3 Asian Penny Stocks With Market Caps Under US$300M To Consider

Amid economic uncertainty and inflation concerns, global markets are experiencing mixed performance, with some regions facing challenges from new trade tariffs and fluctuating consumer sentiment. In such a climate, investors often look for opportunities in less conventional areas like penny stocks, which—though an outdated term—still represent potential growth avenues. These smaller or newer companies can offer unique value propositions when backed by strong financials, making them intriguing options for those seeking under-the-radar investments with long-term potential.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Interlink Telecom (SET:ITEL) | THB1.40 | THB1.94B | ✅ 4 ⚠️ 5 View Analysis > |

| Chumporn Palm Oil Industry (SET:CPI) | THB2.76 | THB1.75B | ✅ 2 ⚠️ 2 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.205 | SGD40.84M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.37 | SGD9.36B | ✅ 5 ⚠️ 0 View Analysis > |

| YesAsia Holdings (SEHK:2209) | HK$3.11 | HK$1.28B | ✅ 4 ⚠️ 4 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.03 | HK$46.16B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.39 | HK$877.02M | ✅ 4 ⚠️ 1 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.43 | HK$2.39B | ✅ 4 ⚠️ 2 View Analysis > |

| China Zheshang Bank (SEHK:2016) | HK$2.56 | HK$83.22B | ✅ 4 ⚠️ 1 View Analysis > |

| Xiamen Hexing Packaging Printing (SZSE:002228) | CN¥3.12 | CN¥3.61B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,108 stocks from our Asian Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Wanka Online (SEHK:1762)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Wanka Online Inc. offers android-based content distribution services in Mainland China and has a market cap of HK$857.13 million.

Operations: Wanka Online Inc. has not reported any revenue segments for its operations.

Market Cap: HK$857.13M

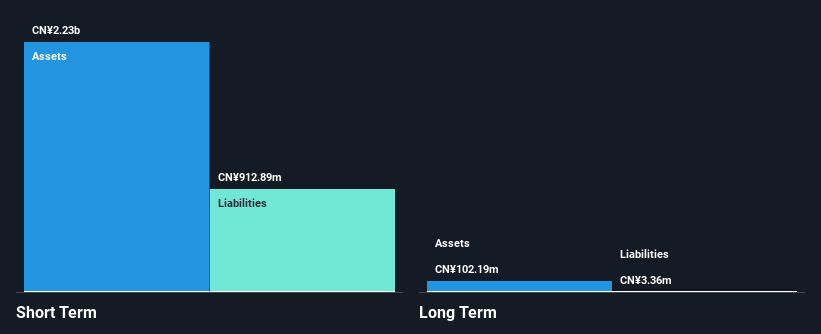

Wanka Online Inc., with a market cap of HK$857.13 million, has shown stable weekly volatility over the past year but remains higher than most Hong Kong stocks. The company reported sales of CN¥2.63 billion for 2024, an increase from the previous year, although net income decreased to CN¥2.27 million. Despite having more cash than total debt and short-term assets exceeding liabilities, Wanka Online's operating cash flow is negative, indicating potential challenges in covering debt through operations alone. A recent follow-on equity offering raised HK$53.1 million, potentially diluting shareholder value slightly despite no significant dilution last year.

- Dive into the specifics of Wanka Online here with our thorough balance sheet health report.

- Learn about Wanka Online's historical performance here.

Logory Logistics Technology (SEHK:2482)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Logory Logistics Technology Co., Ltd. offers digital freight transportation services and solutions in China, with a market cap of HK$1.98 billion.

Operations: Logory Logistics Technology Co., Ltd. has not reported any specific revenue segments.

