Discovering US Undiscovered Gems in April 2025

As the U.S. stock market navigates a landscape marked by trade tensions and tariff uncertainties, small-cap indices like the S&P 600 are being closely watched for their potential to offer unique investment opportunities. In this environment, identifying lesser-known stocks with strong fundamentals and growth potential can be key to uncovering hidden gems that may thrive despite broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Oakworth Capital | 32.14% | 14.78% | 4.37% | ★★★★★★ |

| Cashmere Valley Bank | 15.62% | 5.80% | 3.51% | ★★★★★★ |

| Omega Flex | NA | -0.52% | 0.74% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| Teekay | NA | -0.89% | 62.53% | ★★★★★★ |

| Solesence | 33.45% | 23.87% | -3.75% | ★★★★★★ |

| Anbio Biotechnology | NA | 8.43% | 184.88% | ★★★★★★ |

| FRMO | 0.08% | 38.78% | 45.85% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

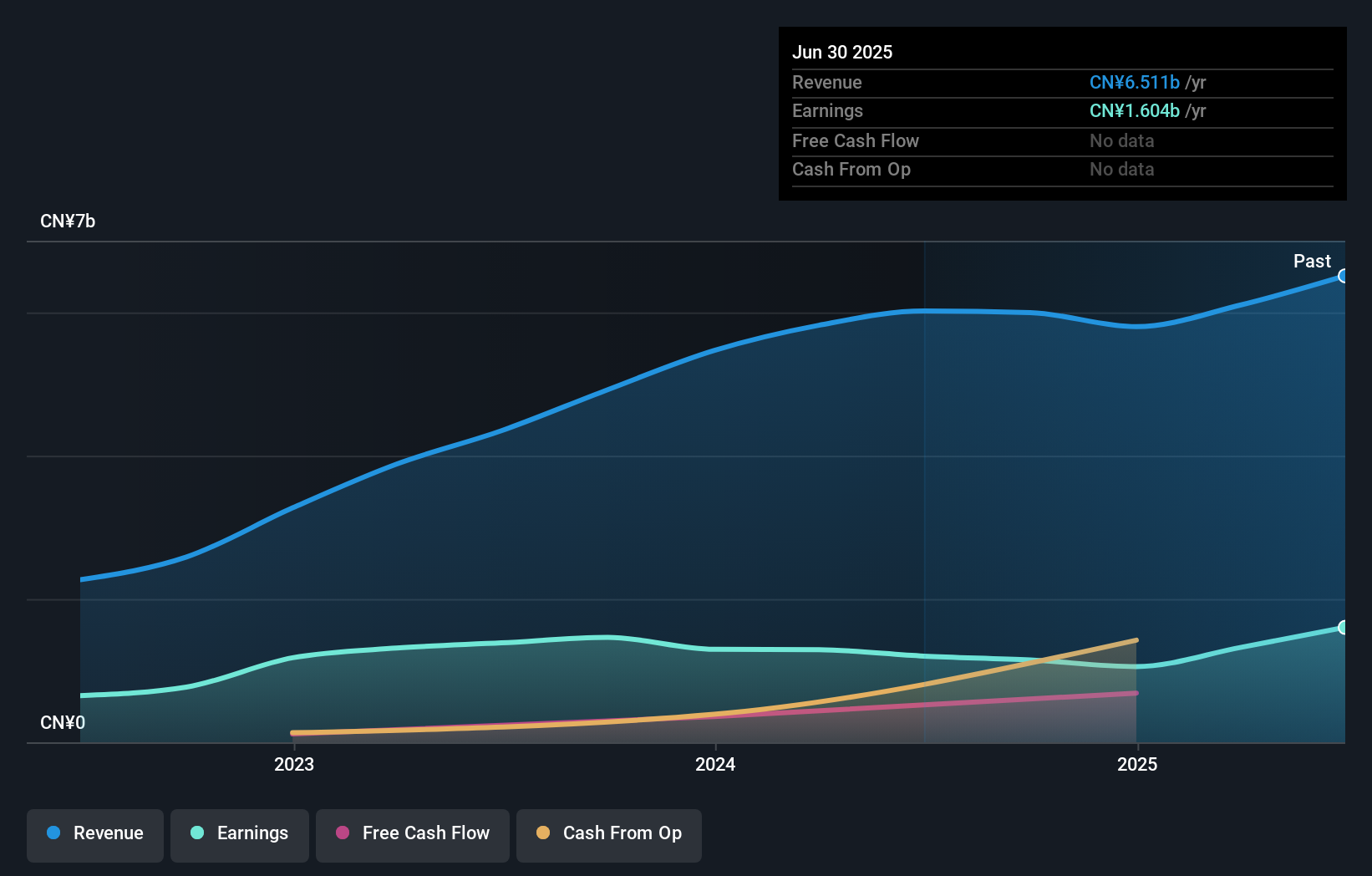

Jiayin Group (NasdaqGM:JFIN)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiayin Group Inc., listed on NasdaqGM under the ticker JFIN, operates as a provider of online consumer finance services in the People’s Republic of China with a market cap of $535.10 million.

Operations: Jiayin Group generates revenue primarily from its online consumer finance services, with reported figures of CN¥5.80 billion. The company's financial performance is influenced by various cost structures associated with delivering these services.

Jiayin Group, a small cap player in the consumer finance sector, showcases high-quality earnings despite experiencing an 18.6% negative earnings growth compared to the industry average of 18%. Trading at 80.8% below its estimated fair value, Jiayin seems undervalued with no debt on its books. The company repurchased about 968,946 shares for $6.31 million from April 2024 to March 2025 and has announced a dividend policy aiming to distribute around 30% of net income after tax annually. However, recent volatility in share price might concern some investors looking for stability.

- Get an in-depth perspective on Jiayin Group's performance by reading our health report here.

Gain insights into Jiayin Group's past trends and performance with our Past report.

