3 Promising Penny Stocks With Market Caps Up To $900M

As the U.S. stock market faces challenges with technology shares leading a recent decline, investors are navigating an uncertain landscape marked by economic concerns and potential policy shifts. Amidst this backdrop, penny stocks—often misunderstood as relics of past trading days—remain a relevant investment area for those seeking opportunities in smaller or newer companies. By focusing on strong financial health and growth potential, these stocks can offer investors the chance to uncover hidden value in promising enterprises.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Safe Bulkers (NYSE:SB) | $3.76 | $395.26M | ✅ 3 ⚠️ 3 View Analysis > |

| Tuya (NYSE:TUYA) | $3.71 | $2.35B | ✅ 3 ⚠️ 3 View Analysis > |

| Sensus Healthcare (NasdaqCM:SRTS) | $4.74 | $80.17M | ✅ 5 ⚠️ 3 View Analysis > |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ✅ 1 ⚠️ 5 View Analysis > |

| TETRA Technologies (NYSE:TTI) | $3.36 | $450.14M | ✅ 5 ⚠️ 2 View Analysis > |

| Permianville Royalty Trust (NYSE:PVL) | $1.51 | $51.15M | ✅ 1 ⚠️ 4 View Analysis > |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.49 | $75.83M | ✅ 3 ⚠️ 1 View Analysis > |

| BAB (OTCPK:BABB) | $0.8206 | $6.01M | ✅ 2 ⚠️ 3 View Analysis > |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $143.12M | ✅ 3 ⚠️ 1 View Analysis > |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8675 | $76.46M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 763 stocks from our US Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Opendoor Technologies (NasdaqGS:OPEN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Opendoor Technologies Inc. operates a digital platform facilitating residential real estate transactions in the United States, with a market cap of approximately $861 million.

Operations: The company's revenue is derived from its Real Estate Brokers segment, generating $5.15 billion.

Market Cap: $860.99M

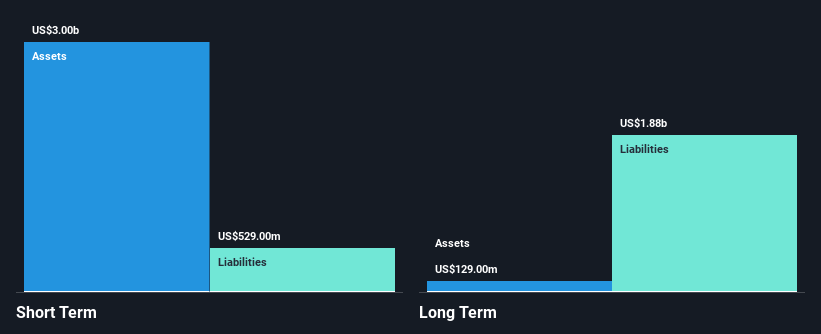

Opendoor Technologies, with a market cap of US$861 million, operates in the real estate sector and recently reported annual revenue of US$5.15 billion. Despite its significant revenue stream, the company remains unprofitable with a negative return on equity of -54.98% and increasing losses over the past five years at 9.8% annually. Opendoor's high net debt to equity ratio of 227.6% is concerning, although it has sufficient short-term assets to cover both short- and long-term liabilities. Recent earnings guidance suggests potential improvement in contribution profit for Q1 2025 amidst ongoing financial challenges.

- Click here and access our complete financial health analysis report to understand the dynamics of Opendoor Technologies.

- Gain insights into Opendoor Technologies' future direction by reviewing our growth report.

Valens Semiconductor (NYSE:VLN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Valens Semiconductor Ltd. develops semiconductor products for the audio-video and automotive sectors across various global markets, with a market cap of $224.12 million.

Operations: The company generates revenue from two main segments: Automotive, which accounts for $21.57 million, and Cross Industry Business (CIB), contributing $36.29 million.

