Unusual Machines, Dominari Holdings Share Volume Spiked Ahead Of Trump Family Appointments: Here's What Happened

Shares of Unusual Machines Inc. (NYSE:UMAC) and Dominari Holdings Inc. (NASDAQ:DOMH) surged ahead of the appointments of President Donald Trump‘s sons, Donald Trump Jr. and Eric Trump, to their advisory boards.

What Happened: The drone maker, Unusual Machines, which announced Trump Jr.’s appointment to the company’s advisory board on Nov. 27, 2024, saw its volume skyrocket in four weeks by 182,100 shares as of Oct. 30, 2024, to 56,839,000 shares as of the date of the announcement, reported the Financial Times.

The shares of the company in the four weeks rose by 495.79%, leading to the announcement.

Unusual Machines told the publication that only three senior officers, its board, and counsel knew of Trump Jr.’s planned involvement. The company believes no one breached their duty and has no information on why investors bought its stock during that time.

Similarly, Dominari Holdings volumes also soared from 109,300 shares on Dec. 31, 2024, to 33,245,300 shares as of Feb. 11, 2025.

The fintech company focused on data centers and AI investment opportunities, announced on Feb. 11, Trump Jr. and Eric Trump’s appointment to its advisory board as well.

The six weeks leading to the announcement saw the stock price climb by 661.2%. Prior to their official appointments, disclosures showed that the Trump brothers each received 966,000 shares of Dominari, representing 6.7% of the company.

Notably, Dominari Holdings underwrote Unusual Machines' initial public offering last year.

Dominari, Eric, and Trump Jr. did not respond to Benzinga’s email about an NDA breach.

Why It Matters: Bill Singer, a lawyer and former regulatory attorney, told FT that the significant price change before the announcement suggested “that this was not a hermetically sealed event.”

Meanwhile, University of Michigan law professor Adam Pritchard called the stock movements “clearly unusual” but noted that, as a board advisor, Trump Jr. might not have the same restrictions against trading on information that a board director does.

Apart from this, Trump Media & Technology Group Corp. (NASDAQ:DJT) has recently announced the launch of Truth Social-branded separately managed accounts. Yorkville America Equities and Index Technologies Group have partnered with DJT on this venture.

Price Action: Unusual Machines was up 2.98% in premarket on Thursday, and it has dropped 68.36% on a year-to-date basis, whereas Dominari Holdings rose 1.30% in premarket, surging 253.21% on a year-to-date basis.

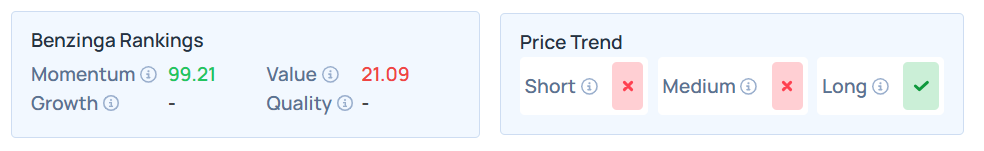

Benzinga Edge Stock Rankings indicate that UMAC has a weaker price trend over the short and medium term but a strong price trend in the long term. Its momentum ranking was sturdy at the 99.21th percentile, whereas its value rankings were weak, the details for which, along with other metrics, are available here.

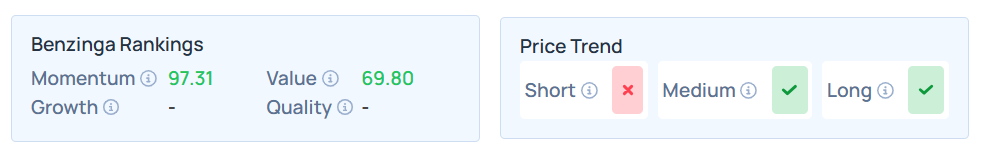

Benzinga Edge Stock Rankings shows that DOMH has a weaker price trend in the short term, whereas it is strong over the medium term and long term. Its momentum ranking is solid at the 97.31th percentile, whereas its value rankings were moderate, the details for which, along with other metrics, are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, rose in premarket on Thursday. The SPY was up 0.76% to $529.67, while the QQQ advanced 0.98% to $448.54, according to Benzinga Pro data.

Read Next:

Image Via Shutterstock

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English