3 Asian Stocks Estimated To Be Trading At Discounts Of Up To 44%

As global trade tensions escalate, Asian markets have faced significant volatility, with investors closely monitoring the economic impacts of ongoing tariff disputes. Amidst this uncertainty, identifying undervalued stocks can present opportunities for investors seeking potential value in a fluctuating market environment.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Ningbo Sanxing Medical ElectricLtd (SHSE:601567) | CN¥26.92 | CN¥53.13 | 49.3% |

| RACCOON HOLDINGS (TSE:3031) | ¥855.00 | ¥1705.77 | 49.9% |

| Nishi-Nippon Financial Holdings (TSE:7189) | ¥1844.00 | ¥3655.42 | 49.6% |

| People & Technology (KOSDAQ:A137400) | ₩39250.00 | ₩77062.66 | 49.1% |

| Micro-Star International (TWSE:2377) | NT$133.50 | NT$265.53 | 49.7% |

| Bairong (SEHK:6608) | HK$6.85 | HK$13.51 | 49.3% |

| AeroEdge (TSE:7409) | ¥1895.00 | ¥3726.08 | 49.1% |

| BIKE O (TSE:3377) | ¥373.00 | ¥730.90 | 49% |

| World Fitness Services (TWSE:2762) | NT$80.00 | NT$156.52 | 48.9% |

| giftee (TSE:4449) | ¥1485.00 | ¥2960.11 | 49.8% |

We're going to check out a few of the best picks from our screener tool.

ALTEOGEN (KOSDAQ:A196170)

Overview: ALTEOGEN Inc. is a biotechnology company that develops long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars, with a market cap of ₩20.63 trillion.

Operations: The company's revenue stems from its biotechnology segment, amounting to ₩102.85 million.

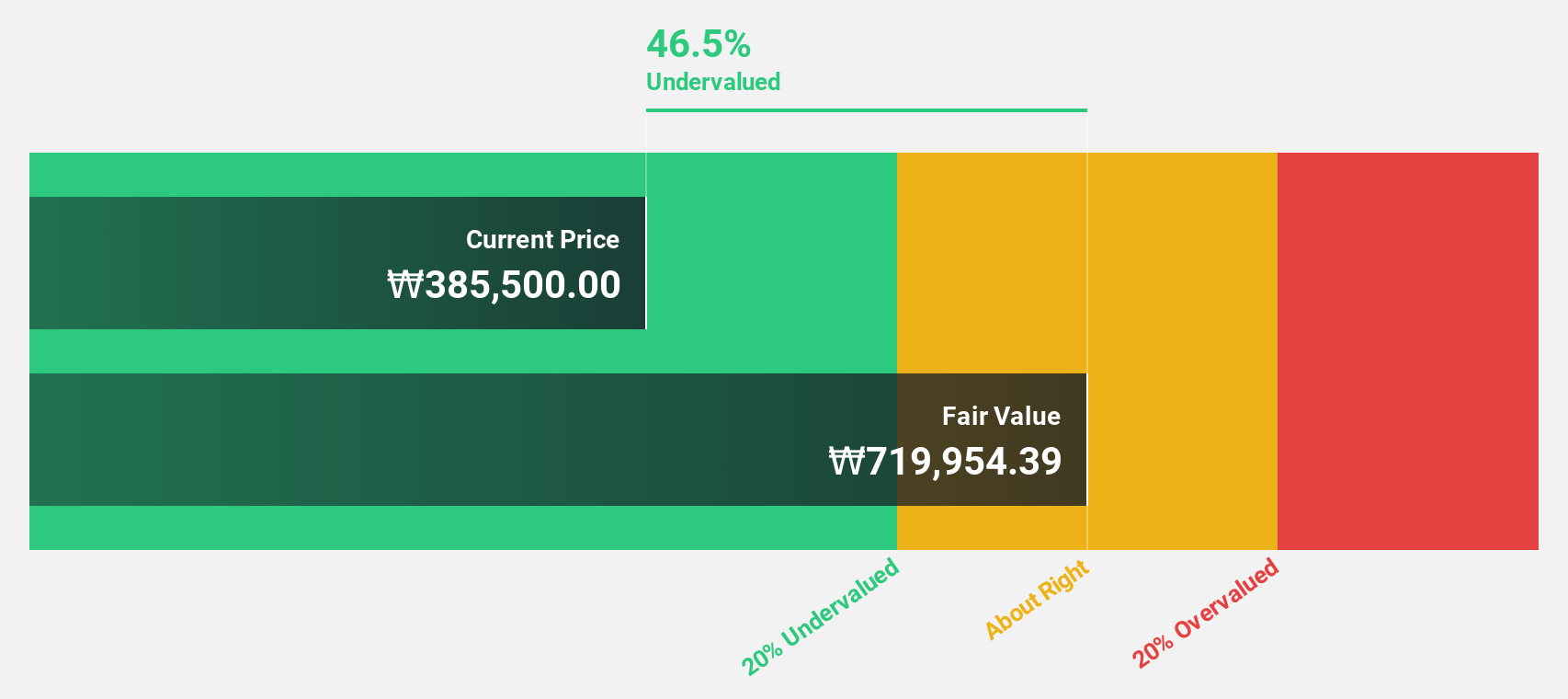

Estimated Discount To Fair Value: 44%

ALTEOGEN is trading at a significant discount, 44% below its estimated fair value of ₩691,476.79, making it highly undervalued based on discounted cash flow analysis. The company's earnings and revenue are expected to grow significantly faster than the Korean market average over the next three years. Recent private placements have strengthened its financial position, potentially supporting future growth initiatives and enhancing cash flows.