Market Cap: $224.12M

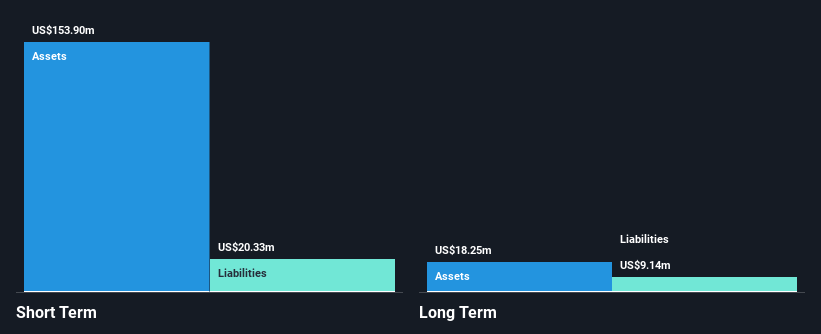

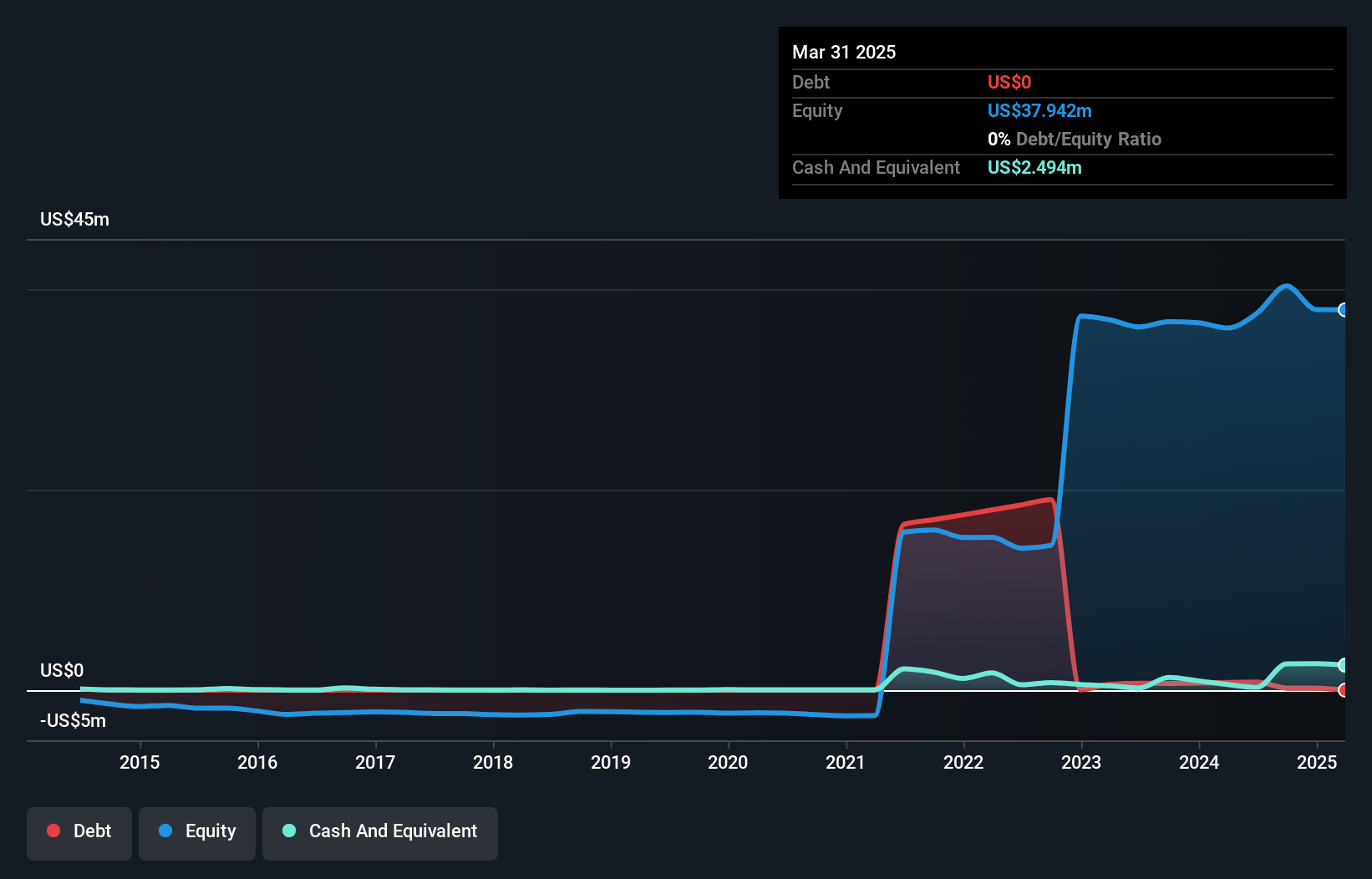

Valens Semiconductor, with a market cap of US$224.12 million, is navigating the challenges typical of penny stocks. The company reported annual revenue of US$57.86 million, primarily from its Automotive and Cross Industry Business segments. Despite being unprofitable with a negative return on equity of -25.64%, Valens has no debt and sufficient short-term assets to cover liabilities, providing some financial stability. Recent interoperability testing in China for MIPI A-PHY technology highlights potential growth avenues in the automotive sector, though volatility remains high with share prices fluctuating significantly over recent months amidst ongoing strategic developments like share buybacks and partnerships in AI robotics systems.

- Unlock comprehensive insights into our analysis of Valens Semiconductor stock in this financial health report.

- Review our growth performance report to gain insights into Valens Semiconductor's future.

Verde Resources (OTCPK:VRDR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Verde Resources, Inc. operates through its subsidiaries in the production of biochar from dairy, palm, and other natural resource industry waste in the United States and Malaysia, with a market cap of $162.38 million.

Operations: Verde Resources generates its revenue through the production of biochar from waste materials in the dairy, palm, and other natural resource industries across the United States and Malaysia.

Market Cap: $162.38M

Verde Resources, with a market cap of US$162.38 million, exemplifies the volatility and potential of penny stocks. Despite generating minimal revenue (US$217K), Verde is pre-revenue and unprofitable, with increasing losses over five years. The company maintains more cash than debt and covers its liabilities with short-term assets (US$4.2M). Recent strategic alliances, notably with Ergon Asphalt & Emulsions for sustainable infrastructure solutions, highlight its commitment to innovation in Net Zero technologies. Leadership changes have seen Eric Bava drive operational growth through strategic partnerships, positioning Verde as a potential leader in eco-friendly building materials despite financial challenges.

- Take a closer look at Verde Resources' potential here in our financial health report.

- Evaluate Verde Resources' historical performance by accessing our past performance report.

Key Takeaways

- Click here to access our complete index of 763 US Penny Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

② More than 40M Downloads Globally : data based on Webull Technologies Limited's internal statistics as of July 14, 2023.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English