Atour Lifestyle Holdings (NasdaqGS:ATAT) Sees US$1,275 Million Net Income Amid 3% Dip

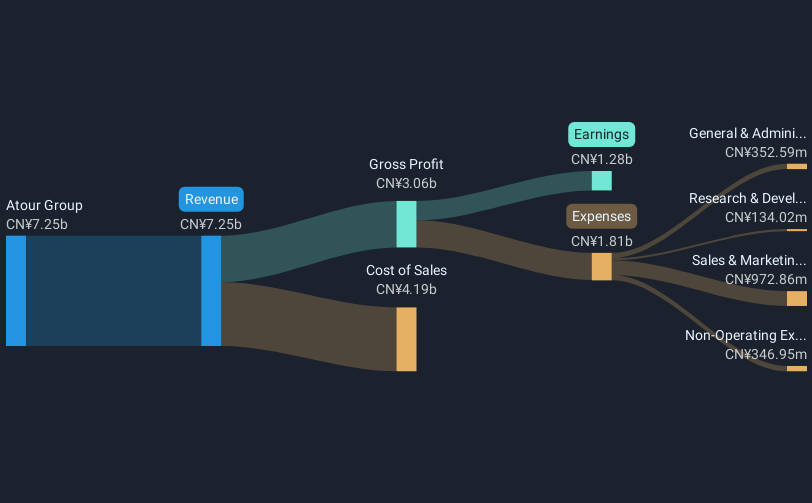

Atour Lifestyle Holdings (NasdaqGS:ATAT) recently reported a promising outlook for 2025, projecting a 25% increase in net revenues while showcasing a strong annual increase in revenue and net income for 2024. Despite a decline in sales, the company saw gains in EPS, possibly influencing its 3.95% price surge last quarter. The broader market also showed resilience, with the S&P 500 and Nasdaq experiencing slight increases amid a rebound rally. This context of market recovery and positive corporate guidance might have contributed to Atour's share performance, making the stock an interesting topic in the evolving market landscape.

Atour Lifestyle Holdings achieved a total shareholder return of 60.26% over the past year. This impressive growth compares favorably to both the broader US Market, which returned 10.2%, and the US Hospitality industry, which reported a 7% return. A key driver of this performance was the company's strong financial results. For instance, net income surged from CN¥17.88 million to CN¥257.16 million, and basic EPS rose significantly in the first quarter of 2024. Additionally, the announcement of a three-year dividend policy to distribute at least 50% of net income likely bolstered investor confidence.

Further contributing to Atour's return was its aggressive expansion strategy, including the addition of 140 new hotels which promises increased future revenue potential. Also, the launch of the upscale SAVHE Hotel brand could enhance occupancy rates. The rapid growth in Atour's retail segment, particularly in high-margin 'deep sleep' products, added to overall revenue growth, while a burgeoning membership base provides a solid customer loyalty foundation. This combination of organic growth and strategic expansion has positioned Atour favorably against market and industry averages.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English