Here's Why Atmus Filtration Technologies (NYSE:ATMU) Has Caught The Eye Of Investors

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Atmus Filtration Technologies (NYSE:ATMU). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

How Fast Is Atmus Filtration Technologies Growing Its Earnings Per Share?

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So it's easy to see why many investors focus in on EPS growth. In previous twelve months, Atmus Filtration Technologies' EPS has risen from US$2.06 to US$2.24. That amounts to a small improvement of 8.9%.

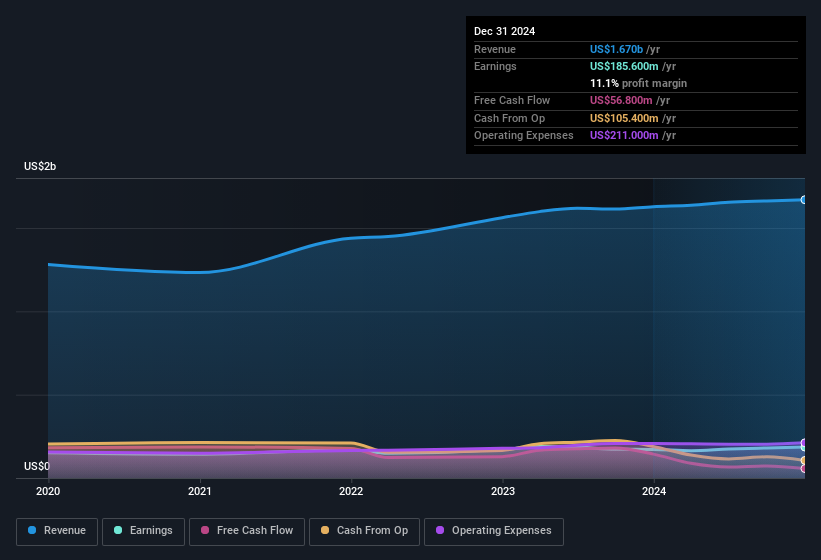

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Atmus Filtration Technologies maintained stable EBIT margins over the last year, all while growing revenue 2.5% to US$1.7b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Check out our latest analysis for Atmus Filtration Technologies

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Atmus Filtration Technologies' forecast profits ?

Are Atmus Filtration Technologies Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Shareholders in Atmus Filtration Technologies will be more than happy to see insiders committing themselves to the company, spending US$460k on shares in just twelve months. This, combined with the lack of sales from insiders, should be a great signal for shareholders in what's to come. Zooming in, we can see that the biggest insider purchase was by Independent Non-Executive Chairman Stephen Macadam for US$260k worth of shares, at about US$31.56 per share.

The good news, alongside the insider buying, for Atmus Filtration Technologies bulls is that insiders (collectively) have a meaningful investment in the stock. To be specific, they have US$15m worth of shares. This considerable investment should help drive long-term value in the business. Despite being just 0.6% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. The cherry on top is that the CEO, Steph Disher is paid comparatively modestly to CEOs at similar sized companies. For companies with market capitalisations between US$2.0b and US$6.4b, like Atmus Filtration Technologies, the median CEO pay is around US$7.5m.

The Atmus Filtration Technologies CEO received US$6.1m in compensation for the year ending December 2024. That seems pretty reasonable, especially given it's below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Should You Add Atmus Filtration Technologies To Your Watchlist?

One positive for Atmus Filtration Technologies is that it is growing EPS. That's nice to see. In addition, insiders have been busy adding to their sizeable holdings in the company. These factors alone make the company an interesting prospect for your watchlist, as well as continuing research. We should say that we've discovered 2 warning signs for Atmus Filtration Technologies that you should be aware of before investing here.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Atmus Filtration Technologies, you'll probably love this curated collection of companies in the US that have an attractive valuation alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English