3 Promising Growth Companies With Insider Ownership Up To 25%

As U.S. stock markets show signs of recovery, with major indices like the Dow Jones and S&P 500 gaining ground amid anticipation of the Federal Reserve's economic forecasts, investors are keenly observing how these developments might influence future interest rates and economic growth. In this context, companies with high insider ownership can be particularly appealing as they often indicate strong confidence from those who know the business best, making them potentially promising opportunities in a fluctuating market landscape.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.7% |

| Duolingo (NasdaqGS:DUOL) | 14.4% | 37.1% |

| Hims & Hers Health (NYSE:HIMS) | 13.2% | 21.8% |

| Corcept Therapeutics (NasdaqCM:CORT) | 11.7% | 36.7% |

| Coastal Financial (NasdaqGS:CCB) | 14.5% | 46.3% |

| Astera Labs (NasdaqGS:ALAB) | 15.9% | 61.3% |

| BBB Foods (NYSE:TBBB) | 16.5% | 41.1% |

| Clene (NasdaqCM:CLNN) | 20.7% | 59.1% |

| Upstart Holdings (NasdaqGS:UPST) | 12.7% | 100.1% |

| Credit Acceptance (NasdaqGS:CACC) | 14.4% | 33.6% |

Here's a peek at a few of the choices from the screener.

LendingTree (NasdaqGS:TREE)

Simply Wall St Growth Rating: ★★★★☆☆

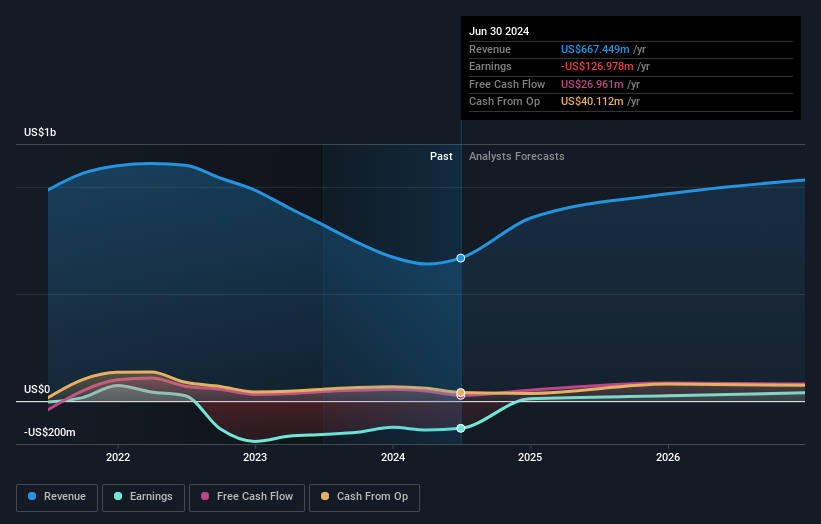

Overview: LendingTree, Inc. operates an online consumer platform in the United States and has a market cap of approximately $678.12 million.

Operations: The company's revenue segments include $128.85 million from Home, $222.46 million from Consumer, and $548.70 million from Insurance.

Insider Ownership: 18.8%

LendingTree is poised for growth with substantial insider buying in the past three months, indicating confidence in its future. The company is expected to become profitable within three years, with earnings projected to grow significantly at 49.01% annually. Despite a volatile share price recently, analysts anticipate a 36.7% rise in stock value compared to peers and industry standards. Recent earnings show improved performance with sales reaching US$900 million, reducing net losses from the previous year.

- Take a closer look at LendingTree's potential here in our earnings growth report.

- Our expertly prepared valuation report LendingTree implies its share price may be lower than expected.

Xometry (NasdaqGS:XMTR)

Simply Wall St Growth Rating: ★★★★☆☆

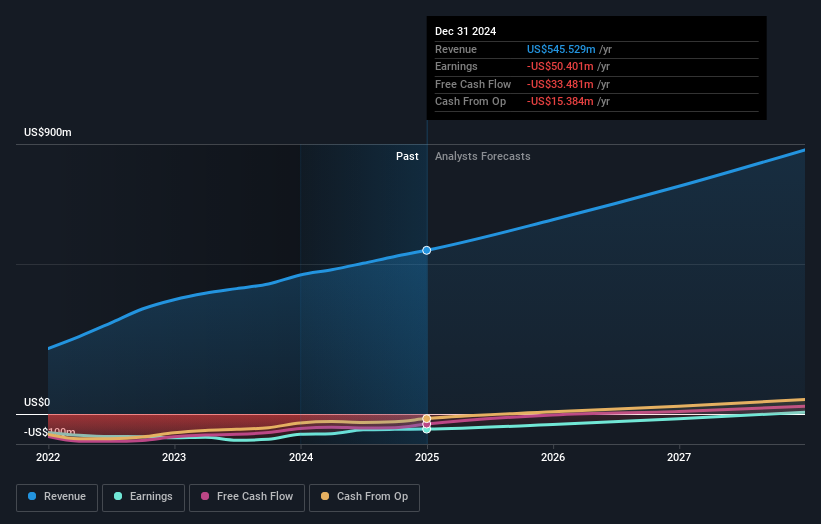

Overview: Xometry, Inc. operates an AI-powered online manufacturing marketplace serving both the United States and international markets, with a market cap of approximately $1.29 billion.

Operations: The company generates revenue of $545.53 million from its Internet Software & Services segment.

Insider Ownership: 13.5%

Xometry's growth potential is underscored by its forecasted earnings increase of 68.79% annually, despite revenue growth expectations being slower than 20% per year. The company trades at a significant discount to its estimated fair value and aims for profitability within three years. Recent changes include new leadership appointments and auditor transitions, which may influence operational efficiencies. Xometry's insider ownership remains stable with no substantial insider trading activity noted in the past three months.

- Unlock comprehensive insights into our analysis of Xometry stock in this growth report.

- Insights from our recent valuation report point to the potential undervaluation of Xometry shares in the market.

Atlas Energy Solutions (NYSE:AESI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Atlas Energy Solutions Inc. operates in the production, processing, and sale of mesh and sand for well completions in the Permian Basin, with a market cap of approximately $2.19 billion.

Operations: The company's revenue segment is primarily derived from Oil Well Equipment & Services, totaling $1.06 billion.

Insider Ownership: 25.5%

Atlas Energy Solutions is positioned for growth with earnings forecasted to rise significantly at 41.5% per year, outpacing the US market. Despite revenue growth projections being moderate at 9.2% annually, insider buying has been substantial recently, indicating confidence in its prospects. However, profit margins have declined from last year and shareholder dilution occurred due to a recent equity offering of US$264.5 million. The company also carries high debt levels following a new US$540 million term loan agreement.

- Delve into the full analysis future growth report here for a deeper understanding of Atlas Energy Solutions.

- According our valuation report, there's an indication that Atlas Energy Solutions' share price might be on the expensive side.

Summing It All Up

- Unlock more gems! Our Fast Growing US Companies With High Insider Ownership screener has unearthed 202 more companies for you to explore.Click here to unveil our expertly curated list of 205 Fast Growing US Companies With High Insider Ownership.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English