Is MaxWin International Holdings (HKG:8513) A Risky Investment?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that MaxWin International Holdings Limited (HKG:8513) does use debt in its business. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

How Much Debt Does MaxWin International Holdings Carry?

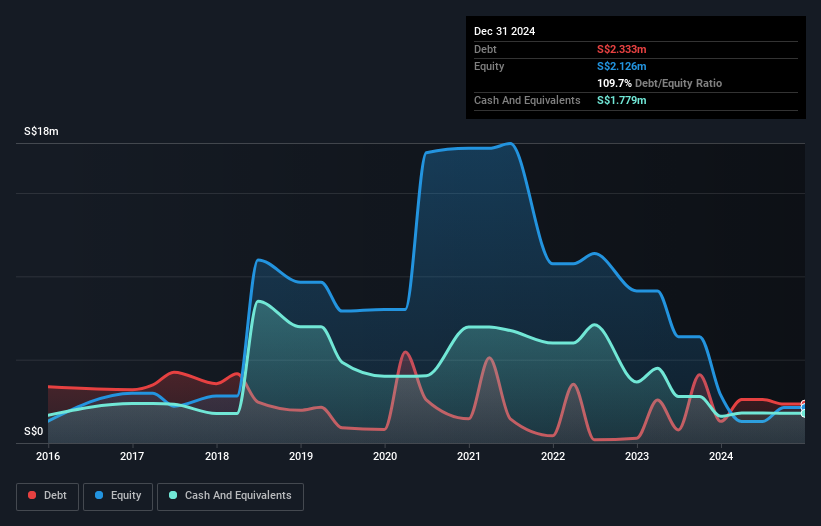

You can click the graphic below for the historical numbers, but it shows that as of December 2024 MaxWin International Holdings had S$2.33m of debt, an increase on S$1.30m, over one year. However, because it has a cash reserve of S$1.78m, its net debt is less, at about S$554.0k.

How Healthy Is MaxWin International Holdings' Balance Sheet?

According to the last reported balance sheet, MaxWin International Holdings had liabilities of S$3.55m due within 12 months, and liabilities of S$3.08m due beyond 12 months. On the other hand, it had cash of S$1.78m and S$4.19m worth of receivables due within a year. So its liabilities total S$660.0k more than the combination of its cash and short-term receivables.

Given MaxWin International Holdings has a market capitalization of S$24.4m, it's hard to believe these liabilities pose much threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since MaxWin International Holdings will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

View our latest analysis for MaxWin International Holdings

In the last year MaxWin International Holdings wasn't profitable at an EBIT level, but managed to grow its revenue by 14%, to S$10m. That rate of growth is a bit slow for our taste, but it takes all types to make a world.

Caveat Emptor

Over the last twelve months MaxWin International Holdings produced an earnings before interest and tax (EBIT) loss. To be specific the EBIT loss came in at S$1.8m. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. Quite frankly we think the balance sheet is far from match-fit, although it could be improved with time. We would feel better if it turned its trailing twelve month loss of S$2.6m into a profit. So we do think this stock is quite risky. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that MaxWin International Holdings is showing 4 warning signs in our investment analysis , and 1 of those shouldn't be ignored...

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English