Nvidia, Moderna, Lucid, Dominari Holdings, Tesla: Why These 5 Stocks Are On Investors' Radars Today

The stock market faced a challenging day as risk sentiment remained under pressure on Wall Street. The S&P 500 experienced a volatile session, hitting its lowest point in over six months before recovering some losses. The S&P ended the day 0.5% higher at 5,611.85. Despite this, the index is on track for its worst month since September 2022, with a 7% decline in March. The Dow Jones Industrial Average was up 1% at 42,001.76 for the day.

Meanwhile, tech stocks struggled, with the Nasdaq 100 dropping 0.14% for the day at 17,299.29 as semiconductor stocks weighed heavily on the sector.

These are the top stocks that gained the attention of retail traders and investors throughout the day.

Nvidia Corporation (NASDAQ:NVDA)

Nvidia’s stock fell 1.18% to close at $108.38, with an intraday high of $110.96 and a low of $103.65. The stock’s 52-week range is between $153.13 and $75.61. The company announced plans to invest billions in the U.S. supply chain over the next four years. CEO Jensen Huang stated that the investment is possible due to suppliers like Taiwan Semiconductor Manufacturing Company and Foxconn.

Moderna, Inc. (NASDAQ:MRNA)

Moderna’s shares tumbled 8.90% to $28.35, with a high of $28.95 and a low of $26.80, marking a new 52-week low. The decline followed a shakeup at the U.S. Food and Drug Administration, with Peter Marks resigning from his role at the FDA's Center for Biologics Evaluation and Research.

Lucid Group, Inc. (NASDAQ:LCID)

Lucid’s stock rose 4.31% to $2.42, reaching a high of $2.44 and a low of $2.21. The 52-week range is $4.43 to $1.93. The increase came after bullish commentary from a company executive, who noted a "dramatic uptick" in orders from former Tesla Inc. customers.

Dominari Holdings Inc. (NASDAQ:DOMH)

Dominari’s shares fell 16.32% to $4, with a high of $5.46 and a low of $3.84. The stock’s 52-week range is $13.58 to $0.83. The decline followed the announcement of a Bitcoin (CRYPTO: BTC) mining deal with Hut 8 Corp and a registered direct offering.

Tesla, Inc. (NASDAQ:TSLA)

Tesla’s stock decreased by 1.67% to $259.16, with an intraday high of $260.56 and a low of $243.36. The 52-week range is $488.54 to $138.8. Despite challenges, Elon Musk remains optimistic about Tesla’s future, viewing the current situation as a buying opportunity.

Image via Shutterstock

Prepare for the day’s trading with top premarket movers and news by Benzinga.

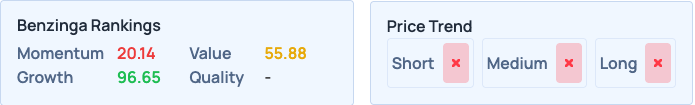

Benzinga Edge Stock Rankings show Lucid with a 97th percentile growth score — curious how Tesla compares? Find out here.

Read Next:

This story was generated using Benzinga Neuro and edited by Shivdeep Dhaliwal

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English