Why Investors Shouldn't Be Surprised By Magnachip Semiconductor Corporation's (NYSE:MX) 25% Share Price Plunge

Magnachip Semiconductor Corporation (NYSE:MX) shares have had a horrible month, losing 25% after a relatively good period beforehand. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 35% share price drop.

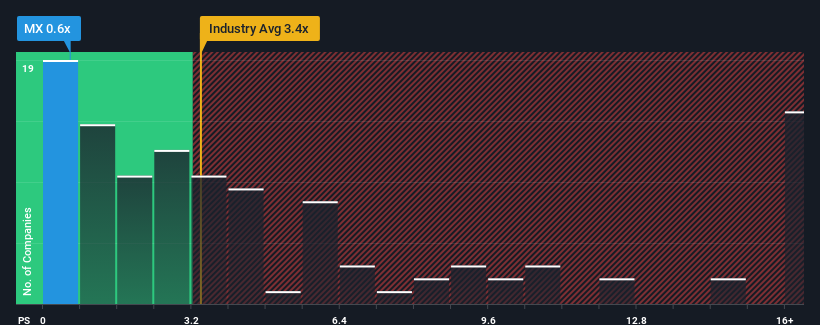

After such a large drop in price, Magnachip Semiconductor may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.6x, since almost half of all companies in the Semiconductor industry in the United States have P/S ratios greater than 3.3x and even P/S higher than 8x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for Magnachip Semiconductor

How Has Magnachip Semiconductor Performed Recently?

With revenue growth that's inferior to most other companies of late, Magnachip Semiconductor has been relatively sluggish. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Magnachip Semiconductor will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

Magnachip Semiconductor's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. This isn't what shareholders were looking for as it means they've been left with a 51% decline in revenue over the last three years in total. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the three analysts covering the company suggest revenue growth is heading into negative territory, declining 14% over the next year. Meanwhile, the broader industry is forecast to expand by 37%, which paints a poor picture.

With this information, we are not surprised that Magnachip Semiconductor is trading at a P/S lower than the industry. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What We Can Learn From Magnachip Semiconductor's P/S?

Shares in Magnachip Semiconductor have plummeted and its P/S has followed suit. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It's clear to see that Magnachip Semiconductor maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Magnachip Semiconductor that you should be aware of.

If you're unsure about the strength of Magnachip Semiconductor's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English