Dollar Tree Surges Nearly 8% After Citi Upgrade: Analysts Say Tariffs Could Boost Margins, Not Hurt Them

Discount retailer Dollar Tree Inc. (NASDAQ:DLTR) was riding high on Monday, ending the day up 7.8% following a surprise upgrade by Citi Research, which calls it one of the ‘silent beneficiaries’ of the widespread trade tariffs imposed by the U.S. Government over the past week.

What Happened: In a somewhat surprising move, Citigroup analysts upgraded Dollar Tree to a ‘Buy’ from their earlier ‘Neutral’ stance. With a new price target of $103, which represents a 41% upside following its rally on Monday.

The move is surprising because, on the face of it, Dollar Tree seems one of the most exposed to the downsides of the tariffs. Especially, the mammoth 34% reciprocal rates imposed on China, from where it imports an estimated 40% of its merchandise, according to a recent analysis by KeyBanc Capital Markets.

The management itself commented late last year that it would have to change product specs, pack sizes, and even phase out certain items if the tariffs were reimposed by the new administration.

However, Citi analysts led by Paul Lejuez believe that the higher tariff regime could provide the company with much-needed cover to increase its prices from the standard $1.25 to $1.50 or even $1.75, significantly boosting margins, and without any blowback since it comes at a time when everyone else will be raising prices.

Why It Matters: The Analysts further believe that the tariffs will hit the company’s rivals much harder, particularly the likes of Temu and Shein, and a recession in the coming months should make Dollar Tree’s value credentials a lot more attractive among consumers.

Besides this, the company’s decision to sell its Family Dollar segment for $1 billion less than 2 weeks ago led to a broad bullish consensus among most analysts. The sale of the segment that was referred to by Evercore ISI analysts as ‘truly addition by subtraction.’

The average price consensus for the stock now stands at $82.85, with Citi at the high point of $103, which is rather impressive considering current market conditions.

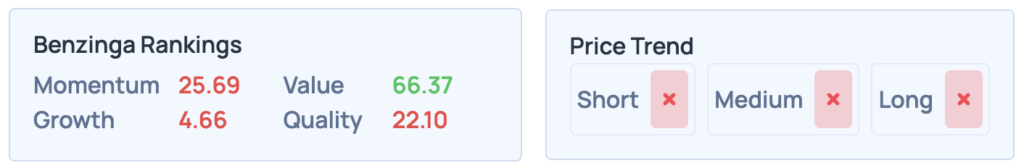

According to Benzinga’s Edge Stock Rankings, Dollar Tree still features weak momentum and growth stats, scoring just 26 and 5, respectively. What about its competitor Dollar General? Sign up to Benzinga Edge Stock Rankings today for more such deeper insights.

Read More:

Photo courtesy: Shutterstock

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English