Alaunos Therapeutics And 2 Other Promising Penny Stocks To Watch

Amidst a turbulent market backdrop, where major indices like the Dow Jones and Nasdaq Composite have faced significant declines due to escalating trade tensions, investors are increasingly seeking alternative opportunities. Penny stocks, often representing smaller or newer companies, continue to hold allure for those looking beyond traditional large-cap investments. Despite being an older term, they offer potential growth when backed by solid financials; this article explores three such stocks that stand out for their promise and resilience in today's challenging economic landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Safe Bulkers (NYSE:SB) | $3.51 | $392.12M | ✅ 4 ⚠️ 3 View Analysis > |

| Tuya (NYSE:TUYA) | $2.79 | $1.83B | ✅ 3 ⚠️ 3 View Analysis > |

| Smith Micro Software (NasdaqCM:SMSI) | $0.742 | $13.53M | ✅ 4 ⚠️ 4 View Analysis > |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $2.8327 | $8.43M | ✅ 4 ⚠️ 1 View Analysis > |

| Flexible Solutions International (NYSEAM:FSI) | $4.55 | $61.59M | ✅ 3 ⚠️ 3 View Analysis > |

| Sensus Healthcare (NasdaqCM:SRTS) | $4.90 | $82.97M | ✅ 5 ⚠️ 3 View Analysis > |

| TETRA Technologies (NYSE:TTI) | $3.02 | $458.08M | ✅ 5 ⚠️ 2 View Analysis > |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.32 | $74.01M | ✅ 3 ⚠️ 1 View Analysis > |

| BAB (OTCPK:BABB) | $0.76 | $5.74M | ✅ 2 ⚠️ 3 View Analysis > |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.727 | $68.37M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 777 stocks from our US Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Alaunos Therapeutics (NasdaqCM:TCRT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Alaunos Therapeutics, Inc. is a clinical-stage company specializing in oncology-focused cell therapies, specifically developing T-cell receptor engineered T-cell therapies to address various solid tumors, with a market cap of $4.48 million.

Operations: Alaunos Therapeutics, Inc. does not report any revenue segments as it is a clinical-stage company focused on developing cell therapies for oncology applications.

Market Cap: $4.48M

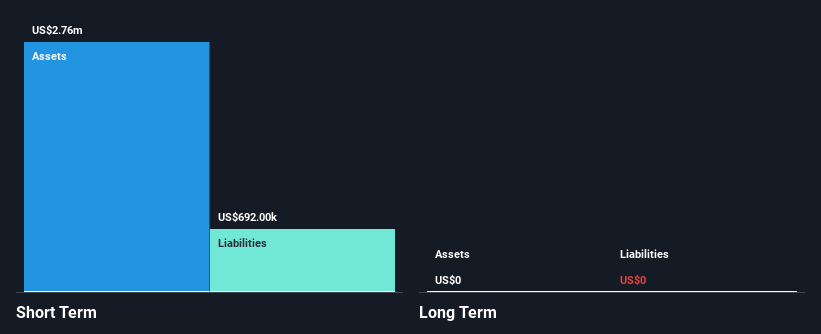

Alaunos Therapeutics, Inc., a clinical-stage biotech company, remains pre-revenue with sales of US$0.01 million for 2024 and a net loss of US$4.68 million, showing an improvement from the previous year's larger loss. Despite having no debt and sufficient short-term assets to cover liabilities, the company faces challenges with less than one year of cash runway and high volatility in its share price. The board is considered experienced with an average tenure of 4.3 years, but the management team's experience level is unclear due to insufficient data. Shareholder dilution has not been significant recently.

- Navigate through the intricacies of Alaunos Therapeutics with our comprehensive balance sheet health report here.

- Understand Alaunos Therapeutics' track record by examining our performance history report.

loanDepot (NYSE:LDI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: loanDepot, Inc. operates in the United States by originating, financing, selling, and servicing residential mortgage loans and has a market cap of approximately $394.07 million.

Operations: The company's revenue primarily comes from originating, financing, and selling mortgage loans, generating $985.65 million.

