What 13 Analyst Ratings Have To Say About American Eagle Outfitters

In the preceding three months, 13 analysts have released ratings for American Eagle Outfitters (NYSE:AEO), presenting a wide array of perspectives from bullish to bearish.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 0 | 11 | 1 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 1 | 0 | 7 | 1 | 0 |

| 3M Ago | 0 | 0 | 3 | 0 | 0 |

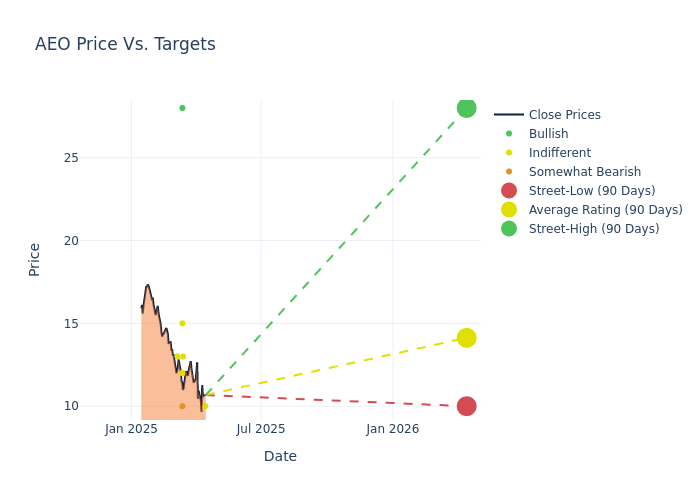

Analysts have set 12-month price targets for American Eagle Outfitters, revealing an average target of $15.15, a high estimate of $28.00, and a low estimate of $10.00. Experiencing a 20.6% decline, the current average is now lower than the previous average price target of $19.08.

Exploring Analyst Ratings: An In-Depth Overview

The standing of American Eagle Outfitters among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating |Current Price Target| Prior Price Target | |--------------------|---------------------|---------------|---------------|--------------------|--------------------| |Matthew Boss |JP Morgan |Lowers |Neutral | $10.00|$15.00 | |Christopher Nardone |B of A Securities |Lowers |Neutral | $13.00|$18.00 | |Matthew Boss |JP Morgan |Lowers |Neutral | $15.00|$19.00 | |Adrienne Yih |Morgan Stanley |Lowers |Equal-Weight | $12.00|$16.00 | |Simeon Siegel |BMO Capital |Lowers |Market Perform | $15.00|$19.00 | |Jay Sole |UBS |Lowers |Buy | $28.00|$32.00 | |Adrienne Yih |Barclays |Lowers |Underweight | $10.00|$17.00 | |Dana Telsey |Telsey Advisory Group|Lowers |Market Perform | $12.00|$18.00 | |Paul Lejuez |Citigroup |Lowers |Neutral | $13.00|$21.00 | |Dana Telsey |Telsey Advisory Group|Maintains |Market Perform | $18.00|$18.00 | |Adrienne Yih |Barclays |Lowers |Equal-Weight | $17.00|$19.00 | |Alex Straton |Morgan Stanley |Raises |Equal-Weight | $16.00|$15.00 | |Christopher Nardone |B of A Securities |Lowers |Neutral | $18.00|$21.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to American Eagle Outfitters. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of American Eagle Outfitters compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of American Eagle Outfitters's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on American Eagle Outfitters analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

All You Need to Know About American Eagle Outfitters

American Eagle Outfitters Inc is a specialty retailer. The company is engaged in the retail of apparel and accessories with company stores in the United States, Canada, Mexico, and Hong Kong. The Company leases all store premises, regional distribution facilities, some of its office space, and certain information technology and office equipment. American Eagle also has its online business. It operates in two segments: American Eagle and Aerie. The majority of its revenue comes from its primary brand, American Eagle, which offers an assortment of specialty apparel, accessories, and personal care products for women and men. Geographically, it generates the majority of its revenue from the United States.

Key Indicators: American Eagle Outfitters's Financial Health

Market Capitalization Analysis: Reflecting a smaller scale, the company's market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Negative Revenue Trend: Examining American Eagle Outfitters's financials over 3M reveals challenges. As of 31 January, 2025, the company experienced a decline of approximately -4.42% in revenue growth, reflecting a decrease in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Consumer Discretionary sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 6.5%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of 5.94%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): American Eagle Outfitters's ROA excels beyond industry benchmarks, reaching 2.76%. This signifies efficient management of assets and strong financial health.

Debt Management: American Eagle Outfitters's debt-to-equity ratio is below the industry average. With a ratio of 0.82, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Analyst Ratings: Simplified

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English