- Insights from our recent growth report point to a promising forecast for ALTEOGEN's business outlook.

- Take a closer look at ALTEOGEN's balance sheet health here in our report.

Xiaomi (SEHK:1810)

Overview: Xiaomi Corporation is an investment holding company that offers hardware and software services both in Mainland China and internationally, with a market cap of HK$1.12 trillion.

Operations: The company generates revenue from several segments, including Smartphones (CN¥191.76 billion), Internet Services (CN¥34.12 billion), IoT and Lifestyle Products (CN¥104.10 billion), and Smart EV and Other New Initiatives (CN¥32.75 billion).

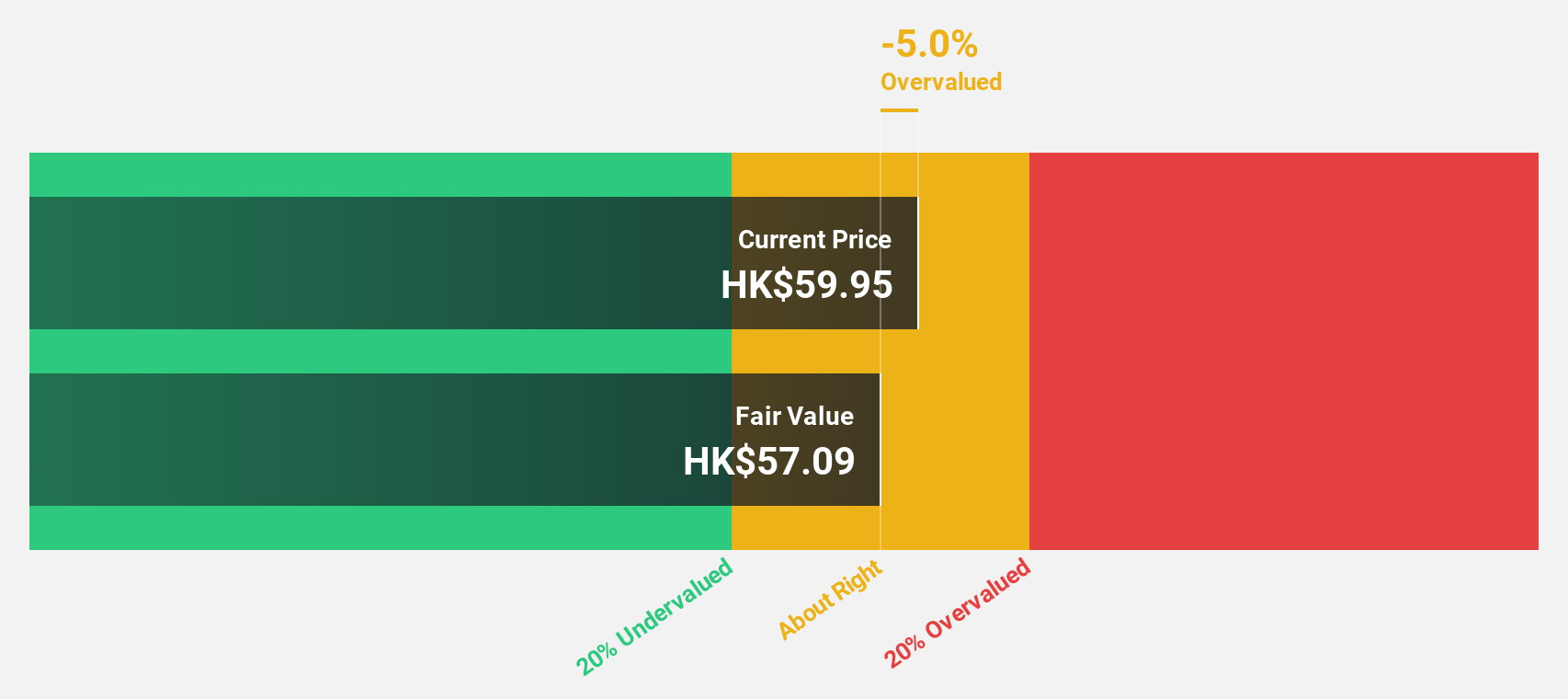

Estimated Discount To Fair Value: 25.7%

Xiaomi is trading at a significant discount, 25.7% below its estimated fair value of HK$58.12, indicating it’s undervalued based on discounted cash flow analysis. The company's earnings are forecast to grow significantly faster than the Hong Kong market over the next three years. Recent strategic partnerships in EV charging and a follow-on equity offering of HK$42.6 billion further bolster its financial position and growth prospects in the expanding NEV market.

