Wolfspeed (NYSE:WOLF) Sees 49% Plummet In Last Month As New CEO Prepares To Take Helm

Wolfspeed (NYSE:WOLF) recently reaffirmed its earnings guidance for Q3 2025 with projections indicating significant net losses, set against the backdrop of major leadership changes as Robert Feurle prepares to assume the roles of CEO and Board Member by May. Despite these developments, the company's stock plummeted 49% over the last month. This steep decline aligns with a broader market downturn exacerbated by intensified trade tensions and widespread sell-offs in the semiconductor sector, which was hit particularly hard as major indices like the Nasdaq Composite entered bear market territory amid these economic stresses.

Every company has risks, and we've spotted 3 risks for Wolfspeed you should know about.

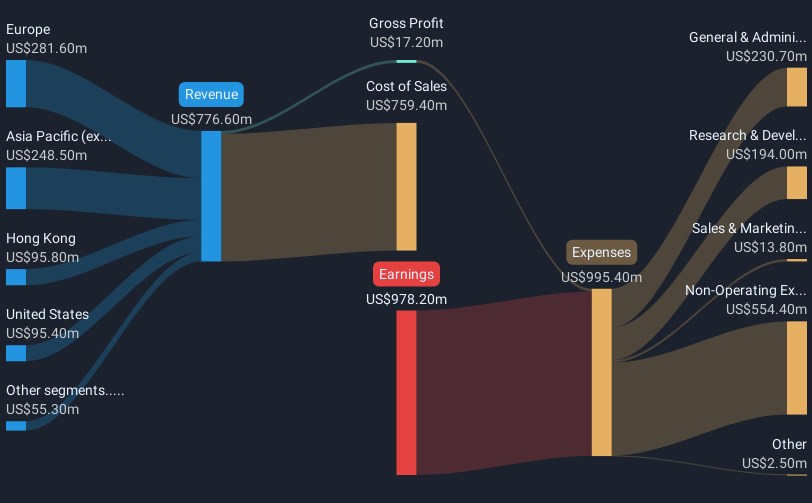

Over the last year, Wolfspeed's total return was a decline of very large magnitude, approximately 90%. This underperformance contrasts sharply with the broader US market, which managed a modest gain of 3.3%. Several key events have shaped this downturn. Wolfspeed's Q2 FY2025 earnings report, released in January 2025, revealed a significant increase in net losses to US$372.2 million, contributing to investor concerns. Additionally, a class-action lawsuit filed in November 2024 alleged securities violations, potentially impacting investor confidence.

Furthermore, operational costs were poised to rise following an October 2024 debt financing move to secure US$750 million for facility expansions. Another factor was the dilutive effect of a January 2025 equity offering that raised US$200 million. While revenue forecasts remain high, these recent challenges, combined with industry competition, may have driven shareholder returns lower than both the market and industry averages over this period.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English