While Wall Street Panicked, These 3 Hidden Small-Caps Exploded Last Week — One Surging A Jaw-Dropping 60%

As uncertainties surrounding trade policies, fresh recession fears, and persistent inflation kept the markets on tenterhooks throughout the past week, a handful of small-caps defied the odds by posting significant gains.

These stocks, all part of the Russell 2000 index, have market caps lower than $2 billion and have rallied between 11% and 60% over the past week, while the broader index witnessed a pullback of 2.5%. Let us explore these stocks and the various factors contributing to their resilience.

1. Lexicon Pharmaceuticals

The three-decades-old Lexicon Pharmaceuticals (NASDAQ:LXRX) posted a phenomenal 58% rally last week, after announcing that it was entering into an exclusive licensing agreement with Danish pharma giant, Novo Nordisk (NYSE:NVO).

The agreement pertains to Lexicon’s LX9851, an oral non-incretin development candidate for treating obesity and other metabolic disorders. It provides Novo with exclusive rights to develop, manufacture, and commercialize the drug worldwide.

The deal is set to generate Lexicon up to $1 billion in milestone and royalty payments over the coming years, prompting a quick ‘Buy’ rating from Joseph Pantginis of H.C. Wainwright, alongside several other analysts.

See Also: Wall Street On Edge: Futures Slide Ahead of Trump’s ‘Liberation Day’ Tariff Shock

3. LightWave Logic

LightWave Logic (NASDAQ:LWLG) develops photonic devices and electro-optic polymer materials for fiber-optic communications, all of which play a critical role in semiconductor foundries and AI data centers.

Last week, the company announced its Process Design Kit (PDK) which is now commercially available after already being implemented at two major foundries. This led the stock to pop 19% on Friday, ending the week up by 10%. A picks-and-shovels play, the stock is expected to maintain momentum as the AI race heats up.

3. Argan Inc

Argan Inc (NYSE:AGX), a Maryland-based engineering, procurement, and construction company that’s been around since the early-60s. The stock popped nearly 20% on Friday, ending the week up by 11%, following its spectacular fourth-quarter earnings performance.

The company reported $232 million in revenue during the fourth quarter, up 40% year-over-year, and a profit of $31.4 million, or $2.22 per share, up 150% year-over-year, while handily beating analyst estimates.

Argan’s performance is largely owing to its power industry services business, with revenues growing 65% to $196 million, and contributing to its massive order backlog at $1.4 billion, up 80% from the prior year. The company is riding the demand for natural gas-fired power plants to fuel the endless new AI data centers.

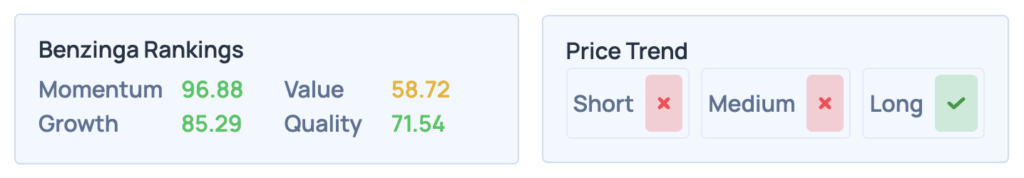

Benzinga's Edge Rankings highlight strong momentum and growth ranking For Argan in the 97th and 85th percentile, respectively. Curious how Lexicon Pharmaceuticals stacks up? Click here to uncover its growth and momentum scores

Image via Shutterstock

Read More:

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English