Retail investors invested in ZG Group (HKG:6676) copped the brunt of last week's HK$932m market cap decline

Key Insights

- ZG Group's significant retail investors ownership suggests that the key decisions are influenced by shareholders from the larger public

- A total of 5 investors have a majority stake in the company with 52% ownership

- Insider ownership in ZG Group is 34%

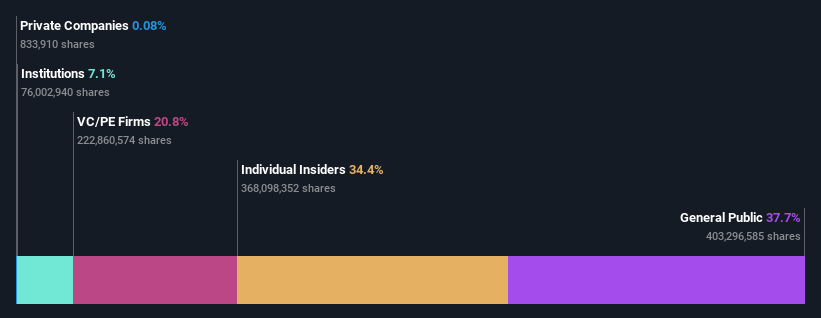

To get a sense of who is truly in control of ZG Group (HKG:6676), it is important to understand the ownership structure of the business. We can see that retail investors own the lion's share in the company with 38% ownership. That is, the group stands to benefit the most if the stock rises (or lose the most if there is a downturn).

While the holdings of retail investors took a hit after last week’s 15% price drop, insiders with their 34% also suffered.

Let's delve deeper into each type of owner of ZG Group, beginning with the chart below.

Check out our latest analysis for ZG Group

What Does The Institutional Ownership Tell Us About ZG Group?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

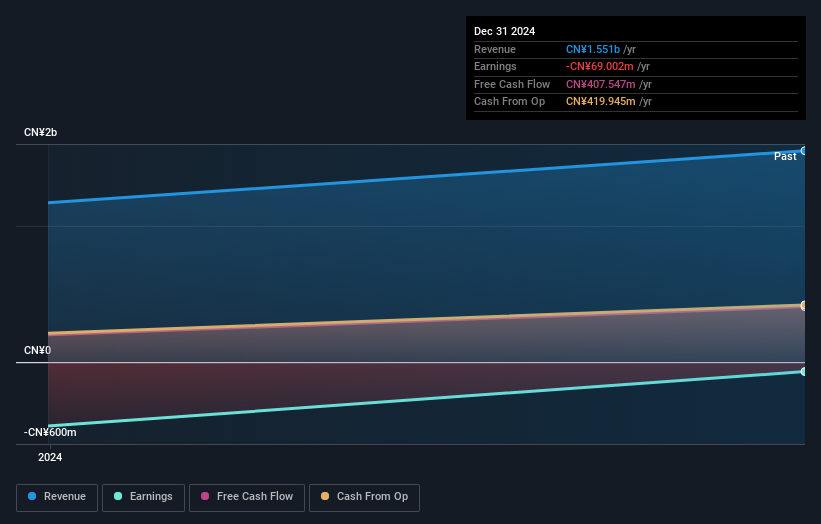

As you can see, institutional investors have a fair amount of stake in ZG Group. This implies the analysts working for those institutions have looked at the stock and they like it. But just like anyone else, they could be wrong. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of ZG Group, (below). Of course, keep in mind that there are other factors to consider, too.

ZG Group is not owned by hedge funds. The company's largest shareholder is Yuan Liu, with ownership of 16%. In comparison, the second and third largest shareholders hold about 15% and 8.4% of the stock. Dong Wang, who is the second-largest shareholder, also happens to hold the title of Chief Executive Officer.

To make our study more interesting, we found that the top 5 shareholders control more than half of the company which implies that this group has considerable sway over the company's decision-making.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. Our information suggests that there isn't any analyst coverage of the stock, so it is probably little known.

Insider Ownership Of ZG Group

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

It seems insiders own a significant proportion of ZG Group. It has a market capitalization of just HK$5.2b, and insiders have HK$1.8b worth of shares in their own names. It is great to see insiders so invested in the business. It might be worth checking if those insiders have been buying recently.

General Public Ownership

With a 38% ownership, the general public, mostly comprising of individual investors, have some degree of sway over ZG Group. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies.

Private Equity Ownership

With a stake of 21%, private equity firms could influence the ZG Group board. Some investors might be encouraged by this, since private equity are sometimes able to encourage strategies that help the market see the value in the company. Alternatively, those holders might be exiting the investment after taking it public.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with ZG Group (at least 1 which is concerning) , and understanding them should be part of your investment process.

If you would prefer check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, backed by strong financial data.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English