Coca-Cola FEMSA. de (NYSE:KOF) Approves Cash Dividend Of MXN 7 Per Unit

Coca-Cola FEMSA, S.A.B. de C.V. (NYSE:KOF) recently announced a significant dividend increase, reflecting its strong financial position. Over the last quarter, the company's share price rose 18%, a stark contrast to the broader market's 12% decline during the same period. The company's positive price movement may have been influenced by this positive dividend news, showing investor confidence, along with its robust Q4 earnings report earlier in the year. As global markets grapple with tariff uncertainties, Coca-Cola FEMSA's performance suggests resilience, countering the prevailing negative market sentiment.

The recent dividend increase by Coca-Cola FEMSA and its strong quarterly performance highlight a positive shift in its financial health, potentially boosting investor confidence. Over the past five years, the company's total return, encompassing share price appreciation and dividends, reached 154.95%. This substantial gain reflects steady growth compared to the past year's volatile market conditions, where Coca-Cola FEMSA managed to outperform the broader market with a negative 5.8% return. Such resilience may continue to drive investor interest in the company, especially given its strategic focus on digital expansion and infrastructure investments in key regions like Brazil and Mexico.

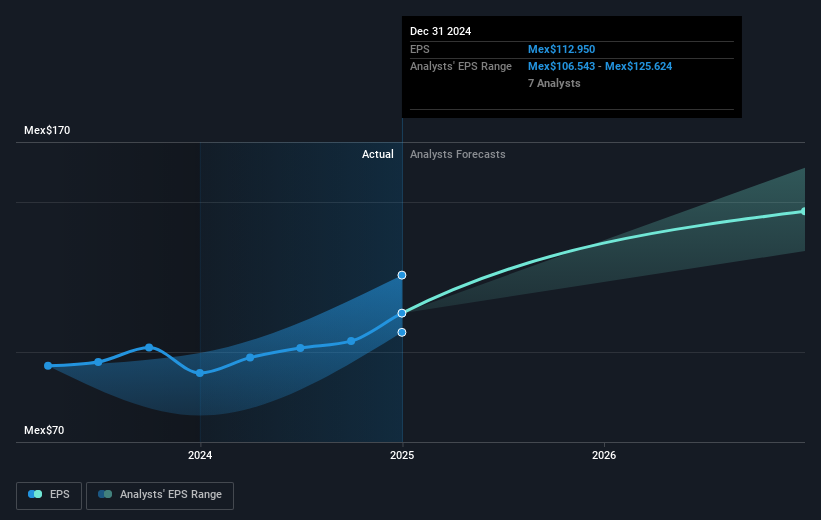

The company's encouraging price movement, up 18% over the last quarter, offers a strong indication of investor optimism. This is partly fueled by robust future revenue and earnings forecasts. Analysts predict revenue growth of around 9.0% annually over the next three years and an increase in profit margins to 9.2%. If Coca-Cola FEMSA meets its earnings expectations, the company is anticipated to trade at a price-to-earnings ratio of 17.9x by 2028, lower than the current industry average in the U.S. Given the current share price of US$93.71 and a consensus price target of US$110.90, this suggests a potential increase of 14.7% if targets are met. However, this remains contingent on mitigating risks such as currency fluctuations and market competition.

Dive into the specifics of Coca-Cola FEMSA. de here with our thorough balance sheet health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English