Himax Technologies (NasdaqGS:HIMX) Partners With Tata Electronics to Enhance India's Semiconductor Ecosystem

Himax Technologies (NasdaqGS:HIMX) recently announced a significant strategic partnership with Tata Electronics and PSMC, aimed at bolstering India's semiconductor ecosystem, which might have contributed to the company's 2.47% price increase over the last quarter. Additionally, the company's participation in the Embedded World 2025, showcasing their advanced AI technologies, likely provided positive investor sentiment. This occurred amid broader market trends where the Dow Jones and Nasdaq experienced mixed movements, with a notable decline led by technology stocks like Tesla and Nvidia. Despite market volatility, Himax's strategic moves may have supported its positive quarterly performance.

Himax Technologies has 2 warning signs we think you should know about.

Over the past five years, Himax Technologies has achieved a total return of 296.73%, including share price appreciation and dividends. This performance could be attributed to several key developments. The company has formed significant strategic alliances, such as the Memorandum of Understanding with Tata Electronics and Powerchip Semiconductor Manufacturing Corporation in March 2025, aimed at strengthening India's semiconductor ecosystem. Additionally, Himax has enhanced its product offerings, notably its WiseEye AI technology and automotive IC solutions, showcased during CES 2025 and Embedded World 2025.

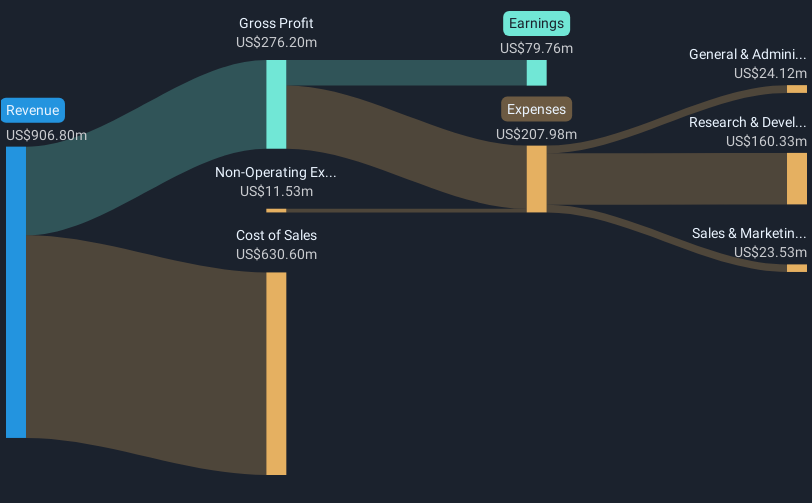

Himax's earnings growth has been impressive, bolstered by advancements in automotive TDDI, Tcon technologies, and Co-Package Optics (CPO). In the recent earnings report for Q4 2024, Himax's revenue rose to US$237.22 million, with net income reaching US$24.61 million. However, the company anticipates a potential revenue decline for Q1 2025. Despite these short-term fluctuations and dividend adjustments, Himax has sustained its growth through product innovations and strategic market expansions, outperforming the US semiconductor industry returns over the past year.

Review our growth performance report to gain insights into Himax Technologies' future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English