SIGN UP

LOG IN

Wall Street's Most Accurate Analysts Spotlight On 3 Financial Stocks With Over 15% Dividend Yields

Benzinga·04/17/2025 11:09:25

Listen to the news

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the financial sector.

Annaly Capital Management, Inc. (NYSE:NLY)

- Dividend Yield: 15.88%

- JP Morgan analyst Richard Shane maintained an Overweight rating and cut the price target from $21 to $19 on April 16, 2025. This analyst has an accuracy rate of 67%.

- Keefe, Bruyette & Woods analyst Bose George maintained an Outperform rating and cut the price target from $21 to $20.15 on April 8, 2025. This analyst has an accuracy rate of 70%.

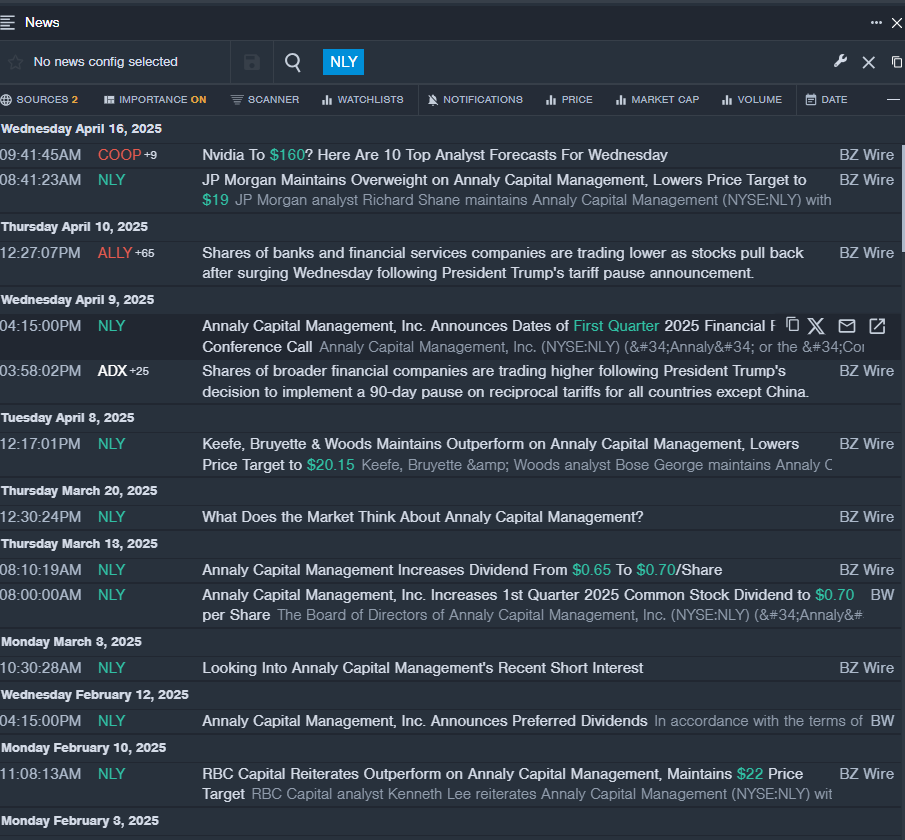

- Recent News: Annaly Capital Management will release its financial results for the quarter ended March 31, after the closing bell on Wednesday, April 30.

- Benzinga Pro’s real-time newsfeed alerted to latest NLY news.

PennantPark Investment Corporation (NYSE:PNNT)

- Dividend Yield: 15.48%

- Ladenburg Thalmann analyst Mickey Schleien downgraded the stock from Buy to Neutral on Nov. 27, 2024. This analyst has an accuracy rate of 64%.

- Compass Point analyst Casey Alexander upgraded the stock from Sell to Neutral with a price target of $6 on Sept. 9, 2024. This analyst has an accuracy rate of 66%.

