Metagenomi Leads The Charge With These 3 Penny Stocks

As U.S. markets navigate the complexities of tariff negotiations and economic uncertainty, investors are keeping a close eye on potential opportunities within various sectors. Penny stocks, often representing smaller or newer companies, continue to pique interest due to their potential for both value and growth—despite being an older term in the investment lexicon. In this article, we explore three penny stocks that stand out for their robust financials and growth prospects, offering investors a chance to uncover hidden gems with promising potential.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Safe Bulkers (NYSE:SB) | $3.22 | $338.65M | ✅ 3 ⚠️ 3 View Analysis > |

| Tuya (NYSE:TUYA) | $2.27 | $1.47B | ✅ 3 ⚠️ 3 View Analysis > |

| Smith Micro Software (NasdaqCM:SMSI) | $0.76 | $12.8M | ✅ 4 ⚠️ 4 View Analysis > |

| Global Self Storage (NasdaqCM:SELF) | $4.94 | $57.02M | ✅ 4 ⚠️ 1 View Analysis > |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $2.60 | $7.88M | ✅ 4 ⚠️ 1 View Analysis > |

| Flexible Solutions International (NYSEAM:FSI) | $3.86 | $52.61M | ✅ 4 ⚠️ 3 View Analysis > |

| TETRA Technologies (NYSE:TTI) | $2.36 | $330.99M | ✅ 5 ⚠️ 2 View Analysis > |

| BAB (OTCPK:BABB) | $0.775 | $5.59M | ✅ 2 ⚠️ 3 View Analysis > |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $213.14M | ✅ 3 ⚠️ 2 View Analysis > |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.7022 | $60.57M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 790 stocks from our US Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Metagenomi (NasdaqGS:MGX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Metagenomi, Inc. is a genetic medicines company in the United States that develops therapeutics using a metagenomics-derived genome editing toolbox, with a market cap of $52.71 million.

Operations: The company's revenue is primarily generated from developing next-generation gene-editing technologies and therapies, amounting to $52.30 million.

Market Cap: $52.71M

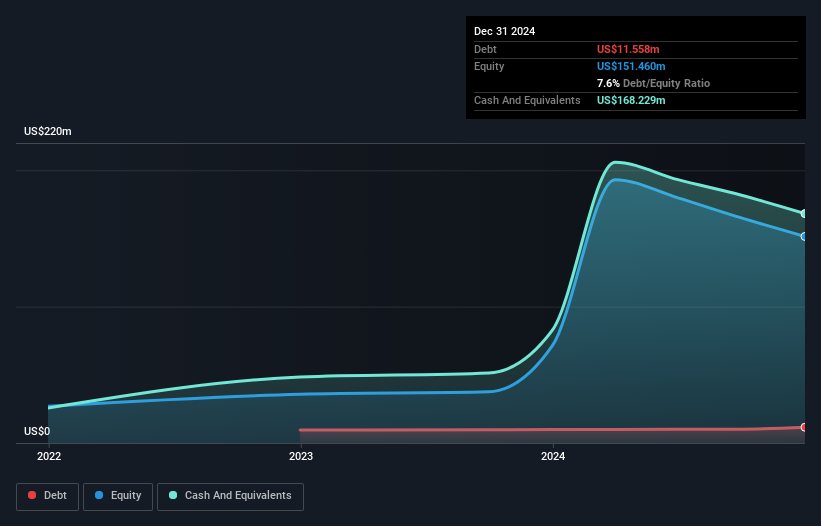

Metagenomi, Inc., with a market cap of US$52.71 million, is navigating the volatile terrain of penny stocks with its innovative gene-editing technologies. Despite being pre-revenue and unprofitable, it boasts a strong cash position with short-term assets covering both short and long-term liabilities. Recent developments include filing for significant equity offerings and announcing advancements in its CAST system for gene editing, which could address complex genetic diseases. However, earnings are forecasted to decline over the next three years, and while management is relatively experienced, the board's tenure suggests recent changes in leadership dynamics.

- Click here to discover the nuances of Metagenomi with our detailed analytical financial health report.

- Review our growth performance report to gain insights into Metagenomi's future.

Seer (NasdaqGS:SEER)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Seer, Inc. is a life sciences company focused on developing and commercializing products to decode the biology of the proteome, with a market cap of approximately $102.23 million.

Operations: The company generates revenue primarily from its Biotechnology (Startups) segment, which amounted to $14.17 million.

Market Cap: $102.23M

Seer, Inc., with a market cap of US$102.23 million, operates within the penny stock segment by focusing on proteome decoding technologies. Despite unprofitability and increasing losses over five years, it maintains a robust cash position with short-term assets covering liabilities and no debt burden. Revenue for 2024 was US$14.17 million, but sales declined to US$2.29 million from the previous year’s US$4.66 million, reflecting ongoing challenges in revenue generation despite projected growth to US$17-18 million in 2025. The company completed a significant share buyback program while maintaining stable weekly volatility and experienced leadership tenure.

- Click to explore a detailed breakdown of our findings in Seer's financial health report.

- Examine Seer's earnings growth report to understand how analysts expect it to perform.

Alto Neuroscience (NYSE:ANRO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Alto Neuroscience, Inc. is a clinical-stage biopharmaceutical company based in the United States with a market cap of $48.73 million.

Operations: Currently, Alto Neuroscience, Inc. does not report any specific revenue segments.

Market Cap: $48.73M

Alto Neuroscience, Inc., with a market cap of US$48.73 million, operates as a pre-revenue entity in the clinical-stage biopharmaceutical sector. Despite its unprofitability and net loss of US$61.43 million for 2024, Alto holds more cash than total debt and maintains sufficient short-term assets to cover liabilities. The company recently announced favorable interim results for its Phase 2b trial of ALTO-300 for major depressive disorder, continuing to expand its clinical trials with plans to increase patient enrollment. However, the stock remains highly volatile and earnings are forecasted to decline over the next three years.

- Click here and access our complete financial health analysis report to understand the dynamics of Alto Neuroscience.

- Gain insights into Alto Neuroscience's future direction by reviewing our growth report.

Key Takeaways

- Embark on your investment journey to our 790 US Penny Stocks selection here.

- Searching for a Fresh Perspective? We've found 27 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English