Exploring US High Growth Tech Stocks This April 2025

Amidst a backdrop of heightened market volatility driven by recent tariff implementations and retaliatory measures, the U.S. stock market has experienced significant fluctuations, with key indices like the Dow Jones and S&P 500 showing mixed performances while the tech-heavy Nasdaq Composite has seen notable gains. In this environment, identifying high-growth tech stocks requires careful consideration of their resilience to economic pressures and their potential for innovation-driven expansion despite broader market uncertainties.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.44% | 29.79% | ★★★★★★ |

| Arcutis Biotherapeutics | 25.83% | 58.17% | ★★★★★★ |

| TG Therapeutics | 26.03% | 37.60% | ★★★★★★ |

| Alkami Technology | 20.46% | 85.16% | ★★★★★★ |

| Travere Therapeutics | 28.45% | 65.05% | ★★★★★★ |

| TKO Group Holdings | 22.48% | 25.17% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.73% | 58.77% | ★★★★★★ |

| AVITA Medical | 27.47% | 56.12% | ★★★★★★ |

| Lumentum Holdings | 21.61% | 120.49% | ★★★★★★ |

| Ascendis Pharma | 32.36% | 59.79% | ★★★★★★ |

Click here to see the full list of 234 stocks from our US High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Agora (NasdaqGS:API)

Simply Wall St Growth Rating: ★★★★☆☆

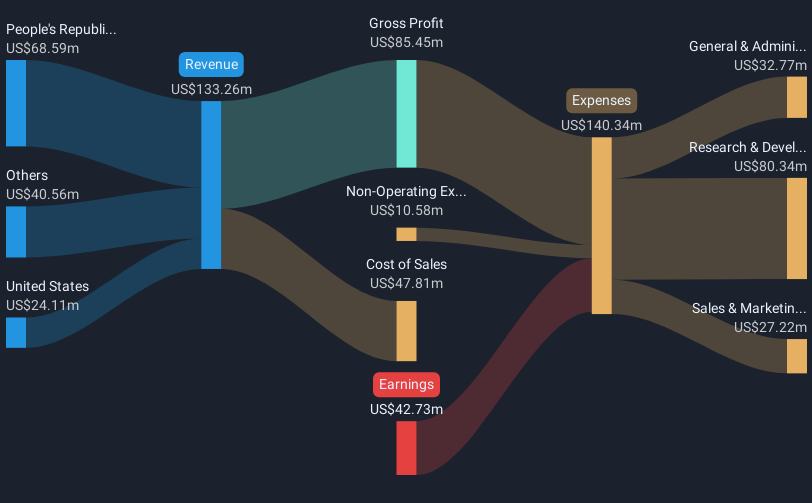

Overview: Agora, Inc. is a company specializing in real-time engagement technology with operations in the People’s Republic of China, the United States, and internationally, and it has a market cap of $297.71 million.

Operations: Agora operates in the real-time engagement technology sector, generating revenue primarily from its Internet Telephone segment, which amounts to $133.26 million.

Agora, Inc. is navigating the competitive tech landscape with a promising outlook, evidenced by its projected revenue growth of 13.5% per year, outpacing the US market average of 8.2%. Despite current unprofitability, earnings are expected to surge by an impressive 136.4% annually. The recent shift towards profitability is underscored by a net income of $0.158 million in Q4 2024, a significant improvement from a net loss of $2.61 million in the previous year's corresponding quarter. Agora's commitment to innovation and market adaptability is further highlighted by its R&D investments which strategically align with its growth trajectory in the highly volatile tech sector.

- Get an in-depth perspective on Agora's performance by reading our health report here.

Review our historical performance report to gain insights into Agora's's past performance.

Day One Biopharmaceuticals (NasdaqGS:DAWN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Day One Biopharmaceuticals, Inc. is a commercial-stage company dedicated to advancing innovative medicines for both childhood and adult diseases in the United States, with a market cap of $711.51 million.

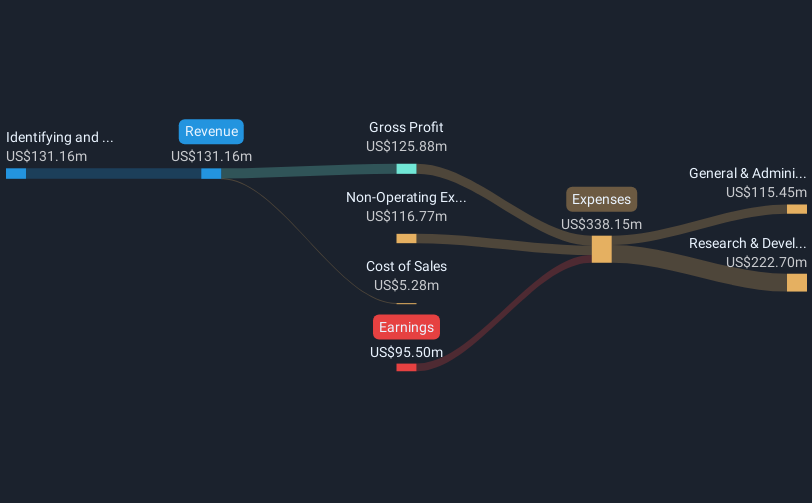

Operations: Day One Biopharmaceuticals focuses on identifying and advancing targeted therapies, generating $131.16 million in revenue from this segment.

Day One Biopharmaceuticals is making significant strides in the biotech sector, marked by a robust annual revenue growth of 30.5%. Despite current unprofitability, the company's earnings are on an upward trajectory with an expected surge of 56.4% annually. At the forefront of innovation, Day One invested $131.16 million in R&D last year, underscoring its commitment to pioneering new treatments and technologies. This focus on research has not only fueled its growth but also positioned it as a future leader in biopharmaceuticals amidst challenging market conditions and a recent net loss reduction from $188.92 million to $95.5 million year-over-year.

Precigen (NasdaqGS:PGEN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Precigen, Inc. is a discovery and clinical-stage biopharmaceutical company focused on developing gene and cell therapies with precision technology for immuno-oncology, autoimmune disorders, and infectious diseases, with a market cap of $391.08 million.

Operations: The company generates revenue primarily from its gene and cell therapy developments, targeting diseases in immuno-oncology, autoimmune disorders, and infectious diseases. With a market capitalization of approximately $391.08 million, Precigen's focus on precision technology aims to advance therapeutic solutions in these specialized medical fields.

Despite facing considerable challenges, Precigen demonstrates a promising trajectory in the biotech landscape, underscored by an anticipated revenue growth of 47.4% annually. This growth is notably higher than the industry average, positioning it favorably against its peers. In 2024, the company's commitment to innovation was evident as it allocated substantial resources to R&D, though specific figures were not disclosed in the provided data. Recent developments include FDA's priority review of Precigen’s groundbreaking gene therapy, PRGN-2012, potentially addressing a critical unmet medical need in respiratory papillomatosis treatment—a move that could significantly impact its market stance upon successful approval and commercialization.

- Dive into the specifics of Precigen here with our thorough health report.

Understand Precigen's track record by examining our Past report.

Summing It All Up

- Click through to start exploring the rest of the 231 US High Growth Tech and AI Stocks now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English