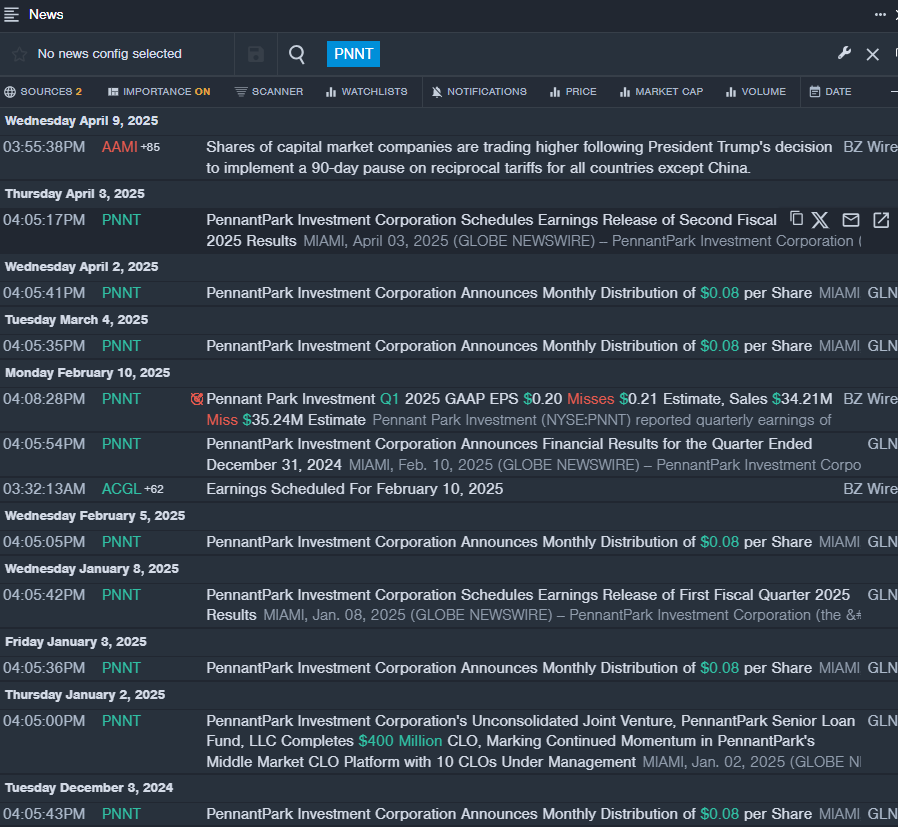

- Recent News: PennantPark Investment will report results for the second fiscal quarter on Monday, May 12, after the close of the financial markets.

- Benzinga Pro's real-time newsfeed alerted to latest PNNT news

New York Mortgage Trust, Inc. (NASDAQ:NYMT)

- Dividend Yield: 15.01%

- UBS analyst Douglas Harter maintained a Neutral rating and cut the price target from $7.5 to $6 on May 8, 2024. This analyst has an accuracy rate of 68%.

- Keefe, Bruyette & Woods analyst Bose George maintained a Market Perform rating and cut the price target from $8.5 to $7 on May 3, 2024. This analyst has an accuracy rate of 70%.

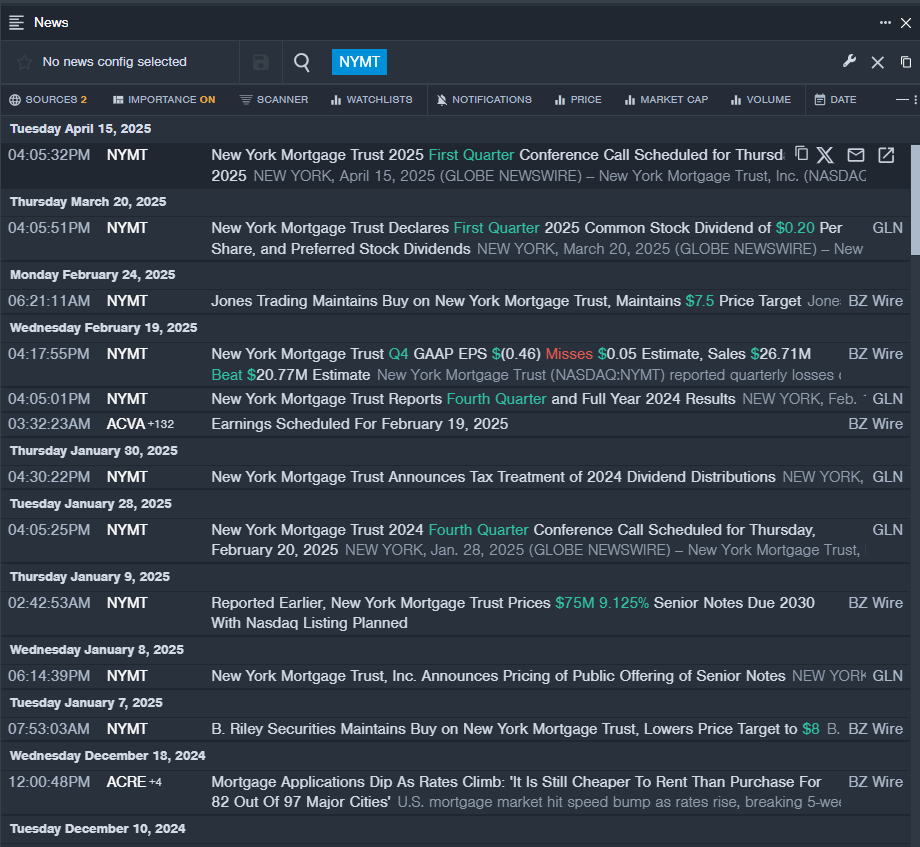

- Recent News: New York Mortgage Trust will report financial results for the three months ended March 31, 2025 after the closing bell on April 30.

- Benzinga Pro’s real-time newsfeed alerted to latest NYMT news

Read More:

Photo via Shutterstock

Risk Disclosure: The content of this page is not an investment advice and does not constitute any offer or solicitation to offer or recommendation of any investment product. It is for general purposes only and does not take into account your individual needs, investment objectives and specific financial circumstances. All investments involve risk and the past performance of securities, or financial products does not guarantee future results or returns. Keep in mind that while diversification may help spread risk it does not assure a profit, or protect against loss, in a down market. There is always the potential of losing money when you invest in securities, or other financial products. Investors should consider their investment objectives and risks carefully before investing. For more details, please refer to risk disclosure.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

Language

English

©2025 Webull Securities Limited. All rights reserved.