2 Gaming Stocks Poised for Growth Despite Industry Challenges

Industry Description

The Zacks Gaming industry includes companies that own and operate integrated casinos, hotels and entertainment resorts. Some industry players also deliver technology products and services across the lotteries, electronic gaming machines, sports betting and interactive gaming markets. Some firms develop and operate gaming establishments and associated lodging, restaurants, horse racing and entertainment amenities. Many companies are involved in developing and selling gaming applications. E-sports or sporting events or tournament services, content management systems, video software, mobile applications and e-sports data platform solutions are provided as well.

Key Themes Shaping the Gaming Industry

Trump’s Policies May Pose Challenges for the U.S. Gambling Industry: The Trump administration could introduce policy shifts that may impact U.S. gambling licensees, particularly in areas like labor and supply chains. Stricter immigration policies could affect casino workforces. Additionally, tariffs on Chinese imports could disrupt access to gaming technology components. While industry leaders remain cautious, these changes could create operational hurdles, especially for brick-and-mortar casinos. As the administration moves forward with its agenda, gambling operators will need to adapt to evolving regulations and economic conditions.

Macau Gaming Revenues Improve: Macau's gross gaming revenue (GGR) rose 0.8% year over year in March, reaching MOP$19.66 billion (approximately US$2.45 billion). Macau's gross gaming revenues for the first three months of 2025 reached MOP$57.7 billion (US$7.19 billion), marking a 0.6% increase year over year. Casino operators are adopting a disciplined operational strategy by streamlining business processes, enhancing marketing approaches, and renegotiating contracts with vendors and third parties. There is an intense emphasis on improving service quality and staffing levels to cater to gamers better.

U.S. Commercial Gaming Revenues Robust: In January 2025, U.S. commercial gaming revenues increased 11.9% year over year. Data from state regulators, compiled by the American Gaming Association, revealed that revenues from traditional casino games, sports betting and iGaming totaled $6.51 billion. For the first 10 months of 2024, commercial gaming revenues reached $59.11 billion, reflecting a 7.3% rise from the prior-year period.

Sports Betting Acts as Major Driver: The legalization of sports betting in Delaware, Mississippi, New Jersey, New Mexico, West Virginia, Pennsylvania, Rhode Island, Montana, Indiana, Tennessee, Illinois and New Hampshire has been driving growth for a while. Bettors can place wagers via digital platforms in Connecticut, Kentucky, Michigan, Massachusetts, Maryland, Minnesota, Missouri, Kansas, Louisiana, Oklahoma, South Carolina, California, Oregon, Arizona, Montana, Colorado and other states. Some popular gaming applications include DraftKings, Barstool, FanDuel, BetMGM, BetRivers, Fox Bet and BetMonarch.

Zacks Industry Rank Indicates Dull Prospects

The Zacks Gaming industry is grouped within the broader Zacks Consumer Discretionary sector. It carries a Zacks Industry Rank #146, which places it in the bottom 40% of more than 245 Zacks industries.

The group’s Zacks Industry Rank, which is the average of the Zacks Rank of all the member stocks, indicates dull near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than two to one.

The industry’s position in the bottom 50% of the Zacks-ranked industries is a result of a negative earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are gradually losing confidence in this group’s earnings growth potential.

Despite the industry’s drab near-term prospects, we will present a few gaming stocks that you can add to your investment portfolio, given their strong fundamentals. But it’s worth looking at the industry’s shareholder returns and its current valuation first.

Industry Outperforms the S&P 500

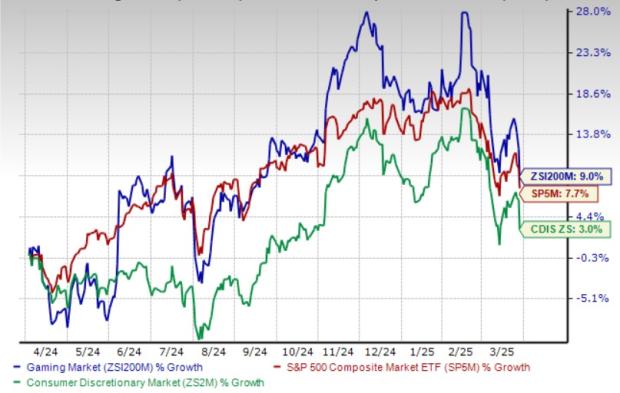

The Zacks Gaming industry has outpaced the S&P 500 Index and the broader Zacks Consumer Discretionary sector in the past year.

The industry has risen 9% over this period compared with the S&P 500 Index’s growth of 7.7%. In the same time frame, the sector has gained 3%.

One-Year Price Performance

Gaming Industry's Valuation

Since gaming companies are debt-laden, valuing the same based on the EV/EBITDA (Enterprise Value/ Earnings before Interest Tax Depreciation and Amortization) ratio makes sense. The industry currently has a forward 12-month EV/EBITDA ratio of 17.19. The space is trading at a discount compared with the market at large, as the forward 12-month EV/EBITDA ratio for the S&P 500 is 24.69.

Over the past five years, the industry has traded as high as 19.73X and as low as 8.65X, with a median of 17.28X, as the chart below shows.

Enterprise Value-to-EBITDA Ratio (Past 5 Years)

2 Gaming Stocks to Watch

GameStop: The company has been progressing well in its growth endeavors while maintaining a solid balance sheet. It has been taking initiatives to diversify its business and become a more technology-driven firm. GameStop has also been pursuing opportunities in cryptocurrency, non-fungible tokens and Web 3.0 gaming verticals. This reduction in operational costs reflects management's commitment to improving efficiency and streamlining business operations.

This Zacks Rank #1 (Strong Buy) player’s shares have gained 97.9% in the past year. GME’s 2026 earnings estimates have increased 161.1% to 47 cents in the past 60 days.

Price & Consensus: GME

Super Group: Super Group remains committed to expanding in key growth markets with a tailored and localized approach. The company continues to operate efficiently with a streamlined cost structure while maintaining a substantial marketing budget to seize the right investment opportunities. Building on the momentum of the previous year, Super Group is well-positioned for another period of strong growth, leveraging its market expertise and strategic investments to drive further success.

This Zacks Rank #2 (Buy) company’s shares have gained 72.7% in the past six months. Super Group’s earnings estimates for 2025 have increased to 60 cents from 47 cents in the past 60 days.

Price & Consensus: SGHC

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers "Most Likely for Early Price Pops."

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.3% per year. So be sure to give these hand picked 7 your immediate attention.

See them now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

GameStop Corp. (GME): Free Stock Analysis Report

Super Group (SGHC) Limited (SGHC): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English