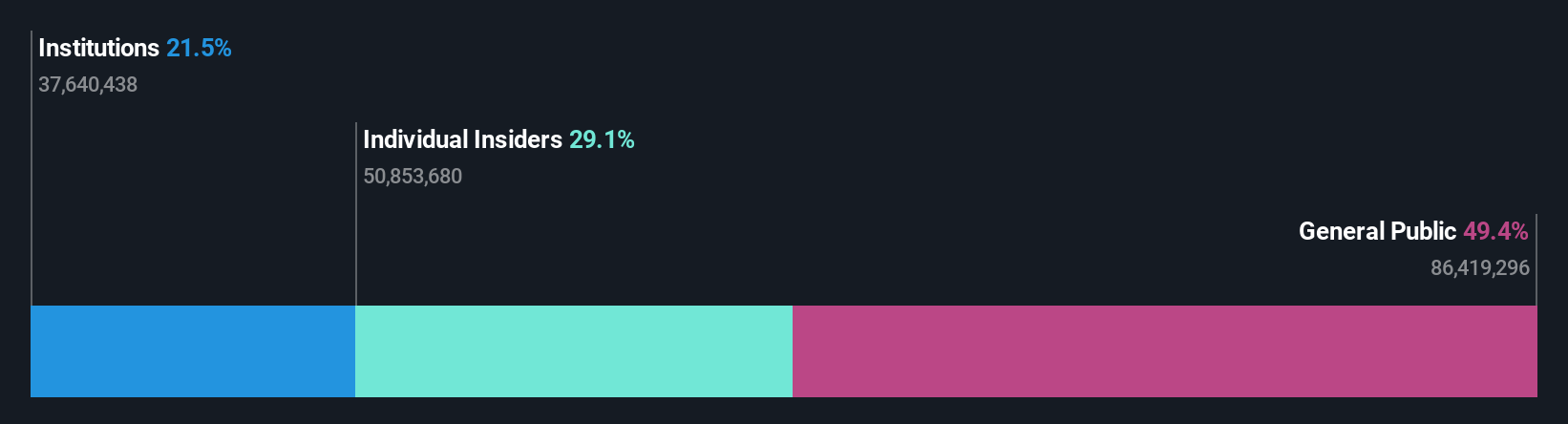

Insider Ownership: 29.1%

Earnings Growth Forecast: 24.2% p.a.

Himax Technologies demonstrates potential as a growth company with high insider ownership, driven by expected annual earnings growth of 24.2%, surpassing the US market average. Despite its volatile share price, it trades at a favorable P/E ratio of 14.1x compared to the broader market. Recent strategic alliances, such as the MoU with Tata Electronics and Powerchip Semiconductor Manufacturing Corporation, aim to expand their display semiconductor and AI sensing solutions globally, enhancing market presence and innovation capabilities.

- Delve into the full analysis future growth report here for a deeper understanding of Himax Technologies.

- Our expertly prepared valuation report Himax Technologies implies its share price may be lower than expected.

Sable Offshore (NYSE:SOC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sable Offshore Corp. is an independent oil and gas company operating in the United States with a market cap of $1.77 billion.

Operations: Sable Offshore Corp.'s revenue is derived from its independent oil and gas operations within the United States.

Insider Ownership: 24.3%

Earnings Growth Forecast: 139.2% p.a.

Sable Offshore faces challenges despite its growth potential, with earnings forecast to grow 139.23% annually and revenue expected to increase by 77.2% per year, outpacing the US market. However, the company reported a significant net loss of US$629.07 million for 2024 and received an auditor's going concern warning. Trading at 77.6% below estimated fair value suggests potential upside if financial stability improves and profitability is achieved within three years as projected.

- Click to explore a detailed breakdown of our findings in Sable Offshore's earnings growth report.

- The analysis detailed in our Sable Offshore valuation report hints at an inflated share price compared to its estimated value.

Vitesse Energy (NYSE:VTS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vitesse Energy, Inc. focuses on acquiring, developing, and producing non-operated oil and natural gas properties in the United States with a market cap of approximately $771.57 million.

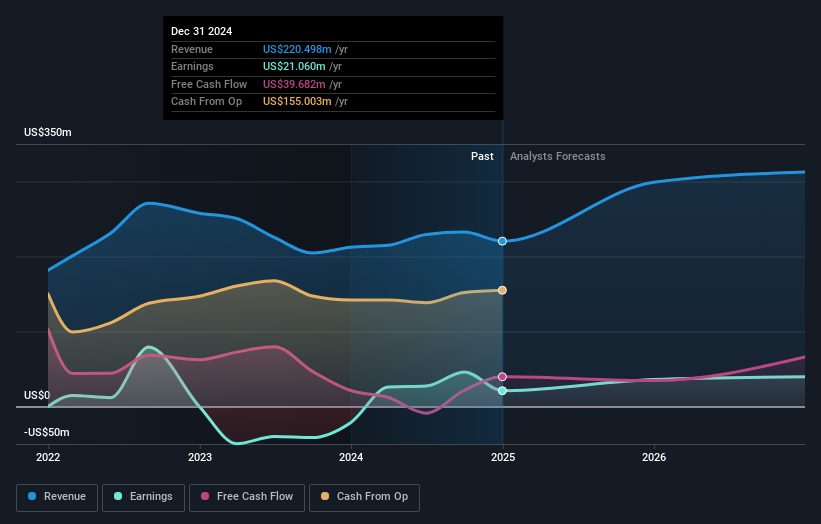

Operations: The company's revenue comes entirely from its oil and gas exploration and production segment, which generated $220.50 million.

Insider Ownership: 17.9%

Earnings Growth Forecast: 31.2% p.a.

Vitesse Energy has demonstrated strong growth potential, with earnings expected to increase by 31.2% annually, surpassing the US market's average. The company recently transitioned to profitability, reporting a net income of US$21.06 million for 2024 compared to a prior net loss. Despite past shareholder dilution, insider ownership remains significant and no recent insider trading activity has been reported. Vitesse is actively pursuing acquisitions, such as Lucero, which are anticipated to enhance financial metrics and support dividend increases.

- Navigate through the intricacies of Vitesse Energy with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Vitesse Energy's shares may be trading at a discount.

Next Steps

- Unlock our comprehensive list of 198 Fast Growing US Companies With High Insider Ownership by clicking here.

- Seeking Other Investments? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English