- The growth report we've compiled suggests that Xiaomi's future prospects could be on the up.

- Get an in-depth perspective on Xiaomi's balance sheet by reading our health report here.

Singapore Technologies Engineering (SGX:S63)

Overview: Singapore Technologies Engineering Ltd is a global technology, defence, and engineering company with a market cap of SGD21.13 billion.

Operations: The company's revenue is primarily derived from three segments: Commercial Aerospace (SGD4.44 billion), Urban Solutions & Satcom (SGD2.01 billion), and Defence & Public Security (SGD4.97 billion).

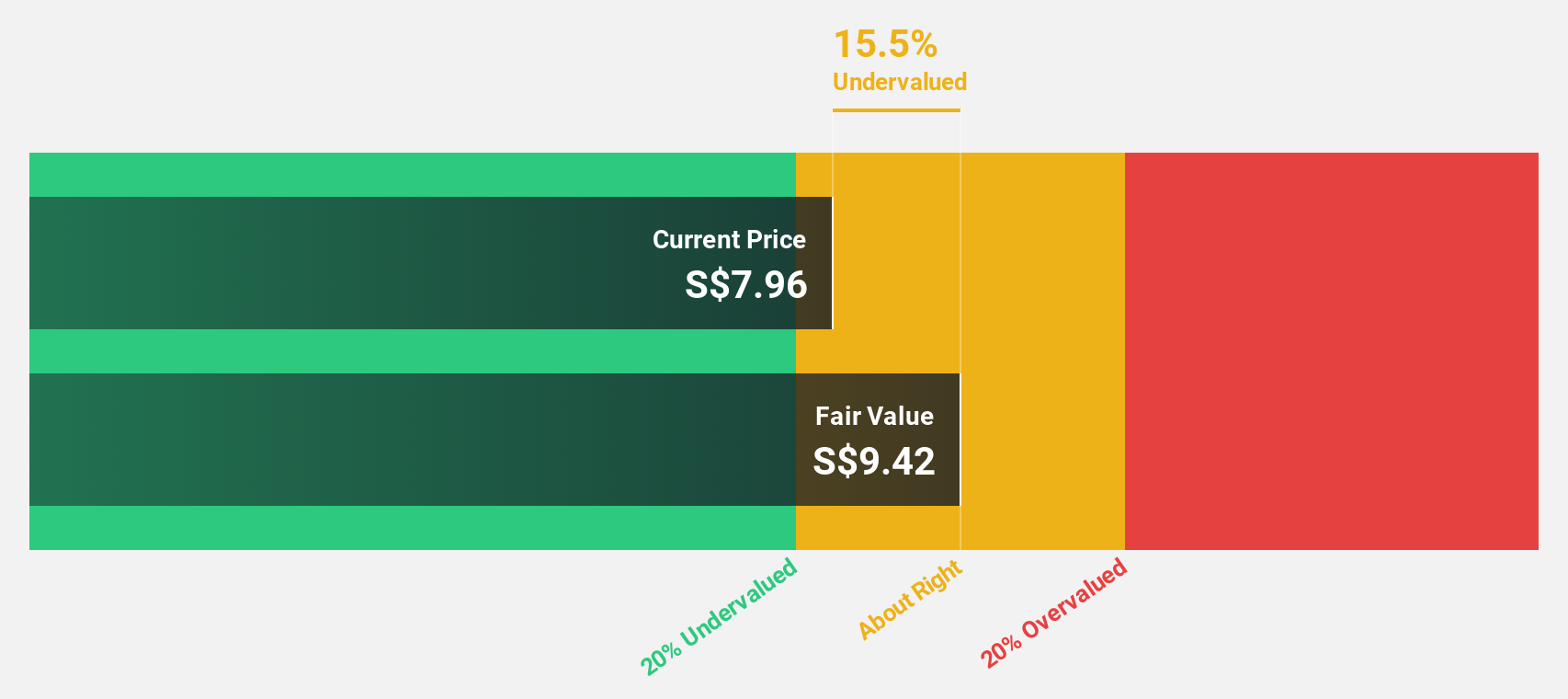

Estimated Discount To Fair Value: 37.4%

Singapore Technologies Engineering is trading at a 37.4% discount to its estimated fair value of S$10.81, highlighting potential undervaluation based on cash flows. The company reported strong earnings growth of 19.7% last year and forecasts suggest continued earnings growth at 11.6% annually, outpacing the Singapore market's average. Despite carrying high debt levels, its strategic initiatives and dividend policy adjustments aim to enhance shareholder returns while maintaining financial stability amid moderate revenue growth expectations.

- Our earnings growth report unveils the potential for significant increases in Singapore Technologies Engineering's future results.

- Delve into the full analysis health report here for a deeper understanding of Singapore Technologies Engineering.

Key Takeaways

- Click here to access our complete index of 264 Undervalued Asian Stocks Based On Cash Flows.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English