Silicon Motion Technology (NASDAQ:SIMO) Has Announced A Dividend Of $0.4975

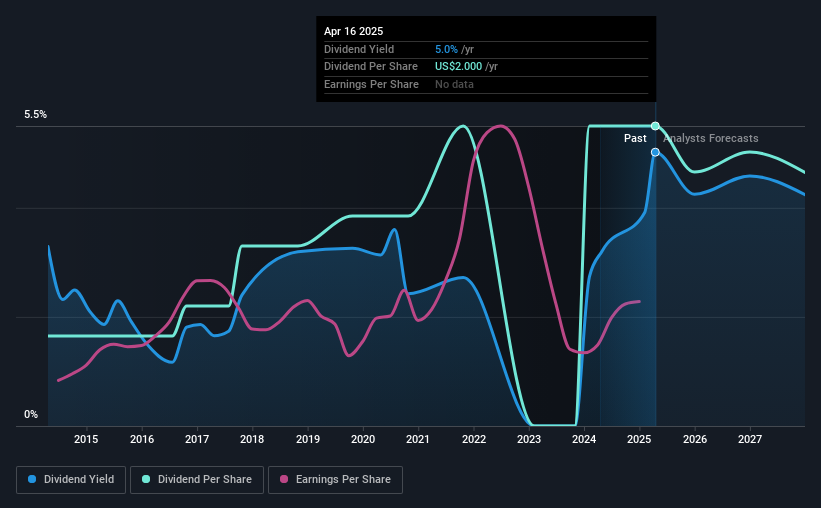

The board of Silicon Motion Technology Corporation (NASDAQ:SIMO) has announced that it will pay a dividend on the 22nd of May, with investors receiving $0.4975 per share. Based on this payment, the dividend yield on the company's stock will be 5.0%, which is an attractive boost to shareholder returns.

Silicon Motion Technology's Projected Earnings Seem Likely To Cover Future Distributions

A big dividend yield for a few years doesn't mean much if it can't be sustained. Before making this announcement, Silicon Motion Technology was paying out quite a large proportion of both earnings and cash flow, with the dividend being 206% of cash flows. Paying out such a high proportion of cash flows certainly exposes the company to cutting the dividend if cash flows were to reduce.

Looking forward, earnings per share is forecast to rise by 55.8% over the next year. If the dividend continues along recent trends, we estimate the payout ratio will be 51%, which is in the range that makes us comfortable with the sustainability of the dividend.

View our latest analysis for Silicon Motion Technology

Dividend Volatility

The company has a long dividend track record, but it doesn't look great with cuts in the past. The annual payment during the last 10 years was $0.60 in 2015, and the most recent fiscal year payment was $2.00. This means that it has been growing its distributions at 13% per annum over that time. It is great to see strong growth in the dividend payments, but cuts are concerning as it may indicate the payout policy is too ambitious.

The Dividend Has Growth Potential

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. We are encouraged to see that Silicon Motion Technology has grown earnings per share at 8.0% per year over the past five years. Recently, the company has been able to grow earnings at a decent rate, but with the payout ratio on the higher end we don't think the dividend has many prospects for growth.

Our Thoughts On Silicon Motion Technology's Dividend

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. With cash flows lacking, it is difficult to see how the company can sustain a dividend payment. We would probably look elsewhere for an income investment.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. As an example, we've identified 1 warning sign for Silicon Motion Technology that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English