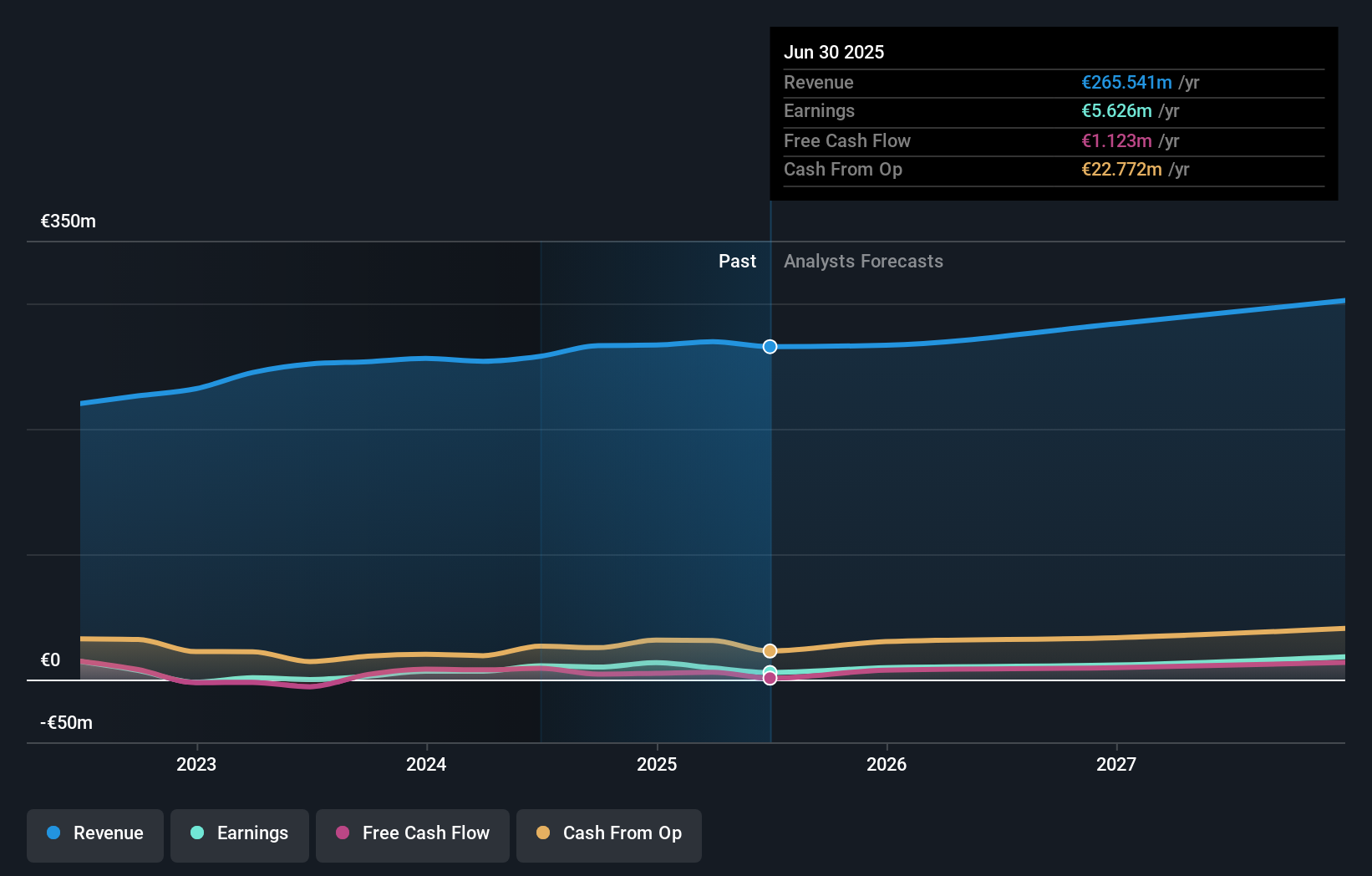

Materialise (NasdaqGS:MTLS)

Simply Wall St Value Rating: ★★★★★★

Overview: Materialise NV specializes in additive manufacturing, medical software, and 3D printing services across the Americas, Europe and Africa, and the Asia-Pacific regions with a market capitalization of approximately $255.76 million.

Operations: Materialise generates revenue primarily from three segments: Materialise Medical (€116.36 million), Materialise Software (€43.90 million), and Materialise Manufacturing (€106.51 million).

Materialise, a company with a focus on 3D printing solutions, has been making strategic moves to enhance its market position and revenue potential. The company's earnings grew by an impressive 99.9% over the past year, significantly outpacing the Software industry average of 25.4%. Materialise is trading at a good value, currently priced at 9.2% below its estimated fair value. With a debt-to-equity ratio reduced from 82.7% to 13.5% over five years and more cash than total debt, financial stability seems strong. Despite challenges like integration issues and European economic conditions affecting short-term results, analysts project revenue growth of about 6.3% annually over the next three years with profit margins expected to rise from 5% to around 6%.

Bank of N.T. Butterfield & Son (NYSE:NTB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: The Bank of N.T. Butterfield & Son Limited offers community, commercial, and private banking services to individuals and small to medium-sized businesses, with a market capitalization of approximately $1.53 billion.

Operations: The primary revenue stream for NTB comes from its banking segment, which generated $579.93 million.

Bank of N.T. Butterfield & Son, with assets totaling US$14.2 billion and equity at US$1 billion, is navigating a challenging environment with earnings growth at -4.1% over the past year compared to the industry average of -1.2%. Despite this, it trades at 77.2% below its estimated fair value and has low-risk funding as 96% of liabilities are customer deposits. With total deposits reaching US$12.7 billion and loans at US$4.5 billion, the bank's net interest margin stands at 2.6%. However, a high level of bad loans (3.3%) and a low allowance for these loans (17%) present concerns amid strategic expansions in retail banking sectors like the Channel Islands and Singapore aimed to boost market share further supported by recent share repurchases worth $69 million representing 4% of outstanding shares which could enhance shareholder value if rising costs don't offset potential gains from these initiatives.

Key Takeaways

- Click this link to deep-dive into the 282 companies within our US Undiscovered Gems With Strong Fundamentals screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English