GoDaddy (NYSE:GDDY) Shares Drop 8% Amid Broader Market Volatility

Over the past month, GoDaddy (NYSE:GDDY) experienced a share price decline of 8%, likely influenced by broader market volatility and trade tensions. With the Dow Jones and S&P 500 experiencing downturns due to geopolitical uncertainties and tariffs affecting multiple sectors, GoDaddy's decline fits within a wider market narrative. The company's financial performance might have been exerted pressure from these broader economic factors and market movements, which weighed heavily on investor sentiment across the technology sector and beyond. Despite Apple's strong performance helping lift tech stocks, GoDaddy's returns were more in line with the broader market's declines.

GoDaddy has 3 warning signs we think you should know about.

The recent 8% decline in GoDaddy's share price is reflective of the current market volatility impacted by geopolitical factors and trade tensions. This decline aligns with broader market trends, though over a longer period, GoDaddy's shares have exhibited strong performance. Over the past five years, the total shareholder return, including dividends, was a substantial 153.93%. In comparison, for the past year, GoDaddy's return was higher than the US market, which experienced a 3.8% decline. This outperformance underscores that while short-term pressures exist, historically, GoDaddy has provided solid returns to its shareholders.

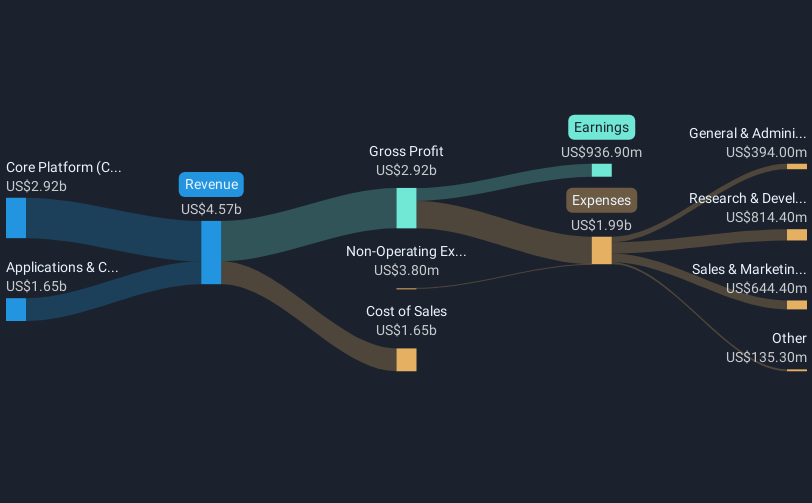

The recent market news could influence the company's revenue and earnings forecasts. With initiatives like strategic pricing and bundling expected to drive growth, the pressure from broader economic factors could temper short-term growth expectations. Analysts forecast a 7.7% revenue growth annually over the next three years and expect profit margins to improve from 20.5% to 22.7%. The share price's current discount to the analyst consensus price target of US$217.86 suggests an upside potential of around 17.0% from its existing level of US$180.72. However, market conditions and strategic shifts could introduce variability in achieving these forecasts and the perceived fair value.

Unlock comprehensive insights into our analysis of GoDaddy stock in this financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English