Ubiquiti (NYSE:UI) Drops 12% Over The Week As Tech Sector Faces Sell-Off

Ubiquiti (NYSE:UI) experienced an 11.9% price decline over the past week, during which significant market pressures were at play. The broader market faced a tumultuous week as U.S. stock indexes plunged, fueled by global trade tensions and the imposition of reciprocal tariffs by the U.S. and China. The S&P 500 and Nasdaq faced substantial losses, with a 9.1% and 10% drop, respectively, dragging down tech stocks, including Ubiquiti, which operates in the technology sector. This sector's decline was part of a widespread sell-off, exacerbated by fears of slowed economic growth and inflationary pressures affecting investor sentiment.

Buy, Hold or Sell Ubiquiti? View our complete analysis and fair value estimate and you decide.

Find companies with promising cash flow potential yet trading below their fair value.

Over the past year, Ubiquiti's total shareholder return stood at 159.11%, a significant achievement compared to the US Communications industry, which returned 7.3%, and the broader US market's 3.3% decline. Key events contributing to this impressive performance include consistent earnings growth, highlighted by a 19.6% rise in earnings over the past year, significantly surpassing its five-year average rate. Ubiquiti also benefited from consistent quarterly dividend payouts of US$0.60 per share, reinforcing investor confidence and potentially enhancing total returns.

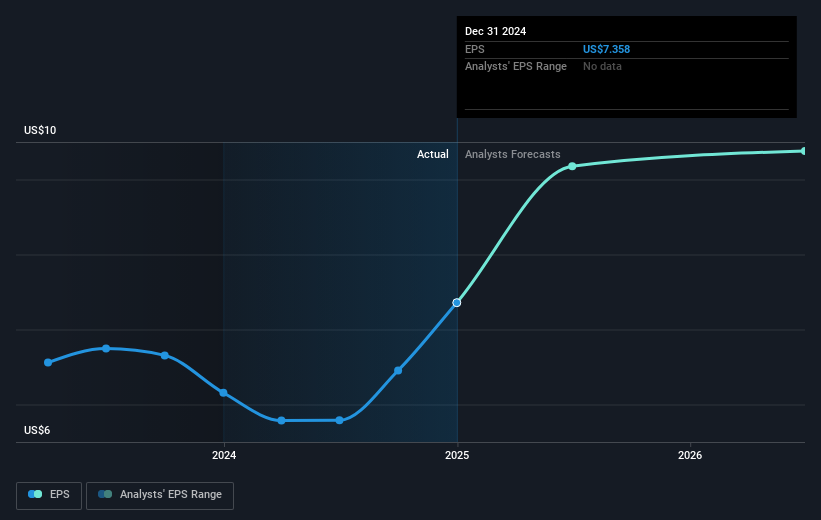

Ubiquiti's financial results contributed to its robust performance. For example, during the second quarter ending December 31, 2024, the company reported sales of US$599.88 million, up from US$464.95 million year over year, with net income increasing to US$136.8 million from US$82.12 million. These quarterly results reflect effective business strategies that enabled Ubiquiti to outperform its peers significantly despite broader market challenges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English