AerCap Holdings (NYSE:AER) Reports Quarterly Sales Increase Despite 7% Price Drop Over Last Quarter

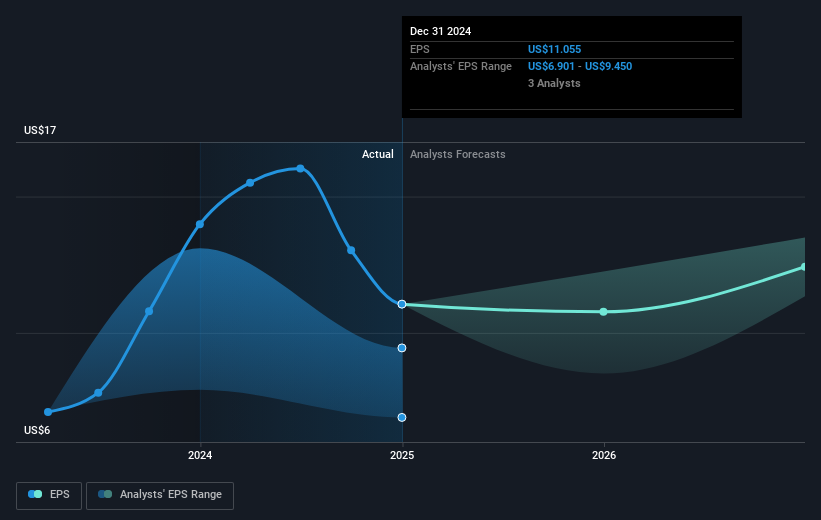

AerCap Holdings (NYSE:AER) recently reported its fourth-quarter results, highlighting an increase in sales and revenue but a decrease in net income and EPS. Despite authorizing a new $1 billion share buyback program and increasing its quarterly dividend, the company's stock saw a decline of 7% over the last quarter. This price move occurred during broader market challenges, including a significant drop in major indices, fueled by escalating global trade tensions, particularly the newly imposed tariffs. While AerCap initiated strategic financial maneuvers, the adverse market sentiment amid these geopolitical tensions likely impacted its total shareholder returns.

AerCap Holdings has delivered an impressive total return of approximately 250.87% over the past five years. This surge can be connected to several core developments. For instance, the company's strategic capital deployment activities, such as significant investments in a diversified fleet and its entry into the engine leasing market, have optimized their assets. High revenue visibility with $45 billion in contracted future lease cash flows also stands out, ensuring financial stability. Additionally, the company’s expanded client agreements - including leasing contracts with major airlines - reflect strong industry engagement.

In contrast, over the past year, AerCap's performance has been challenged, matching the US market’s 3.3% return, yet outperforming the US Trade Distributors industry, which saw an 18.1% decline. Financially, buyback transactions authorized from February 2025, totaling up to $1 billion, and a quarterly cash dividend increment have played crucial roles. Despite some volatility, AerCap appears positioned to harness these efforts for sustained shareholder value creation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English