Market Cap: $394.07M

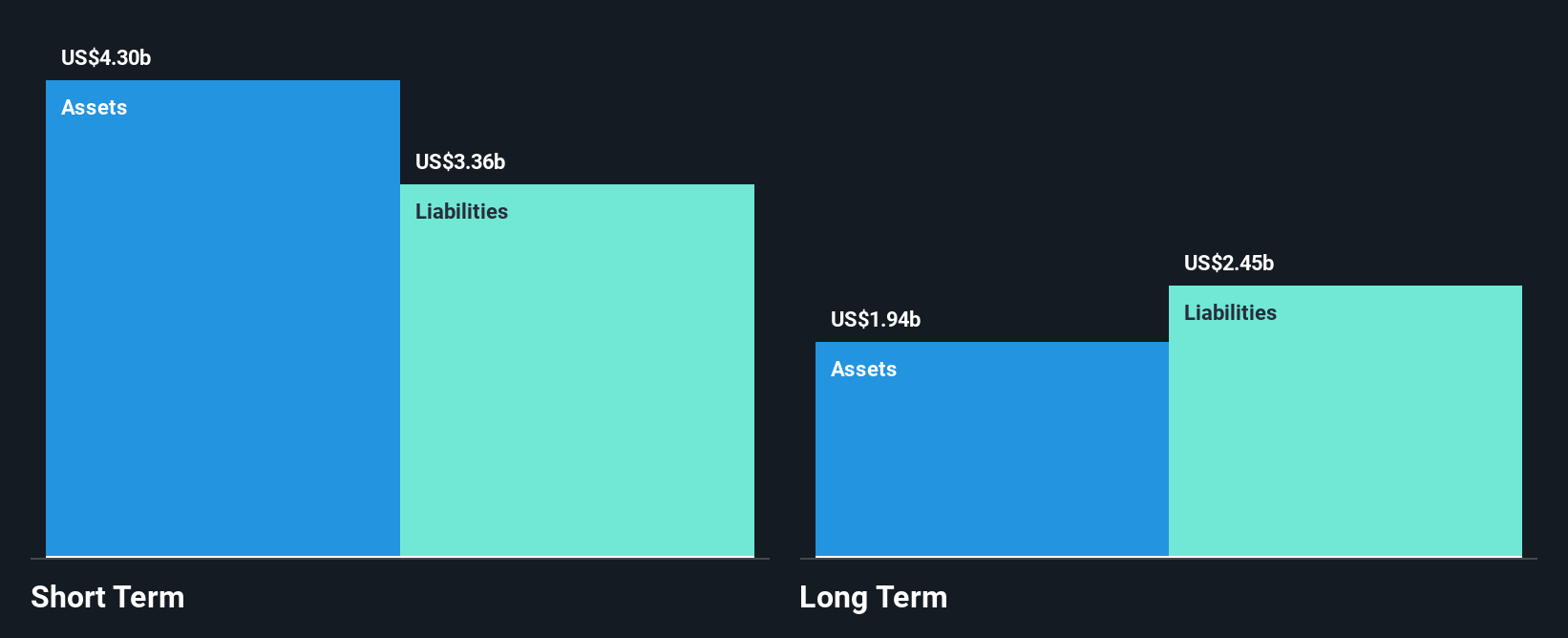

loanDepot faces challenges with high net debt to equity at 961.6% and ongoing unprofitability, reporting a net loss of US$33.23 million for Q4 2024. Despite this, the company maintains strong short-term assets exceeding its liabilities and has not significantly diluted shareholders recently. Leadership changes are underway with founder Anthony Hsieh returning as Executive Chairman, while a CEO search is conducted. Strategic moves include expanding the equityFREEDOM portfolio and forming joint ventures like Onx X+ Mortgage to enhance market presence in Florida and Texas, potentially capitalizing on new revenue opportunities amidst industry volatility.

- Get an in-depth perspective on loanDepot's performance by reading our balance sheet health report here.

- Evaluate loanDepot's prospects by accessing our earnings growth report.

Vaso (OTCPK:VASO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Vaso Corporation, with a market cap of $25.05 million, operates in the healthcare equipment and information technology industries both in the United States and internationally.

Operations: There are no reported revenue segments for Vaso Corporation.

Market Cap: $25.05M

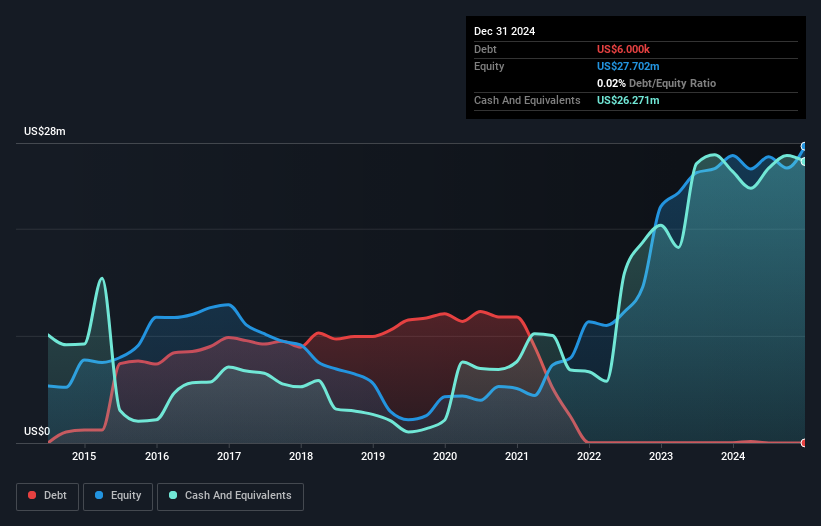

Vaso Corporation, with a market cap of US$25.05 million, operates debt-free and has seen a reduction in its debt levels from five years ago. Despite experiencing negative earnings growth of -80.2% over the past year, Vaso remains profitable with sales reaching US$86.77 million for 2024, though net income declined to US$0.951 million from the previous year’s US$4.81 million. The company's short-term assets significantly exceed both short and long-term liabilities, offering financial stability amidst fluctuating profit margins and low return on equity at 3.4%. Recent board changes include Edgar Rios becoming Vice Chairman while retaining his audit committee role.

- Dive into the specifics of Vaso here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into Vaso's track record.

Make It Happen

- Dive into all 777 of the US Penny Stocks we have identified here.

- Seeking Other Investments? These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English