Market Cap: HK$1.98B

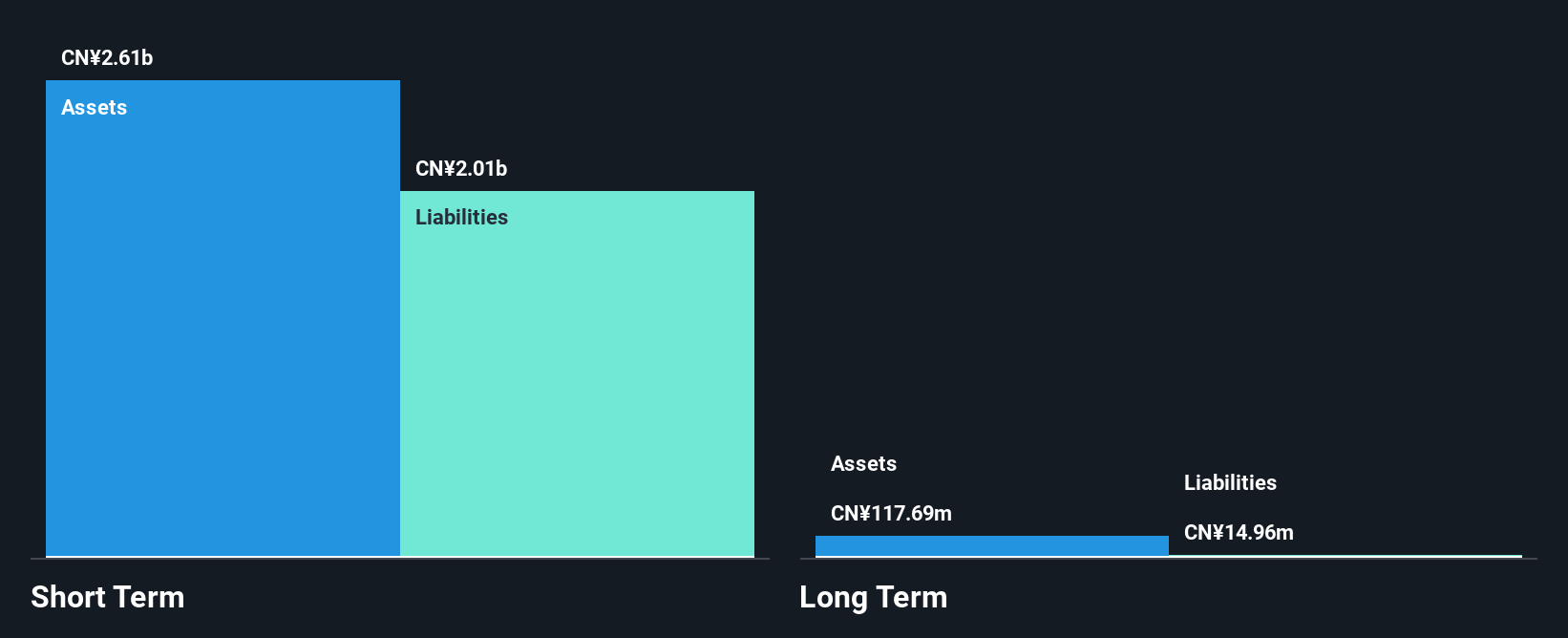

Logory Logistics Technology Co., Ltd., with a market cap of HK$1.98 billion, has recently turned profitable, reporting net income of CN¥50.03 million for 2024 compared to a loss the previous year. Despite high share price volatility over the past three months, its weekly volatility has been stable relative to other Hong Kong stocks. The company maintains more cash than total debt and short-term assets significantly exceed liabilities, suggesting financial stability. However, negative operating cash flow poses challenges in covering debt through operations alone. The experienced management and board provide strategic guidance as Logory navigates profitability growth in the logistics sector.

- Jump into the full analysis health report here for a deeper understanding of Logory Logistics Technology.

- Assess Logory Logistics Technology's previous results with our detailed historical performance reports.

Zero Fintech Group (SEHK:93)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Zero Fintech Group Limited is an investment holding company that focuses on investing in, developing, and selling real estate properties in the People’s Republic of China and Hong Kong, with a market cap of HK$1.60 billion.

Operations: The company generates revenue primarily from money lending, which accounts for HK$257.47 million, and property development and investment, contributing HK$1.51 million.

Market Cap: HK$1.6B

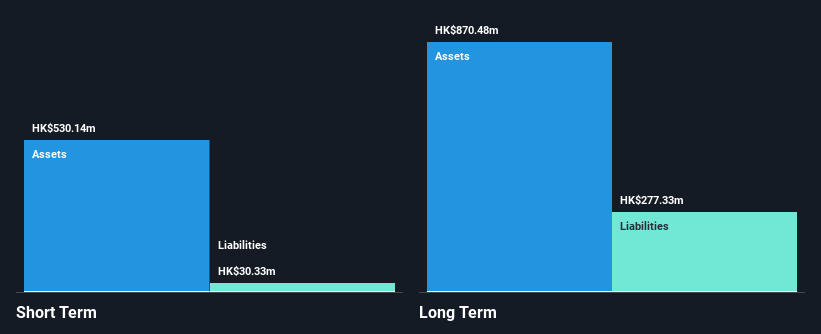

Zero Fintech Group Limited, with a market cap of HK$1.60 billion, reported significant earnings growth for 2024, driven by its money lending business which generated interest income of approximately HK$250 million. Despite negative operating cash flow indicating challenges in covering debt through operations, the company's short-term assets comfortably cover both short and long-term liabilities. Earnings grew by 123.1% over the past year, surpassing industry averages and improving net profit margins to 10.3%. The management team is seasoned; however, the board lacks experience with an average tenure under three years.

- Click to explore a detailed breakdown of our findings in Zero Fintech Group's financial health report.

- Understand Zero Fintech Group's track record by examining our performance history report.

Taking Advantage

- Click here to access our complete index of 1,108 Asian Penny Stocks.

- Looking For Alternative Opportunities? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 22 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English